Question

Thunder Hollow Inc. makes and sells hood ornaments for $118 each. The company is considering upgrading its machinery, which would increase its fixed costs

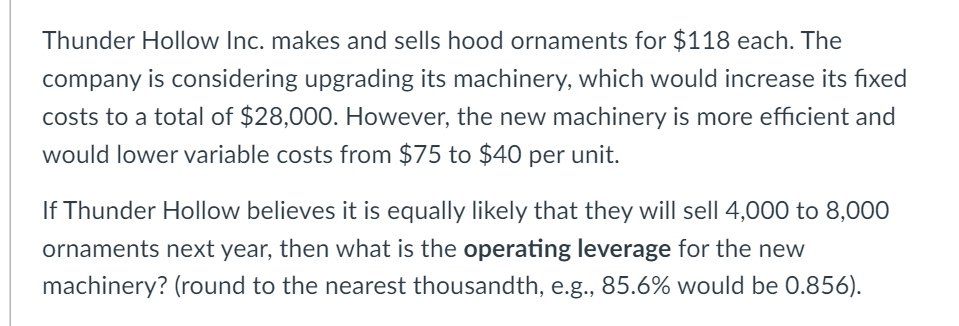

Thunder Hollow Inc. makes and sells hood ornaments for $118 each. The company is considering upgrading its machinery, which would increase its fixed costs to a total of $28,000. However, the new machinery is more efficient and would lower variable costs from $75 to $40 per unit. If Thunder Hollow believes it is equally likely that they will sell 4,000 to 8,000 ornaments next year, then what is the operating leverage for the new machinery? (round to the nearest thousandth, e.g., 85.6% would be 0.856).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Operating leverage measures the sensitivity of a companys operating income to changes in sales volum...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Managing Operations Across the Supply Chain

Authors: Morgan Swink, Steven Melnyk, Bixby Cooper, Janet Hartley

2nd edition

9780077535063, 007802403X, 77535065, 978-0078024030

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App