Thw case is from an Introduction to Finance Course at the Smith School of Business (COMM 121): WEIGHTED AVERAGE COST OF CAPITAL (FALL 2023): BOMBARDIER

Thw case is from an Introduction to Finance Course at the Smith School of Business (COMM 121):

WEIGHTED AVERAGE COST OF CAPITAL (FALL 2023):

BOMBARDIER

Shin Lee, a commerce student at the Smith School of Business, had heard a great deal about recent turmoil at Bombardier - and it had piqued his interest in the company. Lee knew that a company in flux was often a good buy, especially if its future looked bright. Did Bombardier's future look bright? Having paid particular attention to his finance courses, Lee knew the answer to that question depended, in part, on the company's Weighted Average Cost of Capital (WACC) - a key indicator of its profitability going forward.

Lee's research informed him that Bombardier's Beta was2.88and that the Equity Market Risk Premium was5.00 per cent. He set out to calculate the weight of all the equity and preferred securities for Bombardier based on the closing share prices as of October 23, 2023. Bombardier's historical share pricing is available from sites such asYahoo Finance(please use "adjusted" closing share price). By looking at the 2022 Annual Report (available as an Additional Resource), Lee could determine the number of common and preferred shares outstanding (see p. 87 of the Annual Report) and exchange rates (see p. 86 of the Annual Report). He decided to ignore warrants, share options, PSUs and DSUs. The exchange rate is important because the values in the Annual Report are in USD whereas the share prices are in CAD. He will need then to convert the USD values to CAD (please do so using the rates in the annual report). He assumed the company's effective tax rate was32.9 per cent(an average of the last several years that Bombardier had a positive tax rate). Lee researched the Canadian 10-year bond yield at the Bank of Canada, which would be necessary in calculating the cost of equity for Bombardier. He found that the yield was approximately4.08 per cent. [Kindly note that we are using Bombardier's latest annual report and then using more recent market pricing for illustrative teaching purposes. Normally one would use the most recent publicly available financial statement data (i.e., quarterly statements) but we will use the annual report for the Case as it has the most disclosure and thus provides the best opportunity to get familiar with more detailed financial statements.]

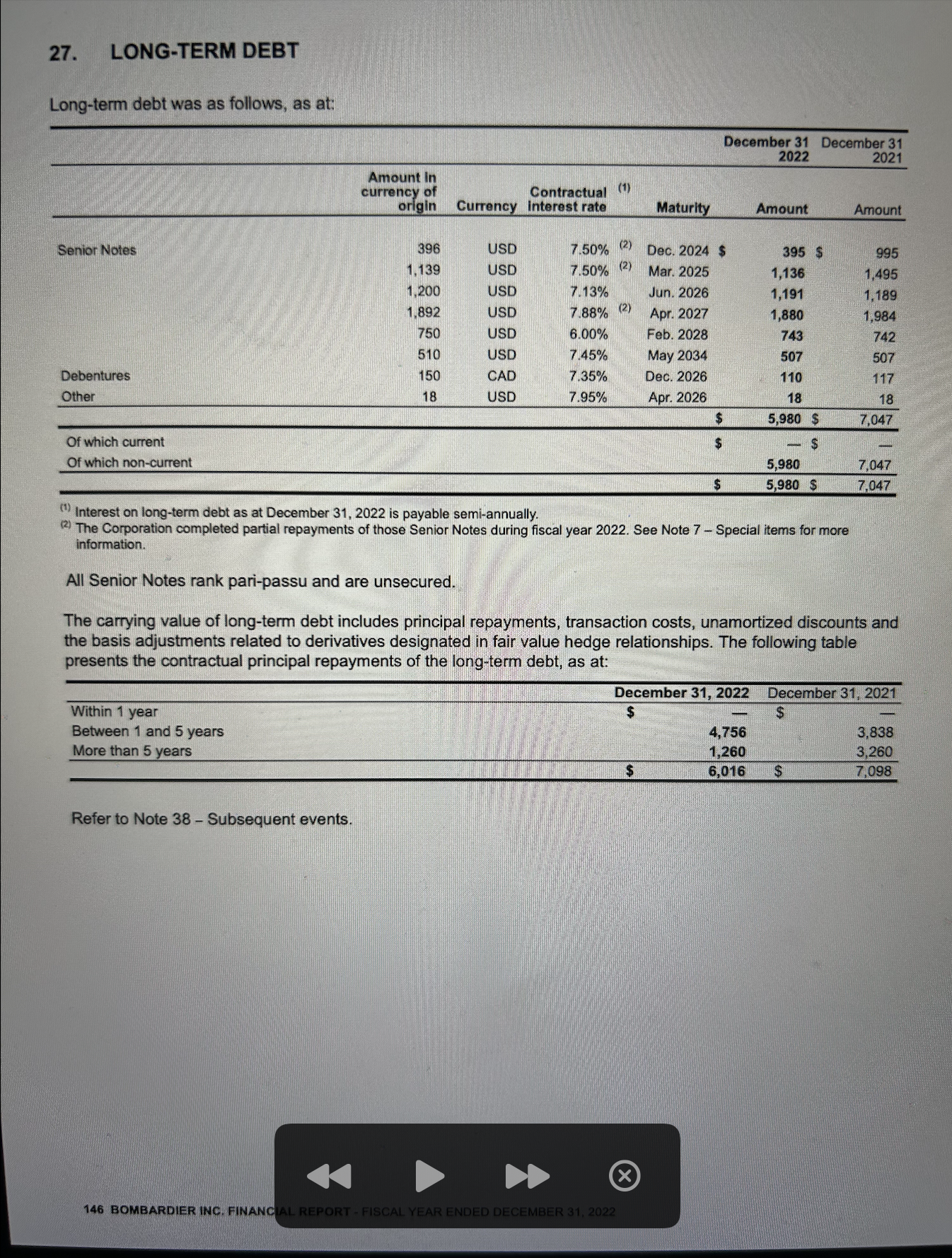

Lee expected to incorporate the range of preferred shares and their most recent dividend payouts (see p. 88 of the Annual Report) into his cost of capital calculations. He assumes that the growth rate of all the preferred shares dividends is zero. He also assumes that both Class A and Class B common shares have the same cost of equity. When calculating the cost of debt, he would include the company's long-term debt (see p. 146 of the Annual Report). He assumes that the amounts of long-term debt on p. 146 of the Annual Report (the column with header December 31st, 2022) were the best estimates of the market values in USD. Lee decided to assume the first bond on the "Senior Note" list (the Dec. 2024 bond) was repaid and to ignore it for simplicity purposes. Lee found the bond prices for thefive additional bonds outstandingas of December 31, 2022 of Bombardier's bonds that are still outstandingusing the Bloomberg terminal at the Techplex in Goodes Hall (see Table 1, below; the face value is 100). The bond prices are necessary for the computation of the YTM of each bond. One issue is how to handle fractional years for bond maturities, especially knowing that they are semi-annual bonds. For simplicity, he decided to round the number of periods when computing the YTM of each bond, as seen in Table 1 below. In addition to the assumed five bonds still outstanding as of December 31, 2022, there are two other pieces of debt that you must take into account. For the cost of debt for the "Debentures" and "Other", use the "Contractual Interest Expense" listed on p. 146 of the Annual Report.

Assume the interest expense for the "Debentures" and "Other" are listed in the "Contractual" column.

Using the above information, please calculate Bombardier's Weighted Average Cost ofCapital. Please show details of all your work, including all weightings and cost of capital calculations. Please submit only one word or PDF document (you may cut and paste from excel, as long as everything is clearly labelled).

Exhibit 1: Bombardier Bonds

| Issue | Price | Years to Maturity |

|---|---|---|

| Mar. 2025 - 7.50% | $97.78 | 1 |

| Jun. 2026 - 7.13% | $92.56 | 3 |

| April 2027 - 7.88% | $94.12 | 3 |

| Feb. 2028 - 6.00% | $91.23 | 4 |

| May 2034 - 7.45% | $93.67 | 10 |

Here are the photos of the required pages from the 2022 Annual Report (in order: p. 87, p. 86, p. 88, p. 146). Let me know if you are missing a required page of the 2022 Annual Report to complete the case study and I will happily provide it for you.

O SHAREHOLDER INFORMATION On June 13, 2022, Bombardier proceeded with a Share Consolidation of the Corporation's Class A shares and Class B shares (subordinate voting) at a consolidation ratio of 25-for-1. As a result, the numbers for the average basic and diluted Class A shares and Class B shares (subordinate voting) outstanding, the number of PSUs, RSUS, DSUS, stock options, warrants and the EPS for the current and prior periods have been adjusted and restated to reflect the effect of the Share Consolidation. See Note 11 - Earnings per share and Note 29 - Sharebased plans, to our Consolidated financial statements for more information. Authorized, issued and outstanding share data, as at February 7, 2023 Class A Shares (multiple voting) Class B Shares (subordinate voting)(2) Series 2 Cumulative Redeemable Preferred Shares Series 3 Cumulative Redeemable Preferred Shares Series 4 Cumulative Redeemable Preferred Shares Warrant, share option, PSU, DSU, RSU, data as at December 31, 2022 Warrants issued and outstanding Options issued and outstanding under the share option plans PSUS, DSUS and RSUS issued and outstanding under the PSU, DSU and RSU plans Class B Subordinate Voting Shares held in trust to satisfy PSU and RSU obligations (1) Ten votes each, convertible at the option of the holder into one Class B Subordinate Voting Share. (2) Convertible at the option of the holder into one Class A Share under certain conditions. (3) Net of 3,704,417 Class B Subordinate Voting Shares purchased and held in trust in connection with the PSU and RSU plans. Information Bombardier Inc. Investor Relations 400 Cte-Vertu Road West Dorval, Qubec, Canada H4S 1Y9 Telephone: +1 514 240-9649 Email: investors@bombardier.com Authorized 143,680,000 143,680,000 12,000,000 12,000,000 9,400,000 Issued and outstanding 12,349,370 82,225,583 (3) 2,684,527 9,315,473 9,400,000 4,234,074 3,683,172 3,730,710 3,704,417 Additional information relating to the Corporation, including the annual information form, are available on SEDAR at sedar.com or on Bombardier's dedicated investor relations website at ir.bombardier.com. Bombardier Inc., 400 Cte-Vertu Road West, Dorval, Qubec, Canada H4S 1Y9 Telephone: +1 514 855 5001; website: bombardier.com The Global 8000 aircraft is currently under development and remains to be finalized and certified. It is expected to enter service in 2025. All specifications and data are approximate, may change without notice and are subject to certain operating rules, assumptions and other conditions. Bombardier, Bombardier Pr Air, Chaise, Challenger, Challenger 300, Challenger 350, Challenger 3500, Challenger 600, Challenger 601, Challenger 604, Challenger 605, Challenger 650, Exceptional by Design, Executive, Global, Global 5000, Global 5500, Global 6000, Global 6500, Global 7500, Global 8000, Global Express, Global Vision, Global XRS, Learjet, Learjet 40, Learjet 45, Learjet 70, Learjet 75, Learjet 75 Liberty, L'Opra, Nuage, Nuage Cube, PrecisionPlus, Smart Parts, Smart Parts Maintenance Plus, Smart Parts Plus, Smart Parts Preferred, Smart Services, Smartfix, Smartfix Plus, Smartlink, Smartlink Plus, Smooth Flex Wing, Soleil, Touch and Vision Flight Deck are trademarks of Bombardier Inc. or its subsidiaries. The printed version of this financial report uses Rolland Opaque paper, containing 30% sustainable recycled fiber. Using this paper, instead of virgin paper, saves the equivalent of 1 mature tree, 267 kg of CO2 emissions (equivalent to 1,061 kilometres driven) and 2,000 litres of water. Un exemplaire en franais est disponible sur demande adresse auprs du service des Relations avec les investisseurs ou sur le site Internet de la Socit ddi aux relations avec les investisseurs, l'adresse ri.bombardier.com. 0033 FINANCIAL REPORT / OTHER 87

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the Weighted Average Cost of Capital WACC for Bombardier we need to follow these steps 1 Calculate the cost of equity Bombardiers Beta is 288 and the Equity Market Risk Premium is 500 The ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started