Question

THX!!! Ben and Marie Gerrard, both in their mid-20s, have been married for 4 years and have two preschool-age children. Ben has an accounting degree

THX!!!

Ben and Marie Gerrard, both in their mid-20s, have been married for 4 years and have two preschool-age children. Ben has an accounting degree and is employed as a cost accountant at an annual salary of $61,000. They're now renting a duplex but wish to buy a home in the suburbs of their rapidly developing city. They've decided they can afford a $210,000 house and hope to find one with the features they desire in a good neighborhood.

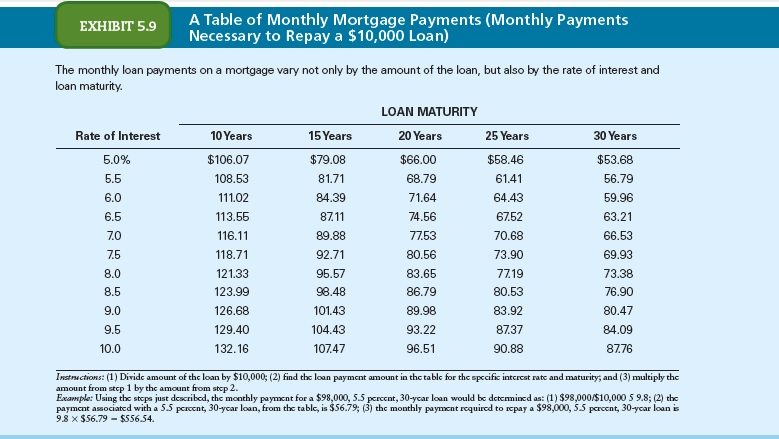

The insurance costs on such a home are expected to be $800 per year, taxes are expected to be $2,000 per year, and annual utility bills are estimated at $1,440 - an increase of $500 over those they pay in the duplex. The Gerrards are considering financing their home with a fixed-rate, 30-year, 6 percent mortgage. The lender charges 2 points on mortgages with 20 percent down and 3 points if less than 20 percent is put down (the commercial bank that the Gerrards will deal with requires a minimum of 10 percent down). Other closing costs are estimated at 5 percent of the home's purchase price. Because of their excellent credit record, the bank will probably be willing to let the Gerrards' monthly mortgage payments (principal and interest portions) equal as much as 27 percent of their monthly gross income. Since getting married, the Gerrards have been saving for the purchase of a home and now have $44,000 in their savings account.

1. How much would the Gerrards have to put down if the lender required a minimum 20 percent down payment? Round the answer to the nearest cent.

$ ( )

- Could they afford it?

Yes / No

2. Given that the Gerrards want to put only $23,000 down, how much would total closing costs be? Down payment should be taken into account. Round the answer to the nearest cent.

$ ( )

- Would they qualify for a loan using a 27 percent affordability ratio?

Yes / No

3. Using a $23,000 down payment on a $210,000 home, what would the Gerrards' loan-to-value ratio be? Round to two decimal places.

( ) %

Calculate the monthly mortgage payments on a PITI basis. Round the answer to the nearest cent.

$ ( )

4. What recommendations would you make to the Gerrards? Explain.

EXHIBIT 5.9 A Table of Monthly Mortgage Payments (Monthly Payments Necessary to Repay a $10,000 Loan) 81.71 The monthly loan payments on a mortgage vary not only by the amount of the loan, but also by the rate of interest and loan maturity. LOAN MATURITY Rate of Interest 10 Years 15 Years 20 Years 25 Years 30 Years 5.0% $106.07 $79.08 $66.00 $58.46 $53.68 108.53 68.79 61.41 56.79 111.02 84.39 71.64 64.43 59.96 113.55 87.11 74.56 67.52 116.11 89.88 77.53 70.68 118.71 92.71 80.56 73.90 69.93 121.33 95.57 83.65 77.19 123.99 98.48 86.79 80.53 76.90 126.68 101.43 89.98 83.92 80.47 129.40 104.43 93.22 87.37 84.09 132.16 107.47 96.51 90.88 87.76 73.38 Instructions: (1) Divide amount of the loan by $10,000; (2) find the loan payment amount in the table for the specific interest rate and maturity, and (3) multiply the amount from stcp 1 by the amount from stcp 2. Example: Using the steps just described, the monthly payment for a $98,000, 55 percent, 30-year loan would be determined as: (1)$98,000/$10,000 5 9.8; (2) the payment associated with a 5.5 percent, 30-year loan, from the tablc, is $56.79; (3) the monthly payment required to pay a $98,000, 5.5 percent, 30-ycar loan is 9.8 X $56.79 - $556.54Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started