Answered step by step

Verified Expert Solution

Question

1 Approved Answer

thx (Single Answer) Consider a risk-averse investor who has initial wealth and is offered a relative bet: winky with probability TT and lose ky with

thx

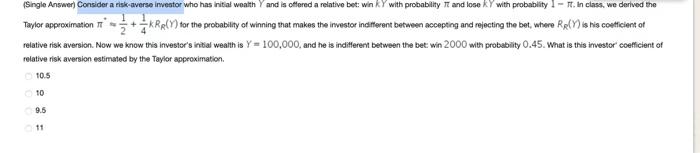

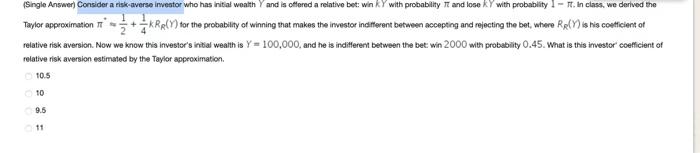

(Single Answer) Consider a risk-averse investor who has initial wealth and is offered a relative bet: winky with probability TT and lose ky with probability 1 - T. in class. we derived the Taylor approximation + KRR(Y) for the probability of winning that makes the investor indifferent between accepting and rejecting the bot, where Rely) is his coefficient of relative risk aversion. Now we know this investor's initial wealth is Y = 100,000, and he is indifferent between the bet win 2000 with probability 0.45. What is this investor coefficient of relative risk aversion estimated by the Taylor approximation 10.5 10 9.5 11 (Single Answer) Consider a risk-averse investor who has initial wealth and is offered a relative bet: winky with probability TT and lose ky with probability 1 - T. in class. we derived the Taylor approximation + KRR(Y) for the probability of winning that makes the investor indifferent between accepting and rejecting the bot, where Rely) is his coefficient of relative risk aversion. Now we know this investor's initial wealth is Y = 100,000, and he is indifferent between the bet win 2000 with probability 0.45. What is this investor coefficient of relative risk aversion estimated by the Taylor approximation 10.5 10 9.5 11

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started