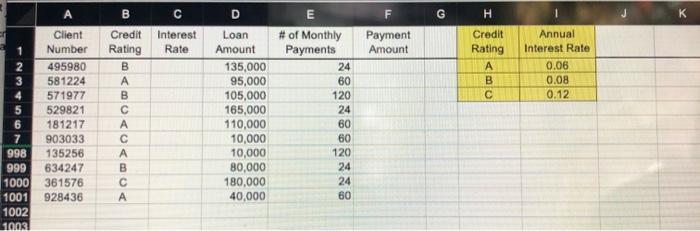

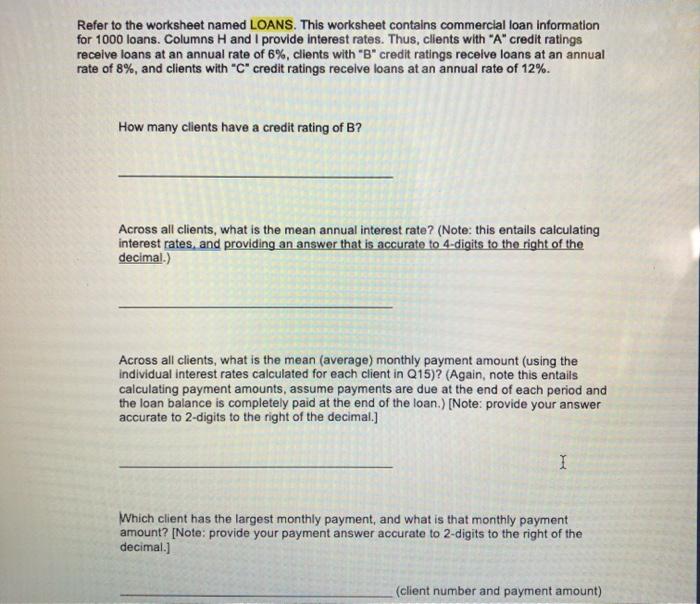

TI K Payment Amount 1 G H Credit Rating A B Credit Interest Rating Rate B B Annual Interest Rate 0.06 0.08 0.12 Client Number 495980 581224 571977 529821 181217 903033 135256 634247 361576 928436 D Loan Amount 135,000 95,000 105,000 165,000 110,000 10,000 10,000 80,000 180,000 40,000 E # of Monthly Payments 24 60 120 24 60 60 120 24 24 60 998 999 1000 1001 1002 1003 A B A Refer to the worksheet named LOANS. This worksheet contains commercial loan information for 1000 loans. Columns H and I provide interest rates. Thus, clients with "A" credit ratings receive loans at an annual rate of 6%, clients with "B" credit ratings receive loans at an annual rate of 8%, and clients with "C" credit ratings receive loans at an annual rate of 12%. How many clients have a credit rating of B? Across all clients, what is the mean annual interest rate? (Note: this entails calculating interest rates, and providing an answer that is accurate to 4-digits to the right of the decimal.) Across all clients, what is the mean (average) monthly payment amount (using the individual interest rates calculated for each client in Q15) (Again, note this entails calculating payment amounts, assume payments are due at the end of each period and the loan balance is completely paid at the end of the loan) (Note: provide your answer accurate to 2-digits to the right of the decimal.) 1 Which client has the largest monthly payment, and what is that monthly payment amount? [Note: provide your payment answer accurate to 2-digits to the right of the decimal.] (client number and payment amount) TI K Payment Amount 1 G H Credit Rating A B Credit Interest Rating Rate B B Annual Interest Rate 0.06 0.08 0.12 Client Number 495980 581224 571977 529821 181217 903033 135256 634247 361576 928436 D Loan Amount 135,000 95,000 105,000 165,000 110,000 10,000 10,000 80,000 180,000 40,000 E # of Monthly Payments 24 60 120 24 60 60 120 24 24 60 998 999 1000 1001 1002 1003 A B A Refer to the worksheet named LOANS. This worksheet contains commercial loan information for 1000 loans. Columns H and I provide interest rates. Thus, clients with "A" credit ratings receive loans at an annual rate of 6%, clients with "B" credit ratings receive loans at an annual rate of 8%, and clients with "C" credit ratings receive loans at an annual rate of 12%. How many clients have a credit rating of B? Across all clients, what is the mean annual interest rate? (Note: this entails calculating interest rates, and providing an answer that is accurate to 4-digits to the right of the decimal.) Across all clients, what is the mean (average) monthly payment amount (using the individual interest rates calculated for each client in Q15) (Again, note this entails calculating payment amounts, assume payments are due at the end of each period and the loan balance is completely paid at the end of the loan) (Note: provide your answer accurate to 2-digits to the right of the decimal.) 1 Which client has the largest monthly payment, and what is that monthly payment amount? [Note: provide your payment answer accurate to 2-digits to the right of the decimal.] (client number and payment amount)