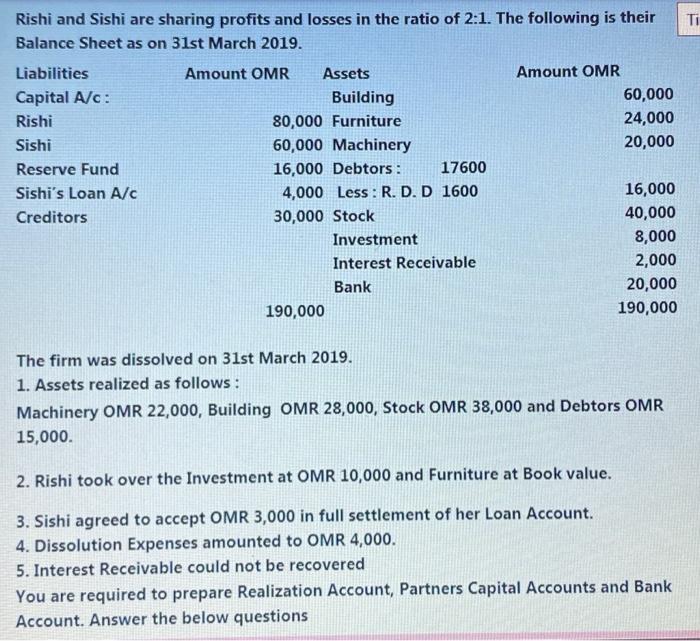

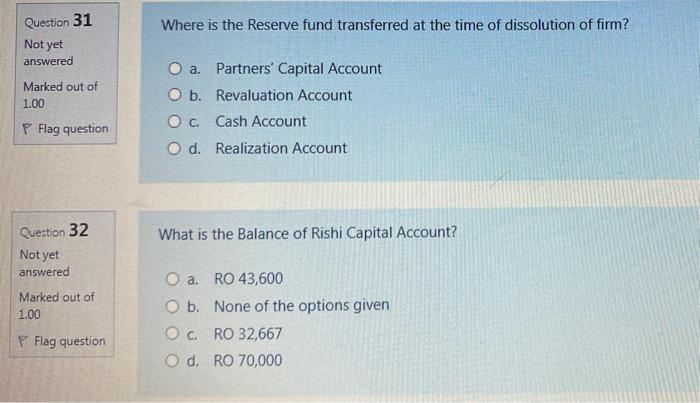

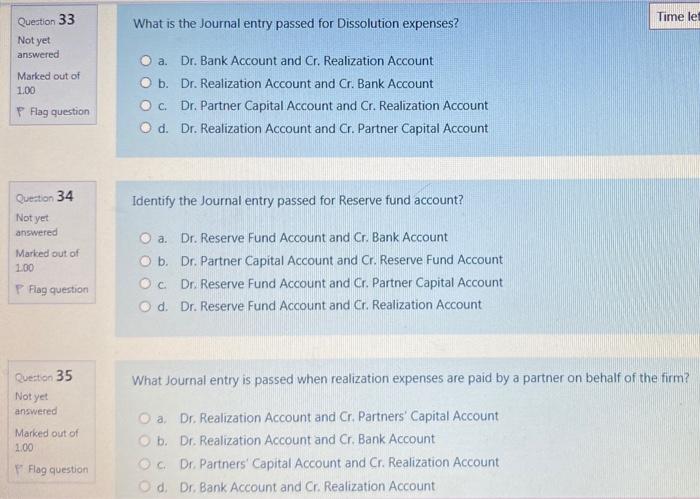

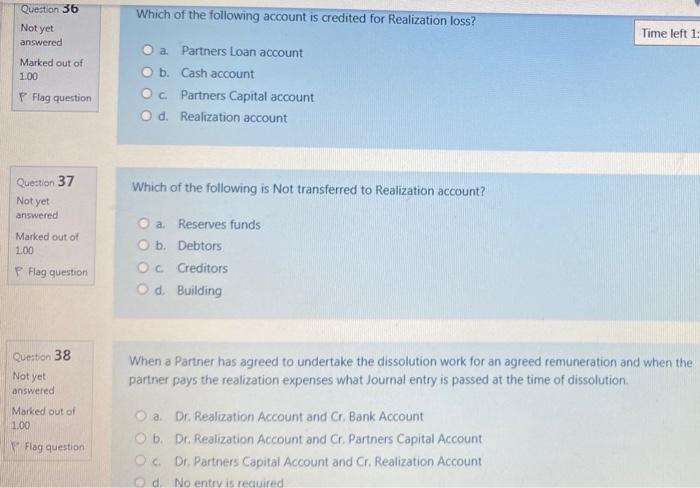

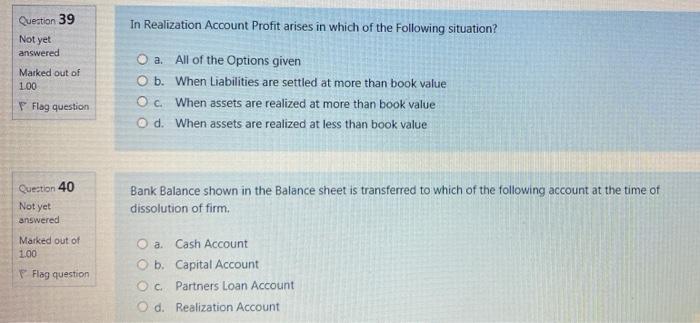

Ti Rishi and Sishi are sharing profits and losses in the ratio of 2:1. The following is their Balance Sheet as on 31st March 2019. Liabilities Amount OMR Assets Amount OMR Capital A/c: Building 60,000 Rishi 80,000 Furniture 24,000 Sishi 60,000 Machinery 20,000 Reserve Fund 16,000 Debtors : 17600 Sishi's Loan A/C 4,000 Less: R.D. D 1600 16,000 Creditors 30,000 Stock 40,000 Investment 8,000 Interest Receivable 2,000 Bank 20,000 190,000 190,000 The firm was dissolved on 31st March 2019. 1. Assets realized as follows: Machinery OMR 22,000, Building OMR 28,000, Stock OMR 38,000 and Debtors OMR 15,000. 2. Rishi took over the Investment at OMR 10,000 and Furniture at Book value. 3. Sishi agreed to accept OMR 3,000 in full settlement of her Loan Account. 4. Dissolution Expenses amounted to OMR 4,000. 5. Interest Receivable could not be recovered You are required to prepare Realization Account, Partners Capital Accounts and Bank Account. Answer the below questions Question 31 Where is the Reserve fund transferred at the time of dissolution of firm? Not yet answered Marked out of 1.00 O a. Partners' Capital Account O b. Revaluation Account OC. Cash Account O d. Realization Account P Flag question Question 32 What is the Balance of Rishi Capital Account? Not yet answered Marked out of 1.00 O a RO 43,600 O b. None of the options given Oc RO 32,667 O d. RO 70,000 P Flag question Time le Question 33 What is the Journal entry passed for Dissolution expenses? Not yet answered Marked out of 100 O a. Dr. Bank Account and Cr. Realization Account O b. Dr. Realization Account and Cr. Bank Account OC Dr. Partner Capital Account and Cr. Realization Account O d. Dr. Realization Account and Cr. Partner Capital Account P Flag question Question 34 Identify the Journal entry passed for Reserve fund account? Not yet answered Marked out of 1.80 a. Dr. Reserve Fund Account and Cr. Bank Account b. Dr. Partner Capital Account and Cr. Reserve Fund Account Oc Dr. Reserve Fund Account and Cr. Partner Capital Account d. Dr. Reserve Fund Account and Cr. Realization Account P Flag question Question 35 What Journal entry is passed when realization expenses are paid by a partner on behalf of the firm? Not yet answered Marked out of 1.00 a, Dr. Realization Account and Cr. Partners' Capital Account b. Dr. Realization Account and Cr. Bank Account Dr. Partners' Capital Account and Cr. Realization Account d Dr. Bank Account and cr. Realization Account Flag question Question 36 Which of the following account is credited for Realization loss? Not yet Time left 1: answered Marked out of 1.00 O a Partners Loan account O b. Cash account OC Partners Capital account O d. Realization account P Flag question Which of the following is not transferred to Realization account? Question 37 Not yet answered Marked out of 1.00 a. Reserves funds b. Debtors Oc Creditors Od Building P Flag question Question 38 Not yet When a Partner has agreed to undertake the dissolution work for an agreed remuneration and when the partner pays the realization expenses what Journal entry is passed at the time of dissolution answered Marked out of 1.00 Flag question a Dr. Realization Account and Cr. Bank Account b. Dr. Realization Account and Cr. Partners Capital Account Oc Dr. Partners Capital Account and Cr. Realization Account ed No entry is required Question 39 In Realization Account Profit arises in which of the following situation? Not yet answered Marked out of 1.00 O a. All of the Options given O b. When Liabilities are settled at more than book value Oc. When assets are realized at more than book value O d. When assets are realized at less than book value Flag question Question 40 Bank Balance shown in the Balance sheet is transferred to which of the following account at the time of dissolution of firm. Not yet answered Marked out of 100 Flag question Cash Account b. Capital Account OC. Partners Loan Account d. Realization Account