Question

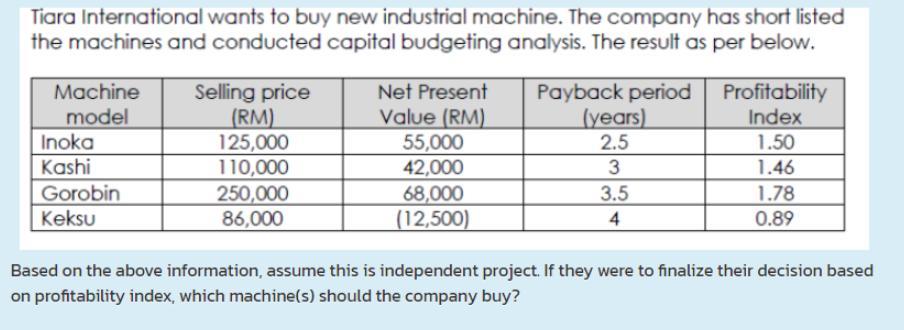

Tiara International wants to buy new industrial machine. The company has short listed the machines and conducted capital budgeting analysis. The result as per

Tiara International wants to buy new industrial machine. The company has short listed the machines and conducted capital budgeting analysis. The result as per below. Machine model Inoka Kashi Gorobin Keksu Selling price (RM) 125,000 110,000 250,000 86,000 Net Present Value (RM) 55,000 42,000 68,000 (12,500) Payback period (years) 2.5 3 3.5 4 Profitability Index 1.50 1.46 1.78 0.89 Based on the above information, assume this is independent project. If they were to finalize their decision based on profitability index, which machine(s) should the company buy?

Step by Step Solution

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Answer i Here there is no budget limitso accept projec...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Reporting Financial Statement Analysis And Valuation A Strategic Perspective

Authors: James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

9th Edition

1337614689, 1337614688, 9781337668262, 978-1337614689

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App