Question

Tibbins Pharmaceuticals: A Case on the Application of Time-Driven ActivityBased Costing in a Pharmaceutical Environment PURPOSE: The purpose of this case study is to actively

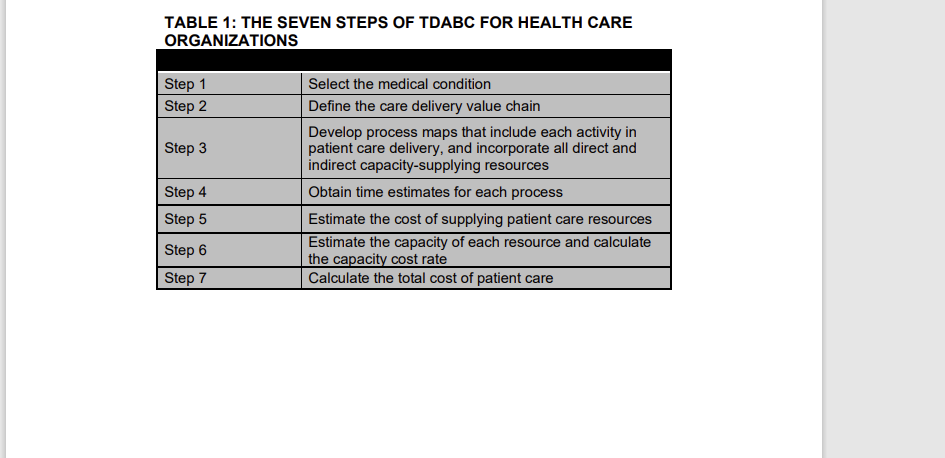

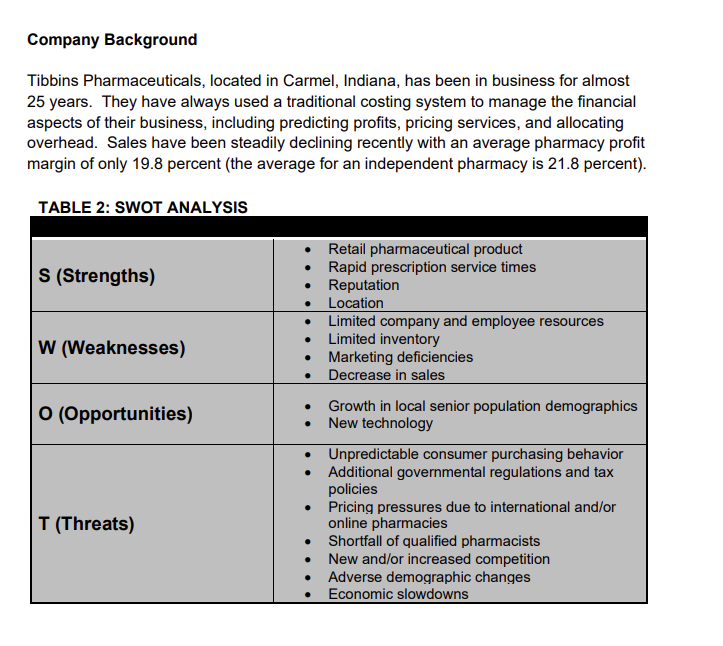

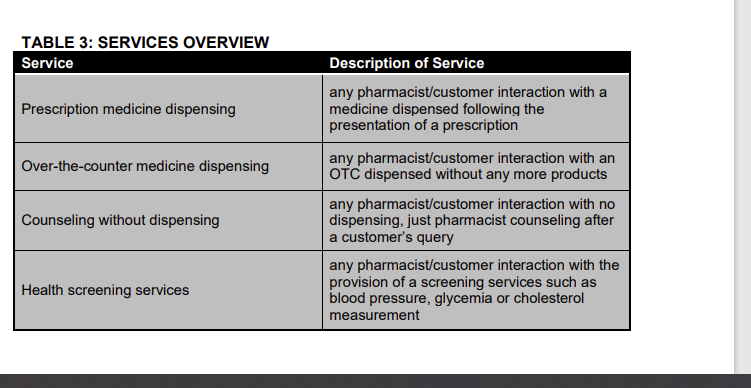

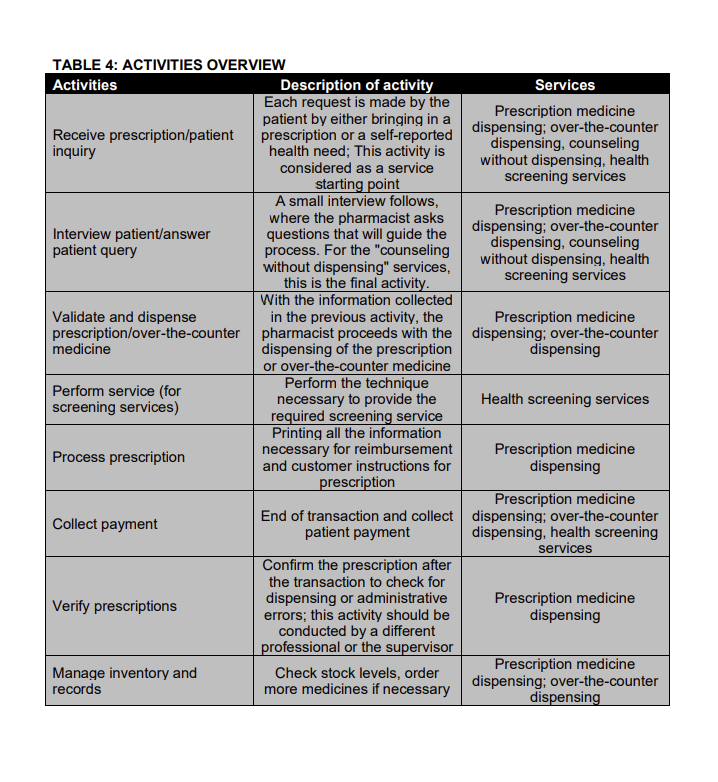

Tibbins Pharmaceuticals: A Case on the Application of Time-Driven ActivityBased Costing in a Pharmaceutical Environment PURPOSE: The purpose of this case study is to actively engage students in a case that explores a variation of activity-based costing in the health care industry called Time-Driven Activity-Based Costing (TDABC) and compare it to traditional cost accounting and activity-based costing (ABC) systems. The learning objectives are: Explain the seven steps necessary for development of a time-driven activitybased costing system. Identify the differences among ABC, TDABC and a traditional costing system. Apply a modified TDABC system to a company using all the steps except process mapping; and Evaluate whether the company should use its existing traditional costing method or convert to TDABC Skills: Students will apply the following skills in this case: Problem solving of a complex business case Analytical reasoning and critical thinking skills Generate a clear and articulate point of view to support decision Knowledge: This assignment will introduce students to cost accounting complexities in the healthcare industry. TASKS: The following are the requirements for this case study: PART 1 - ANALYSIS a. Identify the four major services provided by the pharmacy. b. List the 8 activities used to make up the four pharmacy services. c. What costs are traced to the process prescription activity? Collect payment activity? d. What is the average time it takes the pharmacists and pharmacy technicians to verify prescriptions? Manage inventory? What activity takes the most time? e. What is the amount of total resource costs incurred by Tibbins each year? How much does each resource cost? Which resource costs the most? The least? f. Calculate the total monthly costs of providing each of the pharmacys activities. Which activity is most costly? Which is least? You should complete and attach 8 separate Excel worksheets using Appendix B as the worksheet to complete for each activity. g. Calculate the pharmacys capacity based on the monthly working hours. Please use Appendix A to complete this question and attach the worksheet to your answer. h. What is the activity cost rate per minute for each of the activities using TDABC? You calculated this in f. Please provide a summary listing the eight activities and the cost rate. i. Allocate each activity cost based on time spent on each activity and calculate the total cost of each of the services. Which service costs the most? Which costs the least? s unprecedented pace resulting in improved production processes, the traditional costing system has remained almost virtually the same as long ago. Consequently, direct labor costs have been decreasing and replaced by greater overhead costs (Boer 1994). Activity-Based Costing To combat these significant changes over the last century that affect the costing of a product, in the late 1980s, Kaplan and Bruns created Activity-Based Costing (ABC). A fundamental purpose of ABC is the understandability of how a product is made, the costs that are involved, and the resulting net profitability. This is accomplished by focusing on cost drivers which can be defined as those activities that actually drive the costs in the making of a product. While traditional costing allocates all manufacturing overhead to products, ABC assigns both manufacturing and non-manufacturing costsbut only those traced to products. Perhaps the biggest difference between these two methods is the way overhead costs to objects are assigned. Traditional costing uses a plant-wide predetermined overhead rate; whereas ABC costs are assigned to activity pools and rates are calculated for each activity. Time-Driven Activity-Based Costing Although ABC is more accurate than traditional costing because it requires a greater understanding of the detailed processes in making a product, it is also more difficult and costly to implement. Additionally, after the initial implementation of ABC, it is often not maintained and updated causing cost estimates to become obsolete and inaccurate (Kaplan & Anderson 2004). This led to the development of Time-Driven Activity-Based Costing (TDABC). TDABC was developed by Kaplan and Anderson in the early 2000s as a modified version of ABC to improve the above-stated problems with the ABC system. TDABC requires estimates of only two parameters: capacity cost rate and time required to perform a transaction/activity. Advantages of implementation of TDABC include quick estimation and installation, inexpensive to develop, and easy to maintain and update changes in processes. Perhaps one of the greatest advantages is the wealth of knowledge that is generated related to the efficiencies of the business processes of the organization (Kaplan & Anderson 2004). TDABC in Health Care Even though ABC began to be implemented in the health care industry in the early 1990s and peaked in the mid-1990s, both the cost and complexity involved for successful implementation led to its demise (Keel, Savage, Rafiq & Mazzocato 2017). Because TDABC demands fewer resources and is easier to implement, the health care industry is beginning to successfully adopt this costing method. In a health care organization, there are seven steps, as shown in Table 1, of TDABC. TDABC uses two specific management tools: process mapping and ABC. It uses a bottoms-up approach to measure the cost of a specific medical condition. The calculation of total costs in a health care environment has been described as simpler and more straightforward than ABC (Keel, et al., p.757). In Waters (2015), the focus is on Boston Childrens Hospitals implementation of TDABC to determine the cost of care delivery which resulted in significant cost savings without jeopardizing patient outcomes (p. S47). In Yu, et al. (2017), they hypothesized that healthcare interventions in pediatric appendicitis can be costed using TDABC. They focused on the specific surgical condition of acute simple appendicitis. The authors concluded that TDABC a) is a useful tool in the appraisal of a specific condition; and b) can result in significant decreases in duration of phases of care as well as total costs (p. 1048). Another study develops the TDABC model with the purpose of calculating the cost of pharmaceutical services. They found that TDABC emphasizes the importance of cost analysis in a pharmaceutical environment and informs management of more efficient policies (Gregorio, Russo & Lapao, 2015). TABLE 1: THE SEVEN STEPS OF TDABC FOR HEALTH CARE ORGANIZATIONS Step 1 Select the medical condition Step 2 Define the care delivery value chain Step 3 Develop process maps that include each activity in patient care delivery, and incorporate all direct and indirect capacity-supplying resources Step 4 Obtain time estimates for each process Step 5 Estimate the cost of supplying patient care resources Step 6 Estimate the capacity of each resource and calculate the capacity cost rate Step 7 Calculate the total cost of patient care II. TIBBINS PHARMACEUTICALS Company Background Tibbins Pharmaceuticals, located in Carmel, Indiana, has been in business for almost 25 years. They have always used a traditional costing system to manage the financial aspects of their business, including predicting profits, pricing services, and allocating overhead. Sales have been steadily declining recently with an average pharmacy profit margin of only 19.8 percent (the average for an independent pharmacy is 21.8 percent). TABLE 2: SWOT ANALYSIS S (Strengths) Retail pharmaceutical product Rapid prescription service times Reputation Location W (Weaknesses) Limited company and employee resources Limited inventory Marketing deficiencies Decrease in sales O (Opportunities) Growth in local senior population demographics New technology T (Threats) Unpredictable consumer purchasing behavior Additional governmental regulations and tax policies Pricing pressures due to international and/or online pharmacies Shortfall of qualified pharmacists New and/or increased competition Adverse demographic changes Economic slowdowns During Tibbins Pharmaceuticals monthly employee meeting, Carolyn Richardson, the business manager, discussed the issue that they were seeing a decline in sales over the past two quarters. Competition is increasing in our area with the new Rite Aid around the corner. Maybe our services are overpriced? I am just not sure how that could be the case as we only markup our sales 20% (20-25% is average in pharmaceutical industry). How are our competitors making any money and beating our prices? Joel Larson, a current accounting major at a local university stated, Should we consider looking at our overhead allocations? Im in a cost accounting class this semester, and we are learning about activity-based costing (ABC), and a new method called timedriven activity-based costing (TDABC). Maybe we should consider reviewing our current allocation practices? Is there a chance that we are allocating incorrectly? Joel knew that TDABC was a newer method, but based on his classes, he also knew that pilot studies using TDABC had proven the system to be effective in healthcare practices. Could it be useful in a pharmacy as well? Joel met with Carolyn after the meeting to discuss his ideas. I know that it is a new costing system, but maybe we should consider time-driven activity-based costing? He was nervous that she would not be interested in this new strategy, but he knew that if he were given the opportunity, he could run the numbers and compare to their current allocations and prices. Maybe he could find a way to help the pharmacy! Carolyn hesitated but replied You are welcome to study the allocations on your own free time Joel. At this point, anything will be helpful. If we have another quarter where we lose sales at this amount, we will have to start looking at layoffs. Thank you, Carolyn! I will let you know what I can find out. Joel was encouraged by her reluctant permission to review the numbers. He had a suspicion that they had been overpricing certain services while underpricing others. He set off to begin his study of the pharmacys allocations. To begin the process of implementing TDABC, Joel knew he needed to begin by identifying the four major services provided by the pharmacy. So, he spoke with the pharmacists and pharmacy technicians to learn about the services they provided. He was able to group them tasks into four major services, prescription medicine dispensing, over-the-counter medicine dispensing, counseling without dispensing, and health screening services. TABLE 3: SERVICES OVERVIEW Service Description of Service Prescription medicine dispensing any pharmacist/customer interaction with a medicine dispensed following the presentation of a prescription Over-the-counter medicine dispensing any pharmacist/customer interaction with an OTC dispensed without any more products Counseling without dispensing any pharmacist/customer interaction with no dispensing, just pharmacist counseling after a customers query Health screening services any pharmacist/customer interaction with the provision of a screening services such as blood pressure, glycemia or cholesterol measurement At this point, Joel knew that he needed to further break down the services into specific activities. Joel went back to the pharmacy technicians to determine what specific activities were included in each service. Some of the activities, like counseling, were included in multiple services. He created Table 4 to help him stay organized as to how each of the activities are used to make up the four pharmacy services. Based on Joels knowledge of cost accounting, he decided to treat every activity as a cost center to which he would assign both direct and indirect costs. TABLE 4: ACTIVITIES OVERVIEW Activities Description of activity Services Receive prescription/patient inquiry Each request is made by the patient by either bringing in a prescription or a self-reported health need; This activity is considered as a service starting point Prescription medicine dispensing; over-the-counter dispensing, counseling without dispensing, health screening services Interview patient/answer patient query A small interview follows, where the pharmacist asks questions that will guide the process. For the "counseling without dispensing" services, this is the final activity. Prescription medicine dispensing; over-the-counter dispensing, counseling without dispensing, health screening services Validate and dispense prescription/over-the-counter medicine With the information collected in the previous activity, the pharmacist proceeds with the dispensing of the prescription or over-the-counter medicine Prescription medicine dispensing; over-the-counter dispensing Perform service (for screening services) Perform the technique necessary to provide the required screening service Health screening services Process prescription Printing all the information necessary for reimbursement and customer instructions for prescription Prescription medicine dispensing Collect payment End of transaction and collect patient payment Prescription medicine dispensing; over-the-counter dispensing, health screening services Verify prescriptions Confirm the prescription after the transaction to check for dispensing or administrative errors; this activity should be conducted by a different professional or the supervisor Prescription medicine dispensing Manage inventory and records Check stock levels, order more medicines if necessary Prescription medicine dispensing; over-the-counter dispensing Next, Joel knew that he would need to understand how the costs could be traced to each of these activities. He visited Carolyn in her office to see if she had this information available. Luckily, she had a table already created for him. This will save a lot of time. Thank you, Carolyn! Joel said. The table Carolyn provided (Table 5: Cost Assignment) clearly showed which costs should be traced to each activity. For instance, to receive a prescription and address a patient inquiry, he would need to assign costs for salaries, workspace, amortization and depreciation, utilities, support costs, and other miscellaneous losses. Joel now had a clear understanding of the services provided, activities, and how the costs could be traced to each activity. This gave him the information needed to begin assigning costs to each of the four services provided.

Tibbins Pharmaceuticals: A Case on the Application of Time-Driven ActivityBased Costing in a Pharmaceutical Environment PURPOSE: The purpose of this case study is to actively engage students in a case that explores a variation of activity-based costing in the health care industry called Time-Driven Activity-Based Costing (TDABC) and compare it to traditional cost accounting and activity-based costing (ABC) systems. The learning objectives are: Explain the seven steps necessary for development of a time-driven activitybased costing system. Identify the differences among ABC, TDABC and a traditional costing system. Apply a modified TDABC system to a company using all the steps except process mapping; and Evaluate whether the company should use its existing traditional costing method or convert to TDABC Skills: Students will apply the following skills in this case: Problem solving of a complex business case Analytical reasoning and critical thinking skills Generate a clear and articulate point of view to support decision Knowledge: This assignment will introduce students to cost accounting complexities in the healthcare industry. TASKS: The following are the requirements for this case study: PART 1 - ANALYSIS a. Identify the four major services provided by the pharmacy. b. List the 8 activities used to make up the four pharmacy services. c. What costs are traced to the process prescription activity? Collect payment activity? d. What is the average time it takes the pharmacists and pharmacy technicians to verify prescriptions? Manage inventory? What activity takes the most time? e. What is the amount of total resource costs incurred by Tibbins each year? How much does each resource cost? Which resource costs the most? The least? f. Calculate the total monthly costs of providing each of the pharmacys activities. Which activity is most costly? Which is least? You should complete and attach 8 separate Excel worksheets using Appendix B as the worksheet to complete for each activity. g. Calculate the pharmacys capacity based on the monthly working hours. Please use Appendix A to complete this question and attach the worksheet to your answer. h. What is the activity cost rate per minute for each of the activities using TDABC? You calculated this in f. Please provide a summary listing the eight activities and the cost rate. i. Allocate each activity cost based on time spent on each activity and calculate the total cost of each of the services. Which service costs the most? Which costs the least? s unprecedented pace resulting in improved production processes, the traditional costing system has remained almost virtually the same as long ago. Consequently, direct labor costs have been decreasing and replaced by greater overhead costs (Boer 1994). Activity-Based Costing To combat these significant changes over the last century that affect the costing of a product, in the late 1980s, Kaplan and Bruns created Activity-Based Costing (ABC). A fundamental purpose of ABC is the understandability of how a product is made, the costs that are involved, and the resulting net profitability. This is accomplished by focusing on cost drivers which can be defined as those activities that actually drive the costs in the making of a product. While traditional costing allocates all manufacturing overhead to products, ABC assigns both manufacturing and non-manufacturing costsbut only those traced to products. Perhaps the biggest difference between these two methods is the way overhead costs to objects are assigned. Traditional costing uses a plant-wide predetermined overhead rate; whereas ABC costs are assigned to activity pools and rates are calculated for each activity. Time-Driven Activity-Based Costing Although ABC is more accurate than traditional costing because it requires a greater understanding of the detailed processes in making a product, it is also more difficult and costly to implement. Additionally, after the initial implementation of ABC, it is often not maintained and updated causing cost estimates to become obsolete and inaccurate (Kaplan & Anderson 2004). This led to the development of Time-Driven Activity-Based Costing (TDABC). TDABC was developed by Kaplan and Anderson in the early 2000s as a modified version of ABC to improve the above-stated problems with the ABC system. TDABC requires estimates of only two parameters: capacity cost rate and time required to perform a transaction/activity. Advantages of implementation of TDABC include quick estimation and installation, inexpensive to develop, and easy to maintain and update changes in processes. Perhaps one of the greatest advantages is the wealth of knowledge that is generated related to the efficiencies of the business processes of the organization (Kaplan & Anderson 2004). TDABC in Health Care Even though ABC began to be implemented in the health care industry in the early 1990s and peaked in the mid-1990s, both the cost and complexity involved for successful implementation led to its demise (Keel, Savage, Rafiq & Mazzocato 2017). Because TDABC demands fewer resources and is easier to implement, the health care industry is beginning to successfully adopt this costing method. In a health care organization, there are seven steps, as shown in Table 1, of TDABC. TDABC uses two specific management tools: process mapping and ABC. It uses a bottoms-up approach to measure the cost of a specific medical condition. The calculation of total costs in a health care environment has been described as simpler and more straightforward than ABC (Keel, et al., p.757). In Waters (2015), the focus is on Boston Childrens Hospitals implementation of TDABC to determine the cost of care delivery which resulted in significant cost savings without jeopardizing patient outcomes (p. S47). In Yu, et al. (2017), they hypothesized that healthcare interventions in pediatric appendicitis can be costed using TDABC. They focused on the specific surgical condition of acute simple appendicitis. The authors concluded that TDABC a) is a useful tool in the appraisal of a specific condition; and b) can result in significant decreases in duration of phases of care as well as total costs (p. 1048). Another study develops the TDABC model with the purpose of calculating the cost of pharmaceutical services. They found that TDABC emphasizes the importance of cost analysis in a pharmaceutical environment and informs management of more efficient policies (Gregorio, Russo & Lapao, 2015). TABLE 1: THE SEVEN STEPS OF TDABC FOR HEALTH CARE ORGANIZATIONS Step 1 Select the medical condition Step 2 Define the care delivery value chain Step 3 Develop process maps that include each activity in patient care delivery, and incorporate all direct and indirect capacity-supplying resources Step 4 Obtain time estimates for each process Step 5 Estimate the cost of supplying patient care resources Step 6 Estimate the capacity of each resource and calculate the capacity cost rate Step 7 Calculate the total cost of patient care II. TIBBINS PHARMACEUTICALS Company Background Tibbins Pharmaceuticals, located in Carmel, Indiana, has been in business for almost 25 years. They have always used a traditional costing system to manage the financial aspects of their business, including predicting profits, pricing services, and allocating overhead. Sales have been steadily declining recently with an average pharmacy profit margin of only 19.8 percent (the average for an independent pharmacy is 21.8 percent). TABLE 2: SWOT ANALYSIS S (Strengths) Retail pharmaceutical product Rapid prescription service times Reputation Location W (Weaknesses) Limited company and employee resources Limited inventory Marketing deficiencies Decrease in sales O (Opportunities) Growth in local senior population demographics New technology T (Threats) Unpredictable consumer purchasing behavior Additional governmental regulations and tax policies Pricing pressures due to international and/or online pharmacies Shortfall of qualified pharmacists New and/or increased competition Adverse demographic changes Economic slowdowns During Tibbins Pharmaceuticals monthly employee meeting, Carolyn Richardson, the business manager, discussed the issue that they were seeing a decline in sales over the past two quarters. Competition is increasing in our area with the new Rite Aid around the corner. Maybe our services are overpriced? I am just not sure how that could be the case as we only markup our sales 20% (20-25% is average in pharmaceutical industry). How are our competitors making any money and beating our prices? Joel Larson, a current accounting major at a local university stated, Should we consider looking at our overhead allocations? Im in a cost accounting class this semester, and we are learning about activity-based costing (ABC), and a new method called timedriven activity-based costing (TDABC). Maybe we should consider reviewing our current allocation practices? Is there a chance that we are allocating incorrectly? Joel knew that TDABC was a newer method, but based on his classes, he also knew that pilot studies using TDABC had proven the system to be effective in healthcare practices. Could it be useful in a pharmacy as well? Joel met with Carolyn after the meeting to discuss his ideas. I know that it is a new costing system, but maybe we should consider time-driven activity-based costing? He was nervous that she would not be interested in this new strategy, but he knew that if he were given the opportunity, he could run the numbers and compare to their current allocations and prices. Maybe he could find a way to help the pharmacy! Carolyn hesitated but replied You are welcome to study the allocations on your own free time Joel. At this point, anything will be helpful. If we have another quarter where we lose sales at this amount, we will have to start looking at layoffs. Thank you, Carolyn! I will let you know what I can find out. Joel was encouraged by her reluctant permission to review the numbers. He had a suspicion that they had been overpricing certain services while underpricing others. He set off to begin his study of the pharmacys allocations. To begin the process of implementing TDABC, Joel knew he needed to begin by identifying the four major services provided by the pharmacy. So, he spoke with the pharmacists and pharmacy technicians to learn about the services they provided. He was able to group them tasks into four major services, prescription medicine dispensing, over-the-counter medicine dispensing, counseling without dispensing, and health screening services. TABLE 3: SERVICES OVERVIEW Service Description of Service Prescription medicine dispensing any pharmacist/customer interaction with a medicine dispensed following the presentation of a prescription Over-the-counter medicine dispensing any pharmacist/customer interaction with an OTC dispensed without any more products Counseling without dispensing any pharmacist/customer interaction with no dispensing, just pharmacist counseling after a customers query Health screening services any pharmacist/customer interaction with the provision of a screening services such as blood pressure, glycemia or cholesterol measurement At this point, Joel knew that he needed to further break down the services into specific activities. Joel went back to the pharmacy technicians to determine what specific activities were included in each service. Some of the activities, like counseling, were included in multiple services. He created Table 4 to help him stay organized as to how each of the activities are used to make up the four pharmacy services. Based on Joels knowledge of cost accounting, he decided to treat every activity as a cost center to which he would assign both direct and indirect costs. TABLE 4: ACTIVITIES OVERVIEW Activities Description of activity Services Receive prescription/patient inquiry Each request is made by the patient by either bringing in a prescription or a self-reported health need; This activity is considered as a service starting point Prescription medicine dispensing; over-the-counter dispensing, counseling without dispensing, health screening services Interview patient/answer patient query A small interview follows, where the pharmacist asks questions that will guide the process. For the "counseling without dispensing" services, this is the final activity. Prescription medicine dispensing; over-the-counter dispensing, counseling without dispensing, health screening services Validate and dispense prescription/over-the-counter medicine With the information collected in the previous activity, the pharmacist proceeds with the dispensing of the prescription or over-the-counter medicine Prescription medicine dispensing; over-the-counter dispensing Perform service (for screening services) Perform the technique necessary to provide the required screening service Health screening services Process prescription Printing all the information necessary for reimbursement and customer instructions for prescription Prescription medicine dispensing Collect payment End of transaction and collect patient payment Prescription medicine dispensing; over-the-counter dispensing, health screening services Verify prescriptions Confirm the prescription after the transaction to check for dispensing or administrative errors; this activity should be conducted by a different professional or the supervisor Prescription medicine dispensing Manage inventory and records Check stock levels, order more medicines if necessary Prescription medicine dispensing; over-the-counter dispensing Next, Joel knew that he would need to understand how the costs could be traced to each of these activities. He visited Carolyn in her office to see if she had this information available. Luckily, she had a table already created for him. This will save a lot of time. Thank you, Carolyn! Joel said. The table Carolyn provided (Table 5: Cost Assignment) clearly showed which costs should be traced to each activity. For instance, to receive a prescription and address a patient inquiry, he would need to assign costs for salaries, workspace, amortization and depreciation, utilities, support costs, and other miscellaneous losses. Joel now had a clear understanding of the services provided, activities, and how the costs could be traced to each activity. This gave him the information needed to begin assigning costs to each of the four services provided.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started