Question

Ticker Symbol: GE PG HD HPQ Research the four firms using either Financials from the overview/main pages for the stocks on Yahoo! Finance Web site.

Ticker Symbol:

Ticker Symbol:

GE PG HD HPQ

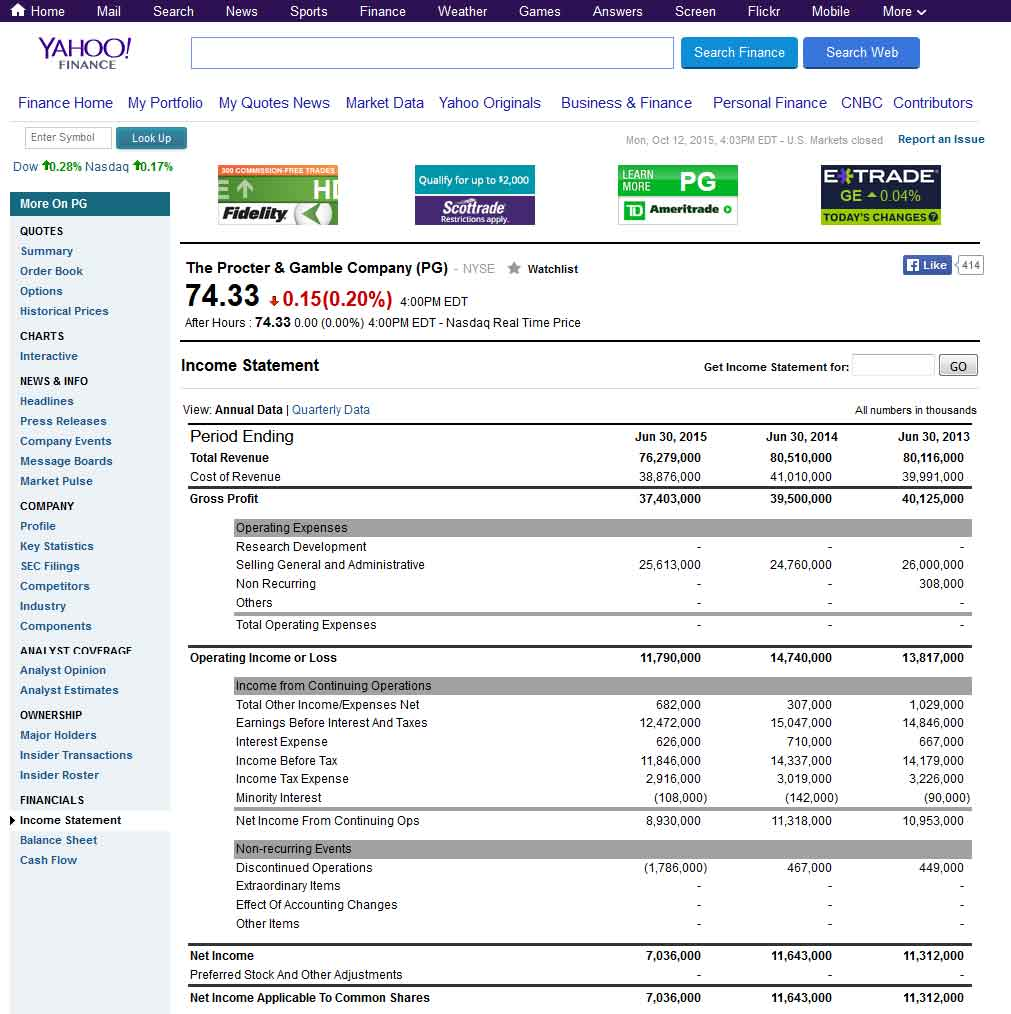

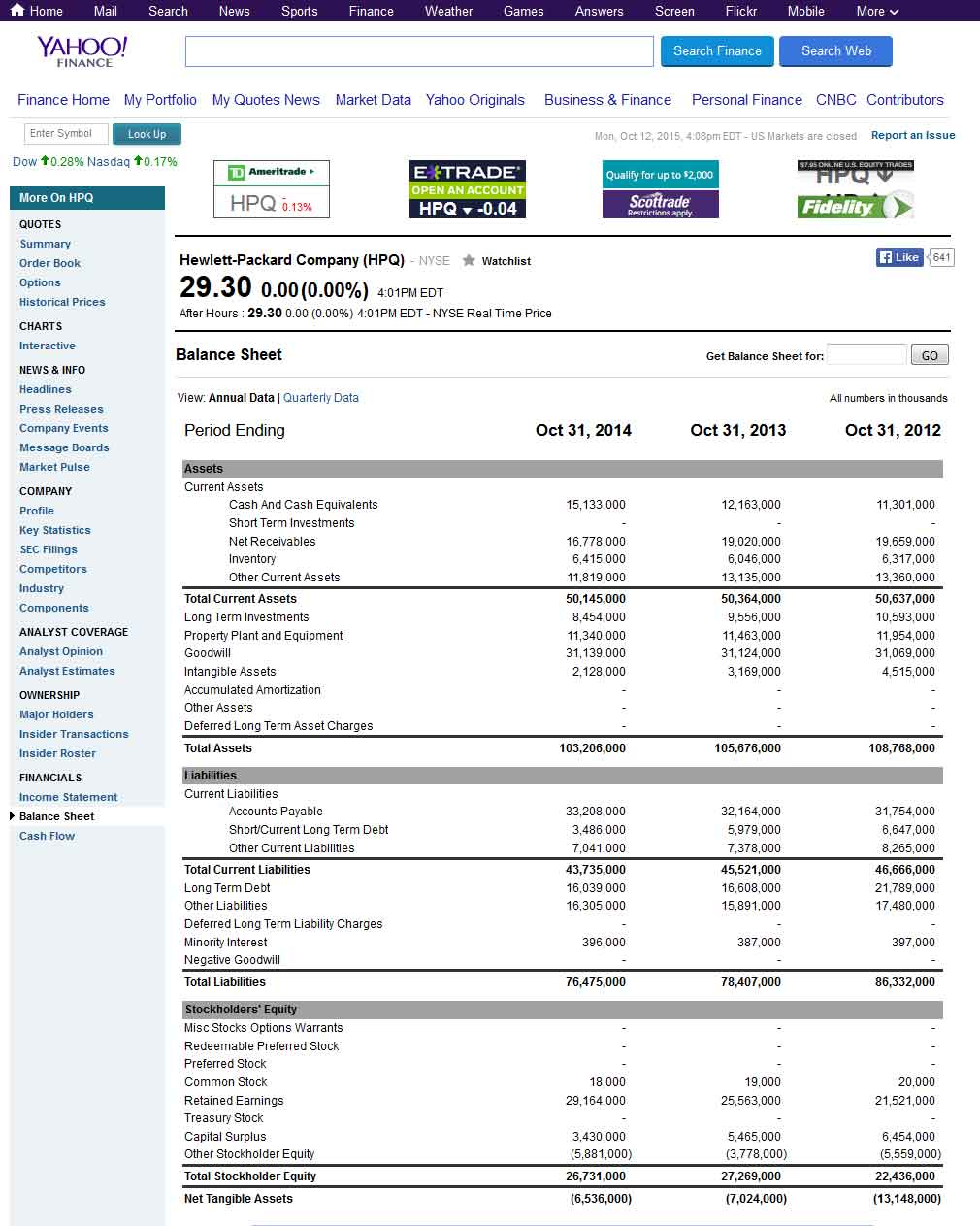

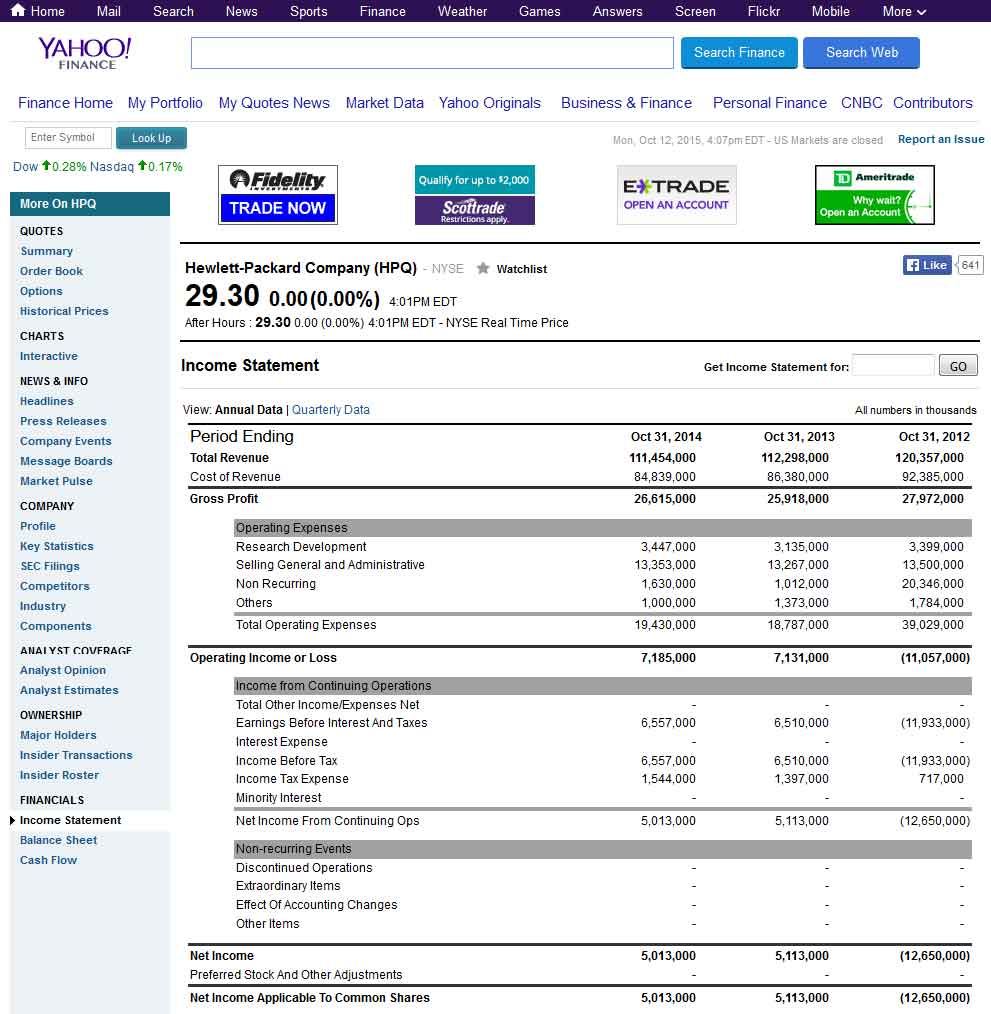

Research the four firms using either Financials from the overview/main pages for the stocks on Yahoo! Finance Web site. Compute and compare the following financial ratios for the four firms for their most recent fiscal years:

1. Current Ratio (X) 2. Sales/Total Assets (percent) or Total asset turnover 3. Times interest earned (X) 4. Total Debt/Equity (percent) 5. Net Income / Net Sales (percent) or Return on Sales (ROS) 6. Net Income / Total Assets (percent) or Return on Assets (ROA) 7. Net Income / Common Equity (percent) or Return on Equity (ROE) 8. P/E or P/E Ratio (X)

Compare the 8 financial ratios listed above for the four companies.Use a spreadsheet to demonstrate your comparison.

Respond to the following questions:

1. How would you rank the four firms in terms of financial performance? 2. Why might their financial performances differ? 3. What economic or market factors might account for big differences in P/E ratios?

Select ONE of the companies and examine the trend in the ratios* for the past three years. Respond to the following question:

1. Is the firm's performance improving, declining, stable, or is something strange going on?

Home Mail Search News Sports Finance Weather Games Answers Screen Flickr Mobile More YAHOO ea Search Web FINANCE Finance Home My Portfolio My Quotes News Market Data Yahoo Originals Business & Finance Personal Finance CNBC Contributors Enter Symbal Mon, Oct 12 2015, 4:03PM EDT-U.S. Markets closed Report an issue Dow 10.28% Nasdaq 10.17% LEARN MORE E TRADE GE 0.04% Qualify for up to $2,000 More On PG QUOTES Su Order Book Scottrade Restrictions apply Ameritrade o The Procter & Gamble Company (PG) NYSE Watchlist 414 0 4:00PM EDT Historical Prices After Hours : 74.33 0.00 (0.00%) 4:00PM EDT-Nasdaq Real Time Price Income Statement Get Income Statement for: GO NEWS & INFO View: Annual Data Quarterly Data All numbers in thousands Press Releases Company Events Message Boards Market Pulse COMPANY Period Ending Total Revenue Cost of Revenue Gross Profit 76,279,000 38,876,000 37.403,000 Jun 30, 2014 80,510,000 41,010,000 39,500,000 Jun 30, 2013 80,116,000 39,991,000 40,125,000 perating Expenses Research Development Selling General and Administrative Non Recurring Key Statistics SEC Filings 25,613,000 24,760,000 26,000,000 308,000 Total Operating Expenses ANAIYST COVFRAGF Analyst Opinion Analyst Estimates OWNERSHIP Major Operating Income or Loss 11,790,000 14,740,000 rations 682,000 12.472.000 626,000 11,846,000 2,916,000 307,000 15,047,000 710,000 14,337,000 3,019,000 Total Other Income/Expenses Net Earnings Before Interest And Taxes 1,029,000 14,846,000 rans Income Before Tax Income Tax Expense Minority Interest Net Income From Continuing Ops 14,179,000 3,226,000 Insider Roster FINANCIALS Income Statement Balance Sheet Cash Flow (108,000) 8,930,000 (142,000) 11,318,000 (90,000) 10,953,000 ven 467,000 Discontinued Operations Extraordinary Items Effect Of Accounting Changes Other Items (1,786,000) 449,000 Net Income Preferred Stock And Other Adjustments Net Income Applicable To Common Shares 7,036,000 11,643,000 11,312,000 7,036,000 11,643.000 11,312,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started