Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Tidwell Company experienced the following during 20X1: A. Sold preferred stock for $489,000. B. Declared dividends of $159,000 payable on March 1, 20X2. C. Borrowed

Tidwell Company experienced the following during 20X1:

| A. | Sold preferred stock for $489,000. |

| B. | Declared dividends of $159,000 payable on March 1, 20X2. |

| C. | Borrowed $582,000 from a bank on a 2-year note. |

| D. | Purchased $84,000 of its own common stock to hold as treasury stock. |

| E. | Repaid 5-year bonds issued for $408,000 that mature and are due in December. |

Required:

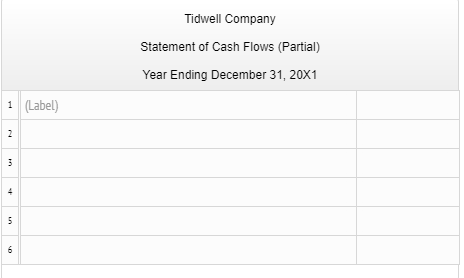

| Prepare the net cash from financing activities section of the statement of cash flows. |

Refer to the list below for the exact wording of an amount description within your Statement of Cash Flows.

| Amount Descriptions | Labels |

| Borrowed from bank | Cash flows from financing activities |

| Issued bonds | Cash flows from investing activities |

| Payment of dividends | |

| Purchased treasury stock | |

| Repaid bank loan | |

| Retired bonds | |

| Sold preferred stock | |

| Sold treasury stock | |

| Net cash from financing activities | |

| Net cash from investing activities |

Prepare the net cash from financing activities section of the statement of cash flows. (Note: Use a minus sign to indicate any decreases in cash or cash outflows. Refer to the Amount Descriptions list provided for the exact wording of the answer choices for text entries.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started