Question

Tiger Equipment Inc., a manufacturer of construction equipment, prepared the following factory overhead cost budget for the Welding Department for May of the current year.

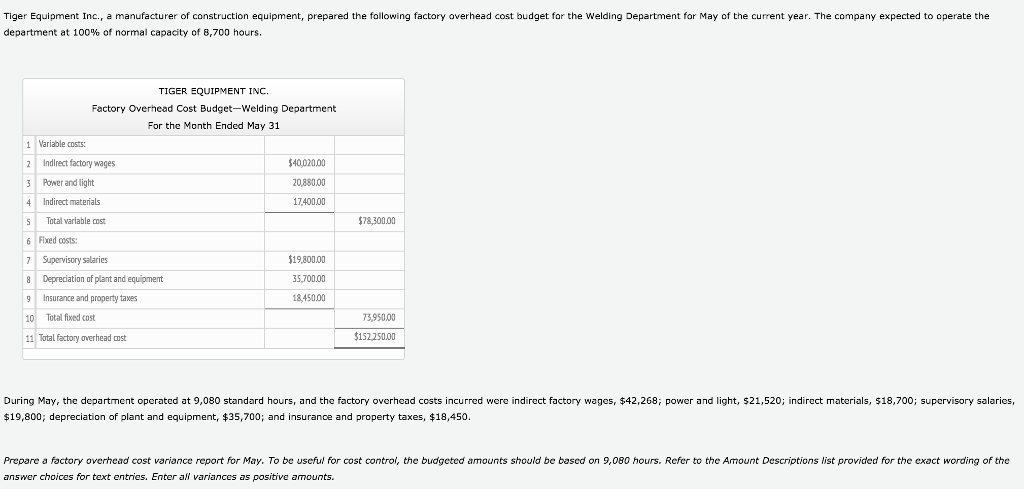

Tiger Equipment Inc., a manufacturer of construction equipment, prepared the following factory overhead cost budget for the Welding Department for May of the current year. The company expected to operate the department at 100% of normal capacity of 8,700 hours.

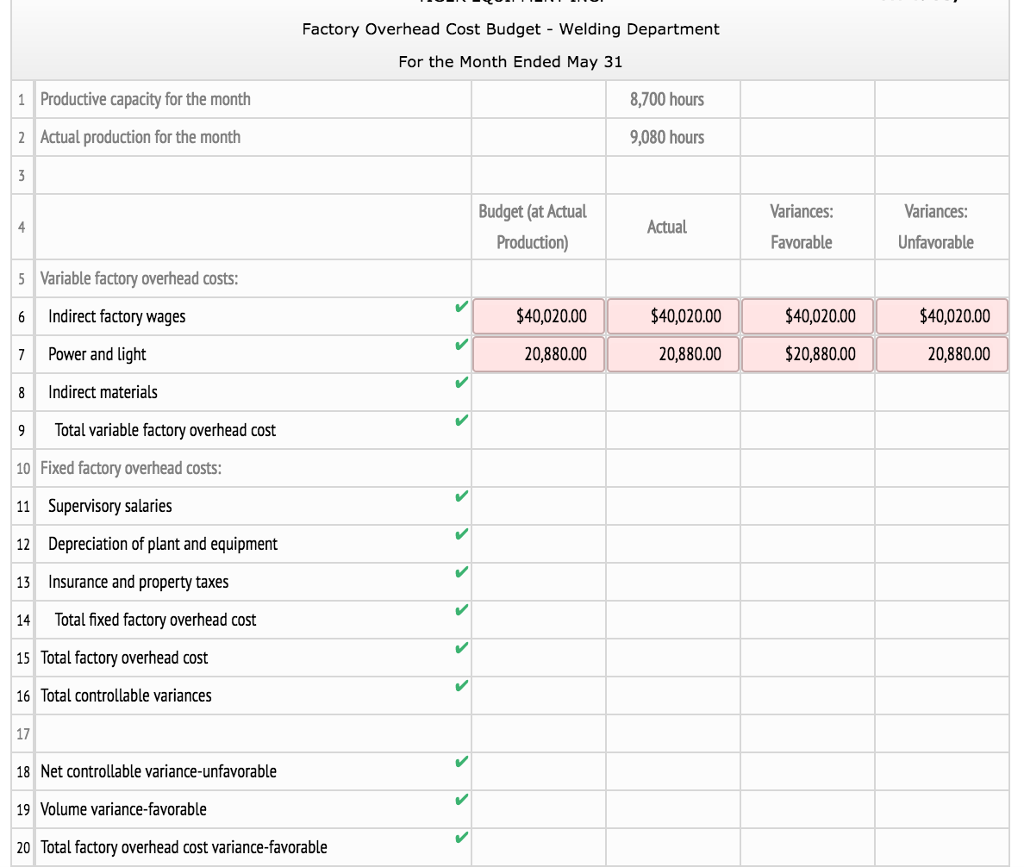

During May, the department operated at 9,080 standard hours, and the factory overhead costs incurred were indirect factory wages, $42,268; power and light, $21,520; indirect materials, $18,700; supervisory salaries, $19,800; depreciation of plant and equipment, $35,700; and insurance and property taxes, $18,450.

Prepare a factory overhead cost variance report for May. To be useful for cost control, the budgeted amounts should be based on 9,080 hours. Refer to the Amount Descriptions list provided for the exact wording of the answer choices for text entries. Enter all variances as positive amounts.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started