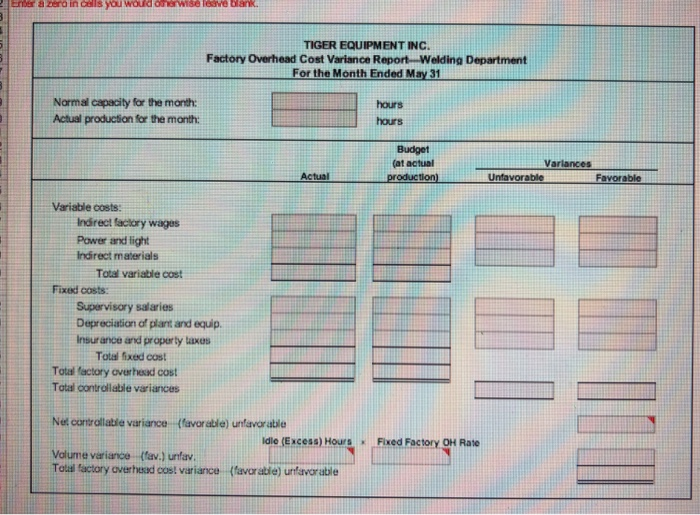

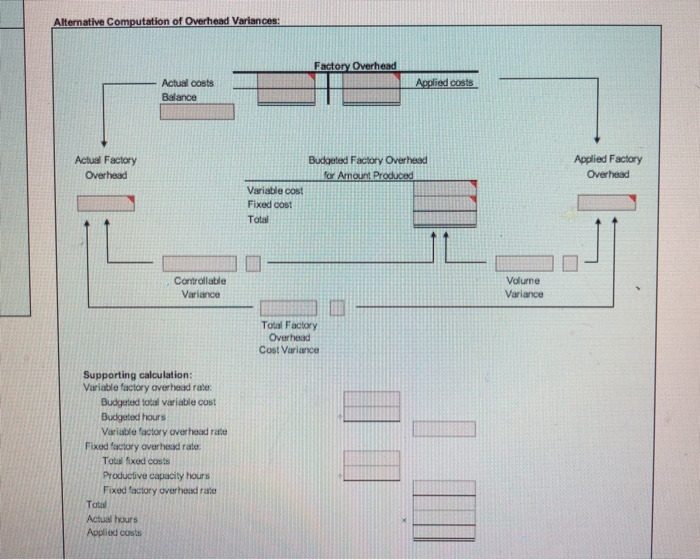

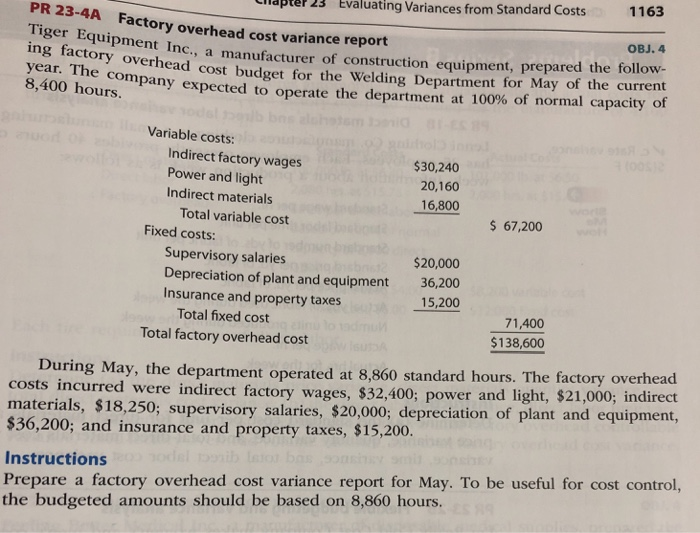

TIGER EQUIPMENT INC. Factory Overhead Cost Variance Report. Welding Department For the Month Ended May 31 Normal capacity for the manth: Actual production for the manth: hours hours Budget at actual Varlances Actual Untavorable Favorable Variable costs Indrect factory wages Power and light Indirect naterials Total variable cost Fixed costs: Supervisory salaries Depreciation of plant and equip Insurance and property taxes Total fixed cost Total factory overhesad cost Total controlable variances Nel controllable variance (favorable) unfavorable Volume variance (fav.) unfav Idle (Excess) Hours Fixed Factory OH Rate Tatal factory overhead cos! variance (favarable) urfavorable Alternative Computation of Overhead Variances: lied costs Actual costs Balance Actual Factory Overhead Budgeted Factory Overhead Applied Factory Overhead Variable cost Fixed cost Total Controllable Variance Vdlume Variance Total Factory Ovarhead Cost Variance Supporting calculation Variable factory overhead rate Budgeted total variable cost Budgeted hours Variable factory averhoad rate Fixed factory overhead rate Total fixed costs Productive capacity hours Fixed factory overhead rate Tatal Actueal hours Applied costs 1163 OBJ. 4 Inc, a manufacturer of construction equipment, prepared the follow- lapter 23 Evaluating Variances from Standard Costs PR 23-4A Factory overhead cost variance report ing facto year. T 8,400 hours. overhead cost budget for the Welding Department for May of the current company expected to operte the department at 100% of normal capacity of he Variable costs: Indirect factory wages Power and light Indirect materials $30,240 20,160 16,800 Total variable cost 67,200 Fixed costs: Supervisory salaries Depreciation of plant and equipment Insurance and property taxes $20,000 36,200 15,200 Total fixed cost Total factory overhead cost 71,400 $138,600 During May, the department operated at 8,860 standard hours. The factory overhead costs incurred were indirect factory materials, $18,250; supervisory salaries, $20,000; depreciation of plant and equipment, $36,200; and insurance and property taxes, $15,200. Instructions Prepare a factory overhead cost variance report for May. To be useful for cost control, the budgeted amounts should be based on 8,860 hours. wages, $32,400; power and light, $21,000; indirect