Question

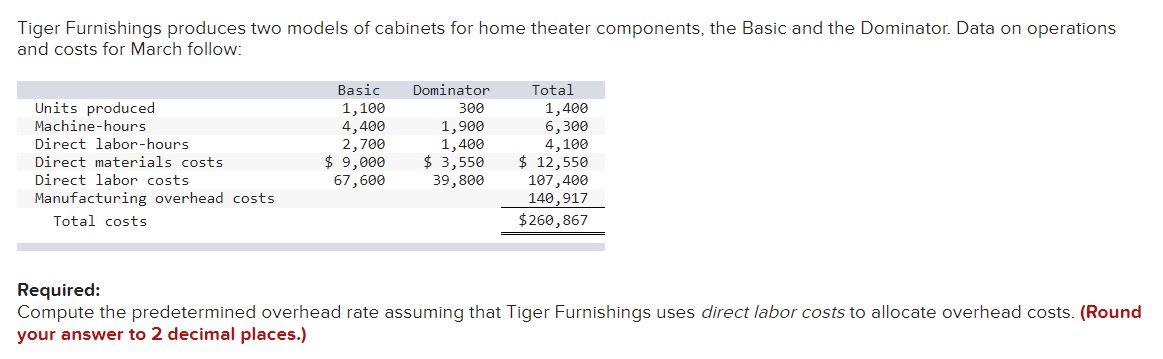

Tiger Furnishings produces two models of cabinets for home theater components, the Basic and the Dominator. Data on operations and costs for March follow:

Tiger Furnishings produces two models of cabinets for home theater components, the Basic and the Dominator. Data on operations and costs for March follow: Total Units produced Basic 1,100 4,400 1,400 Dominator 300 1,900 1,400 Machine-hours Direct labor-hours 2,700 $ 3,550 Direct materials costs. Direct labor costs. $9,000 67,600 6,300 4,100 $ 12,550 107,400 140,917 $260,867 39,800 Manufacturing overhead costs Total costs Required: Compute the predetermined overhead rate assuming that Tiger Furnishings uses direct labor costs to allocate overhead costs. (Round your answer to 2 decimal places.)

Step by Step Solution

3.52 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Labor cost related overhead rate T...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Cost Accounting

Authors: William Lanen, Shannon Anderson, Michael Maher

3rd Edition

9780078025525, 9780077517359, 77517350, 978-0077398194

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App