Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Tiger Ltd is a distributor of golf bags. On 1 June 2017, Tiger Ltd had 300 golf bags on hand at a cost of

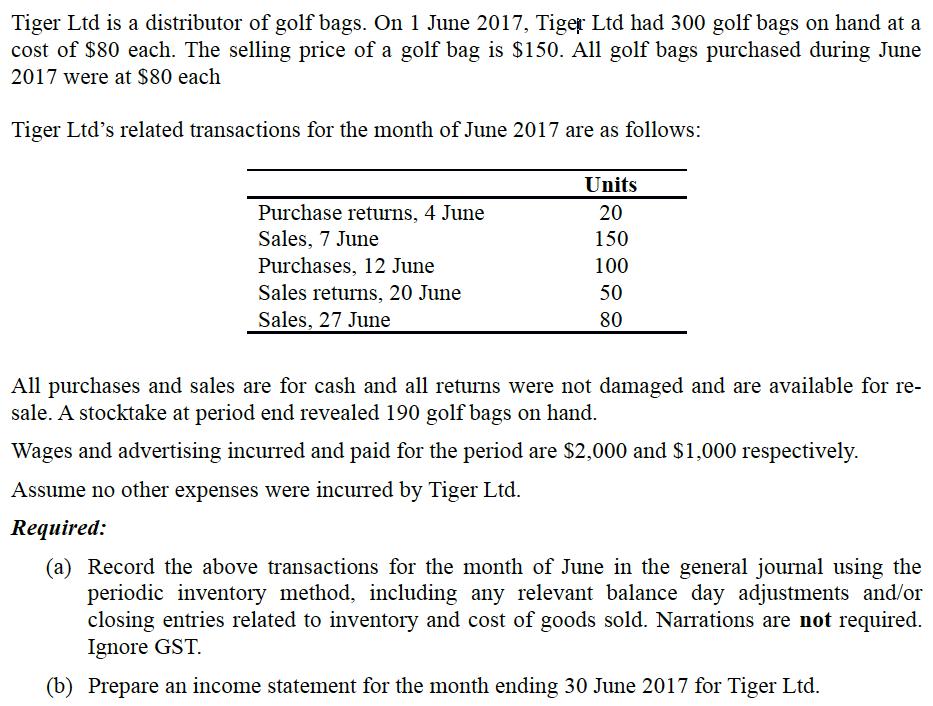

Tiger Ltd is a distributor of golf bags. On 1 June 2017, Tiger Ltd had 300 golf bags on hand at a cost of $80 each. The selling price of a golf bag is $150. All golf bags purchased during June 2017 were at $80 each Tiger Ltd's related transactions for the month of June 2017 are as follows: Units Purchase returns, 4 June Sales, 7 June Purchases, 12 June Sales returns, 20 June Sales, 27 June 20 150 100 50 80 All purchases and sales are for cash and all returns were not damaged and are available for re- sale. A stocktake at period end revealed 190 golf bags on hand. Wages and advertising incurred and paid for the period are $2,000 and $1,000 respectively. Assume no other expenses were incurred by Tiger Ltd. Required: (a) Record the above transactions for the month of June in the general journal using the periodic inventory method, including any relevant balance day adjustments and/or closing entries related to inventory and cost of goods sold. Narrations are not required. Ignore GST. (b) Prepare an income statement for the month ending 30 June 2017 for Tiger Ltd.

Step by Step Solution

★★★★★

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Date Particulars Debit credit 01 June Trading ac Opening stock 24000 24000 04 June C...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started