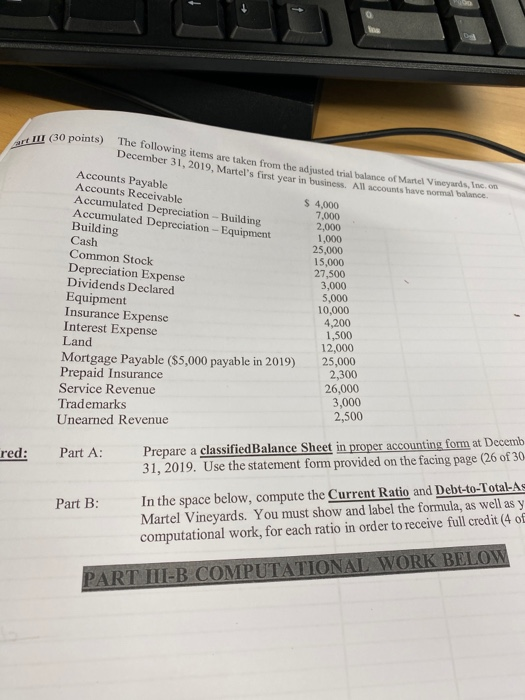

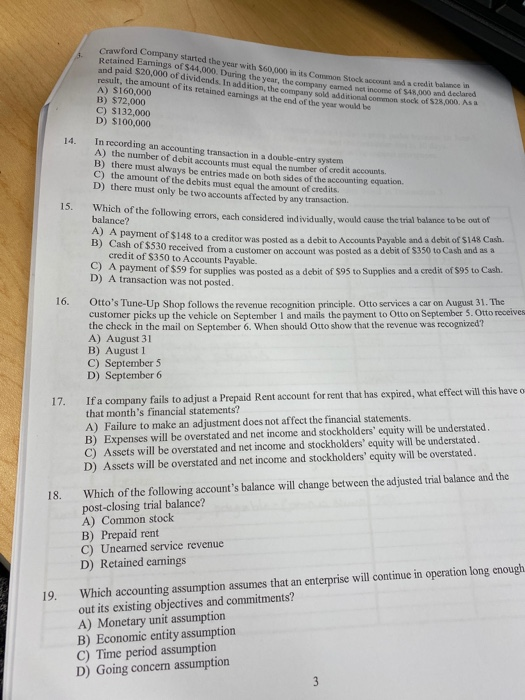

TIIG (30 points) The following items are taken from the ansted trial balance of Man Vineyards, in December 31, 2019, Martel's first year in lusiness All accounts have bande Accounts Payable Accounts Receivable Accumulated Depreciation - Building Accumulated Depreciation - Equipment Building Cash Common Stock Depreciation Expense Dividends Declared Equipment Insurance Expense Interest Expense $ 4,000 7,000 2,000 1,000 25.000 15,000 27,500 3,000 5,000 10.000 4,200 1,500 12,000 25,000 2.300 26,000 3,000 2,500 Land Mortgage Payable ($5,000 payable in 2019) Prepaid Insurance Service Revenue Trademarks Unearned Revenue red: Part A: Prepare a classifiedBalance Sheet in proper accounting form at Decemb 31, 2019. Use the statement form provided on the facing page (26 of 30 Part B: In the space below, compute the Current Ratio and Debt-to-Total-As Martel Vineyards. You must show and label the formula, as well as y computational work, for each ratio in order to receive full credit (4 of PART HI-B COMPUTATIONAL WORK BELOW Crawford Company started the year with 560.000 in its Common Stock Retained Earnings of $44 da credit balance and paid $20,000 of dividends. In de 2000. During the year, the company amed be income of $4.000 od declared result, the amount of its retained emings at the end of the year would be In addition, the company sold additional common stock of 528,000. As a A) S160,000 B) $72,000 C) $132.000 D) $100.000 14. In recording an accounting transaction in a double-entry system A) the number of debit accounts must squal the number of credit accounts B) there must always be entries made on both sides of the accounting equation. C) the amount of the debits must qual the amount of credits D) there must only be two accounts affected by any transaction. 15 Which of the following errors, each considered individually, would cause the trial balance to be out of balance? A) A payment of $148 to a creditor was posted as a dcbit to Accounts Payable and a debit of $148 Cash B) Cash of $S30 received from a customer on account was posted as a debit of $350 to Cash and as a credit of $350 to Accounts Payable. A payment of $59 for supplies was posted as a debit of $95 to Supplies and a credit of $95 to Cash D) A transaction was not posted Otto's Tune-Up Shop follows the revenue recognition principle. Otto services a car on August 31. The customer picks up the vehicle on September and mails the payment to Otto on September 5. Otto receives the check in the mail on September 6. When should Otto show that the revenue was recognized? A) August 31 B) August 1 C) September 5 D) September 6 17. If a company fails to adjust a Prepaid Rent account for rent that has expired, what effect will this have o that month's financial statements? A) Failure to make an adjustment does not affect the financial statements. B) Expenses will be overstated and net income and stockholders' equity will be understated C) Assets will be overstated and net income and stockholders' equity will be understated. D) Assets will be overstated and net income and stockholders' equity will be overstated. Which of the following account's balance will change between the adjusted trial balance and the post-closing trial balance? A) Common stock B) Prepaid rent C) Uneamed service revenue D) Retained earnings 19. Which accounting assumption assumes that an enterprise will continue in operation long enough out its existing objectives and commitments? A) Monetary unit assumption B) Economic entity assumption C) Time period assumption D) Going concern assumption