Answered step by step

Verified Expert Solution

Question

1 Approved Answer

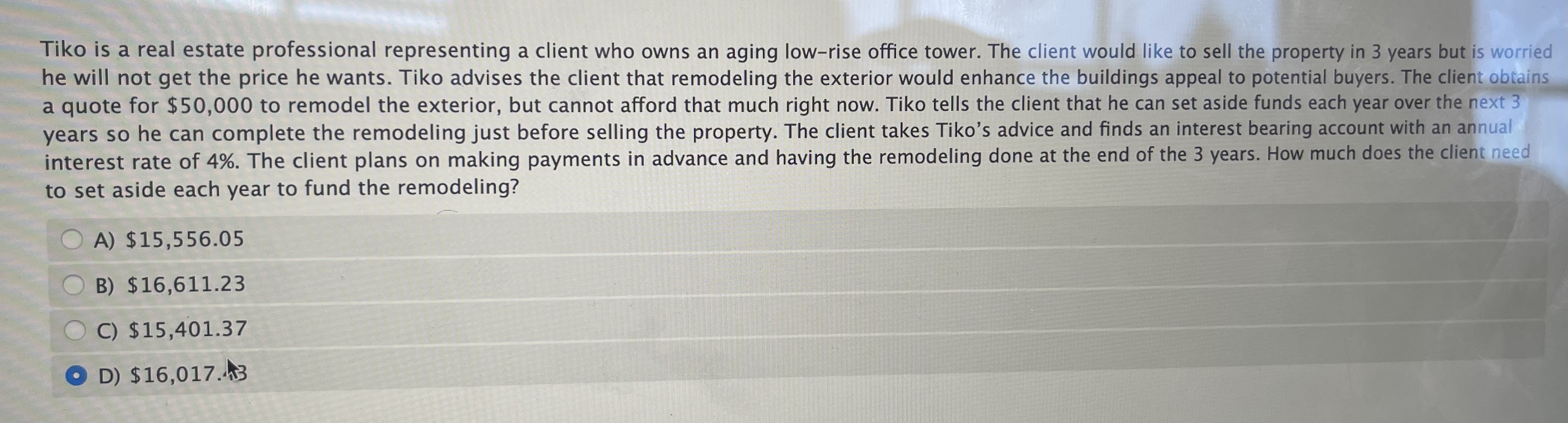

Tiko is a real estate professional representing a client who owns an aging low - rise office tower. The client would like to sell the

Tiko is a real estate professional representing a client who owns an aging lowrise office tower. The client would like to sell the property in years but is worried

he will not get the price he wants. Tiko advises the client that remodeling the exterior would enhance the buildings appeal to potential buyers. The client obtains

a quote for $ to remodel the exterior, but cannot afford that much right now. Tiko tells the client that he can set aside funds each year over the next

years so he can complete the remodeling just before selling the property. The client takes Tiko's advice and finds an interest bearing account with an annual

interest rate of The client plans on making payments in advance and having the remodeling done at the end of the years. How much does the client need

to set aside each year to fund the remodeling?

A $

B $

C $

D $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started