Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Til Debt Do Us Part host Gail Vaz-Oxlade has made it her mission to help couples who are headed for disaster to get out

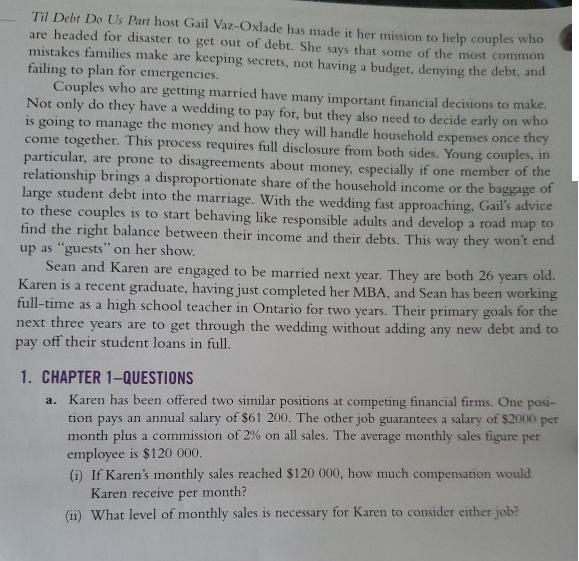

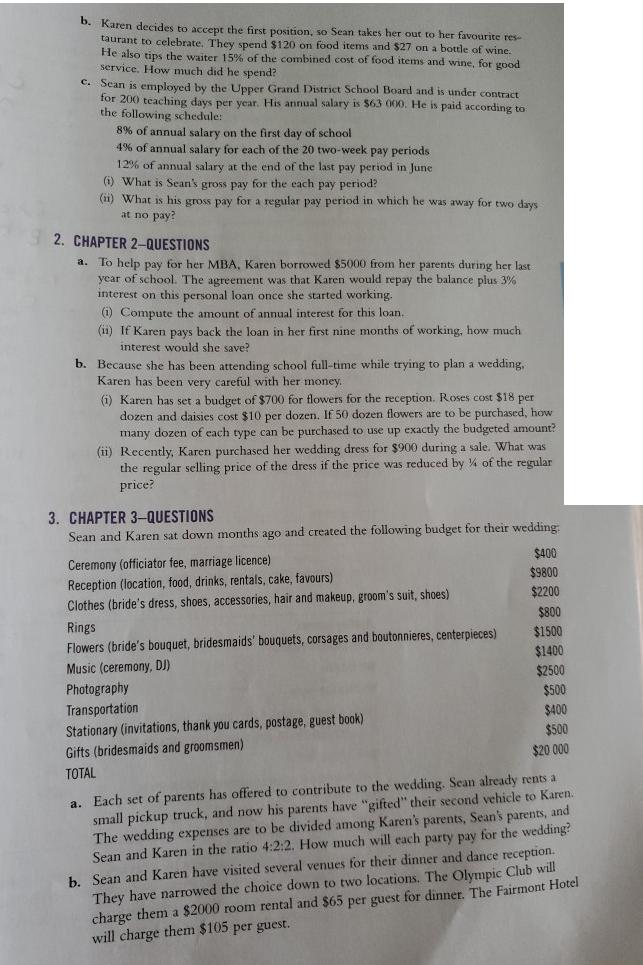

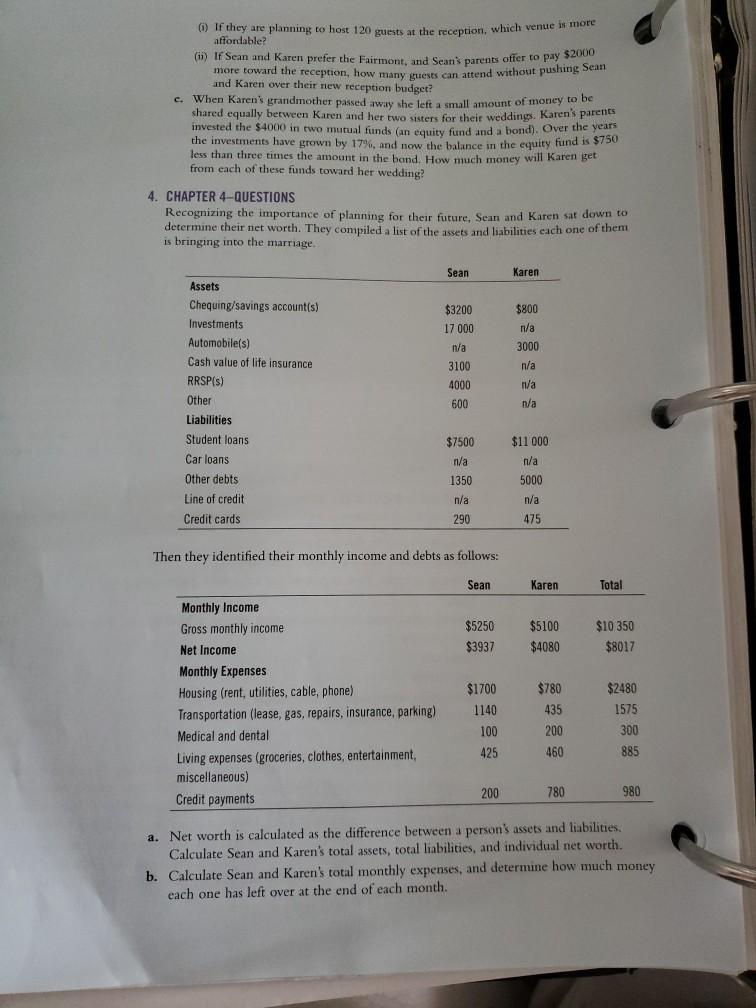

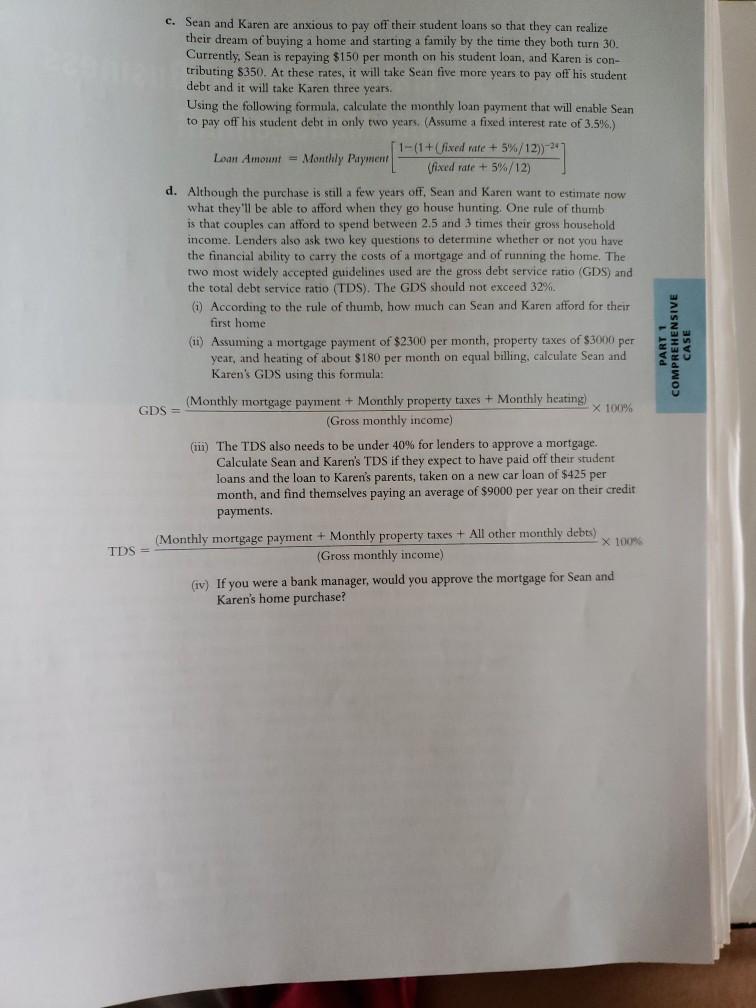

Til Debt Do Us Part host Gail Vaz-Oxlade has made it her mission to help couples who are headed for disaster to get out of debt. She says that some of the most common mistakes families make are keeping secrets, not having a budget, denying the debt, and failing to plan for emergencies. Couples who are getting married have many important financial decisions to make. Not only do they have a wedding to pay for, but they also need to decide early on who is going to manage the money and how they will handle household expenses once they come together. This process requires full disclosure from both sides. Young couples, in particular, are prone to disagreements about money, especially if one member of the relationship brings a disproportionate share of the household income or the baggage of large student debt into the marriage. With the wedding fast approaching, Gail's advice to these couples is to start behaving like responsible adults and develop a road map to find the right balance between their income and their debts. This way they won't end up as "guests" on her show. Sean and Karen are engaged to be married next year. They are both 26 years old. Karen is a recent graduate, having just completed her MBA, and Sean has been working full-time as a high school teacher in Ontario for two years. Their primary goals for the next three years are to get through the wedding without adding any new debt and to pay off their student loans in full. 1. CHAPTER 1-QUESTIONS a. Karen has been offered two similar positions at competing financial firms. One posi- tion pays an annual salary of $61 200. The other job guarantees a salary of $2000 per month plus a commission of 2% on all sales. The average monthly sales figure per employee is $120 000. (1) If Karen's monthly sales reached $120 000, how much compensation would Karen receive per month? (ii) What level of monthly sales is necessary for Karen to consider either job? b. Karen decides to accept the first position, so Sean takes her out to her favourite res- taurant to celebrate. They spend $120 on food items and $27 on a bottle of wine. He also tips the waiter 15% of the combined cost of food items and wine, for good service. How much did he spend? C. Sean is employed by the Upper Grand District School Board and is under contract for 200 teaching days per year. His annual salary is $63 000. He is paid according to the following schedule: 8% of annual salary on the first day of school 4% of annual salary for each of the 20 two-week pay periods 12% of annual salary at the end of the last pay period in June (i) What is Sean's gross pay for the each pay period? (ii) What is his gross pay for a regular pay period in which he was away for two days at no pay? 2. CHAPTER 2-QUESTIONS a. To help pay for her MBA, Karen borrowed $5000 from her parents during her last year of school. The agreement was that Karen would repay the balance plus 3% interest on this personal loan once she started working. (1) Compute the amount of annual interest for this loan. (ii) If Karen pays back the loan in her first nine months of working, how much interest would she save? b. Because she has been attending school full-time while trying to plan a wedding, Karen has been very careful with her money. (i) Karen has set a budget of $700 for flowers for the reception. Roses cost $18 per dozen and daisies cost $10 per dozen. If 50 dozen flowers are to be purchased, how many dozen of each type can be purchased to use up exactly the budgeted amount? (ii) Recently, Karen purchased her wedding dress for $900 during a sale. What was the regular selling price of the dress if the price was reduced by % of the regular price? 3. CHAPTER 3-QUESTIONS Sean and Karen sat down months ago and created the following budget for their wedding: Ceremony (officiator fee, marriage licence) Reception (location, food, drinks, rentals, cake, favours) Clothes (bride's dress, shoes, accessories, hair and makeup, groom's suit, shoes) Rings Flowers (bride's bouquet, bridesmaids' bouquets, corsages and boutonnieres, centerpieces) Music (ceremony, DJ) Photography Transportation Stationary (invitations, thank you cards, postage, guest book) Gifts (bridesmaids and groomsmen) TOTAL $400 $9800 $2200 $800 $1500 $1400 $2500 $500 $400 $500 $20 000 a. Each set of parents has offered to contribute to the wedding. Sean already rents a small pickup truck, and now his parents have "gifted" their second vehicle to Karen. The wedding expenses are to be divided among Karen's parents, Sean's parents, and Sean and Karen in the ratio 4:2:2. How much will each party pay for the wedding? b. Sean and Karen have visited several venues for their dinner and dance reception. They have narrowed the choice down to two locations. The Olympic Club will charge them a $2000 room rental and $65 per guest for dinner. The Fairmont Hotel will charge them $105 per guest. (i) If they are planning to host 120 guests at the reception, which venue is more affordable? (ii) If Sean and Karen prefer the Fairmont, and Sean's parents offer to pay $2000 more toward the reception, how many guests can attend without pushing Sean and Karen over their new reception budget? c. When Karen's grandmother passed away she left a small amount of money to be shared equally between Karen and her two sisters for their weddings. Karen's parents invested the $4000 in two mutual funds (an equity fund and a bond). Over the years the investments have grown by 17%, and now the balance in the equity fund is $750 less than three times the amount in the bond. How much money will Karen get from each of these funds toward her wedding? 4. CHAPTER 4-QUESTIONS Recognizing the importance of planning for their future, Sean and Karen sat down to determine their net worth. They compiled a list of the assets and liabilities each one of them is bringing into the marriage. Assets Chequing/savings account(s) Investments Automobile(s) Cash value of life insurance RRSP(s) Other Liabilities Student loans Car loans Other debts Line of credit Credit cards Monthly Income Gross monthly income Net Income Monthly Expenses Housing (rent, utilities, cable, phone) Transportation (lease, gas, repairs, insurance, parking) Sean Then they identified their monthly income and debts as follows: Sean Medical and dental Living expenses (groceries, clothes, entertainment, miscellaneous) Credit payments $3200 17 000 n/a 3100 4000 600 $7500 n/a 1350 n/a 290 $5250 $3937 $1700 1140 100 425 200 Karen $800 n/a 3000 n/a n/a n/a $11 000 n/a 5000 n/a 475 Karen $5100 $4080 $780 435 200 460 780 Total $10 350 $8017 $2480 1575 300 885 980 a. Net worth is calculated as the difference between a person's assets and liabilities. Calculate Sean and Karen's total assets, total liabilities, and individual net worth. b. Calcul and Karen's total monthly expenses, and determine how much money each one has left over at the end of each month. TDS c. Sean and Karen are anxious to pay off their student loans so that they can realize their dream of buying a home and starting a family by the time they both turn 30. Currently, Sean is repaying $150 per month on his student loan, and Karen is con- tributing $350. At these rates, it will take Sean five more years to pay off his student debt and it will take Karen three years. Using the following formula, calculate the monthly loan payment that will enable Sean to pay off his student debt in only two years. (Assume a fixed interest rate of 3.5%) GDS= [1-(1+(fixed rate + 5%/12)) -247 (fixed rate + 5%/12) Loan Amount = Monthly Payment d. Although the purchase is still a few years off, Sean and Karen want to estimate now what they'll be able to afford when they go house hunting. One rule of thumb is that couples can afford to spend between 2.5 and 3 times their gross household income. Lenders also ask two key questions to determine whether or not you have the financial ability to carry the costs of a mortgage and of running the home. The two most widely accepted guidelines used are the gross debt service ratio (GDS) and the total debt service ratio (TDS). The GDS should not exceed 32%. (i) According to the rule of thumb, how much can Sean and Karen afford for their first home (ii) Assuming a mortgage payment of $2300 per month, property taxes of $3000 per year, and heating of about $180 per month on equal billing, calculate Sean and Karen's GDS using this formula: (Monthly mortgage payment + Monthly property taxes + Monthly heating) (Gross monthly income) x 100% (iii) The TDS also needs to be under 40% for lenders to approve a mortgage. Calculate Sean and Karen's TDS if they expect to have paid off their student loans and the loan to Karen's parents, taken on a new car loan of $425 per month, and find themselves paying an average of $9000 per year on their credit payments. (Monthly mortgage payment + Monthly property taxes + All other monthly debts) (Gross monthly income) X 100% (iv) If you were a bank manager, would you approve the mortgage for Sean and Karen's home purchase? PART 1 COMPREHENSIVE

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started