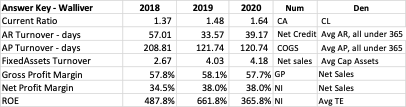

Tim DaSilva is impressed by the quality of your analysis. He needs some additional help this time with evaluating how one of his companys Walliver Corporation (WAC) - is performing. WAC is a chain of retail stores operating across Canada. Tim has asked you to perform some financial statement analysis. He asks that you look at how the company has performed relative to history and industry benchmarks. He wants you to calculate the following ratios for each of 2018, 2019 and 2020, using the data he provides below. Be sure to comment on what you think the results mean. He has also included industry information that you can use in your analysis. Note that for the ROA and ROE, you should use the average total assets and the average total equity in your calculations. For turnover ratios, please also use the average. (e.g., for Accounts Receivable Turnover, take Credit Sales / Average Accounts Receivable for the year). 1. Current ratio 2. Account Receivable turnover days; all sales are credit sales 3. Accounts Payable turnover days 4. Fixed Asset Turnover 5. Gross Profit margin 6. Net Profit Margin 7. Return on Equity Industry Benchmarks Current Ratio 1.35 Cash Ratio 0.25 Inventory Turnover (days) 40.12 AR Turnover (days) 34.5 AP Turnover (days) 50.1 Fixed Asset Turnover 3.5 Total Asset Turnover 1.75 Debt Ratio 0.5 Times Interest earned 10.5 Gross Profit Margin 28% Operating Profit Margin 12% Net Profit Margin 7.50% ROA 15.50% ROE 37.50%

- Current ratio

- Account Receivable turnover days; all sales are credit sales

- Accounts Payable turnover days

- Fixed Asset Turnover

- Gross Profit margin

- Net Profit Margin

- Return on Equity

| Industry Benchmarks | |

| | |

| Current Ratio | 1.35 |

| Cash Ratio | 0.25 |

| Inventory Turnover (days) | 40.12 |

| AR Turnover (days) | 34.5 |

| AP Turnover (days) | 50.1 |

| Fixed Asset Turnover | 3.5 |

| Total Asset Turnover | 1.75 |

| Debt Ratio | 0.5 |

| Times Interest earned | 10.5 |

| Gross Profit Margin | 28% |

| Operating Profit Margin | 12% |

| Net Profit Margin | 7.50% |

| ROA | 15.50% |

| ROE | 37.50% |

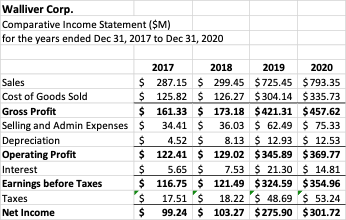

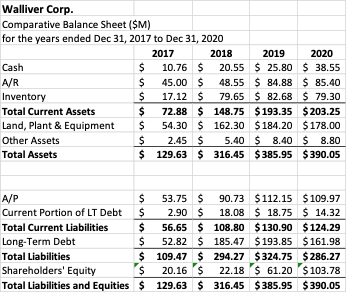

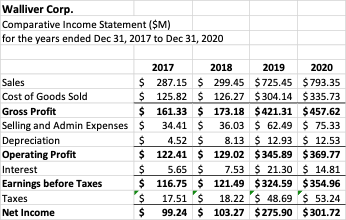

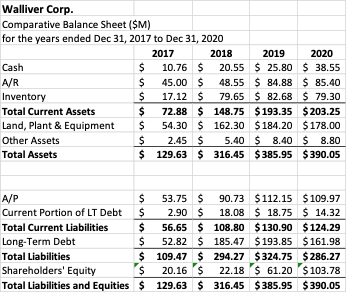

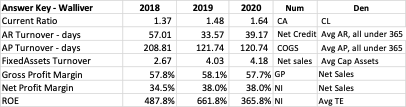

Walliver Corp. Comparative Income Statement ($M) for the years ended Dec 31, 2017 to Dec 31, 2020 2017 2018 2019 2020 Sales $ 287.15 $ 299.45 $725.45 $ 793.35 Cost of Goods Sold $ 125.82 $126.27 $ 304.14 $335.73 Gross Profit $ 161.33 $ 173.18 $421.31 $ 457.62 Selling and Admin Expenses $ 34.41 $ 36.03 $ 62.49 $ 75.33 Depreciation $ 4.52 $ 8.13 $ 12.93 $ 12.53 Operating Profit $ 122.41 $ 129.02 $345.89 $ 369.77 Interest $ 5.65 $ 7.53 $ 21.30 $ 14.81 Earnings before Taxes $ 116.75 $ 121.49 $324.59 $ 354.96 Taxes $ 17.51 $ 18.22 $ 48.69 $ 53.24 Net Income $ 99.24 $ 103.27 $275.90 $ 301.72 Walliver Corp. Comparative Balance Sheet ($M) for the years ended Dec 31, 2017 to Dec 31, 2020 2017 2018 2019 2020 Cash $ 10.76 $ 20.55 $ 25.80 $ 38.55 A/R $ 45.00 $ 48.55 $ 84.88 $ 85.40 Inventory $ 17.12 $ 79.65 $ 82.68 $ 79.30 Total Current Assets $ $ 72.88 $ 148.75 $ 193.35 $ 203.25 Land, Plant & Equipment $ 54.30 $ 162.30 $184.20 $ 178.00 Other Assets $ 2.45 $ 5.40 $ 8.40 $ 8.80 Total Assets $ 129.63 $ 316.45 $385.95 $390.05 uuuuuuu nin A/P $ $ 53.75 $ 90.73 $112.15 $109.97 Current Portion of LT Debt $ 2.90 $ 18.08 $18.75 $ 14.32 Total Current Liabilities $ 56.65 $ 108.80 $ 130.90 $ 124.29 $ $ Long-Term Debt $ 52.82 $ 185.47 $ 193.85 $ 161.98 Total Liabilities $ 109.47 $ 294.27 $324.75 $286.27 Shareholders' Equity $ 20.16 $ 22.18 $ 61.20 $103.78 Total Liabilities and Equities $ 129.63 $ 316.45 $385.95 $390.05 Answer Key - Walliver Current Ratio AR Turnover - days AP Turnover - days Fixed Assets Turnover Gross Profit Margin Net Profit Margin ROE 2018 1.37 57.01 208.81 2.67 57.8% 34.5% 487.8% 2019 1.48 33.57 121.74 4.03 58.1% 38.0% 661.8% 2020 Num Den 1.64 CA CL 39.17 Net Credit Avg AR, all under 365 120.74 COGS Avg AP, all under 365 4.18 Net sales Avg Cap Assets 57.7% GP Net Sales 38.0% NI Net Sales 365.8% NI Avg TE Walliver Corp. Comparative Income Statement ($M) for the years ended Dec 31, 2017 to Dec 31, 2020 2017 2018 2019 2020 Sales $ 287.15 $ 299.45 $725.45 $ 793.35 Cost of Goods Sold $ 125.82 $126.27 $ 304.14 $335.73 Gross Profit $ 161.33 $ 173.18 $421.31 $ 457.62 Selling and Admin Expenses $ 34.41 $ 36.03 $ 62.49 $ 75.33 Depreciation $ 4.52 $ 8.13 $ 12.93 $ 12.53 Operating Profit $ 122.41 $ 129.02 $345.89 $ 369.77 Interest $ 5.65 $ 7.53 $ 21.30 $ 14.81 Earnings before Taxes $ 116.75 $ 121.49 $324.59 $ 354.96 Taxes $ 17.51 $ 18.22 $ 48.69 $ 53.24 Net Income $ 99.24 $ 103.27 $275.90 $ 301.72 Walliver Corp. Comparative Balance Sheet ($M) for the years ended Dec 31, 2017 to Dec 31, 2020 2017 2018 2019 2020 Cash $ 10.76 $ 20.55 $ 25.80 $ 38.55 A/R $ 45.00 $ 48.55 $ 84.88 $ 85.40 Inventory $ 17.12 $ 79.65 $ 82.68 $ 79.30 Total Current Assets $ $ 72.88 $ 148.75 $ 193.35 $ 203.25 Land, Plant & Equipment $ 54.30 $ 162.30 $184.20 $ 178.00 Other Assets $ 2.45 $ 5.40 $ 8.40 $ 8.80 Total Assets $ 129.63 $ 316.45 $385.95 $390.05 uuuuuuu nin A/P $ $ 53.75 $ 90.73 $112.15 $109.97 Current Portion of LT Debt $ 2.90 $ 18.08 $18.75 $ 14.32 Total Current Liabilities $ 56.65 $ 108.80 $ 130.90 $ 124.29 $ $ Long-Term Debt $ 52.82 $ 185.47 $ 193.85 $ 161.98 Total Liabilities $ 109.47 $ 294.27 $324.75 $286.27 Shareholders' Equity $ 20.16 $ 22.18 $ 61.20 $103.78 Total Liabilities and Equities $ 129.63 $ 316.45 $385.95 $390.05 Answer Key - Walliver Current Ratio AR Turnover - days AP Turnover - days Fixed Assets Turnover Gross Profit Margin Net Profit Margin ROE 2018 1.37 57.01 208.81 2.67 57.8% 34.5% 487.8% 2019 1.48 33.57 121.74 4.03 58.1% 38.0% 661.8% 2020 Num Den 1.64 CA CL 39.17 Net Credit Avg AR, all under 365 120.74 COGS Avg AP, all under 365 4.18 Net sales Avg Cap Assets 57.7% GP Net Sales 38.0% NI Net Sales 365.8% NI Avg TE