Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Tim farms a total of 1,903.5 acres of corn and soybeans. He does not have any livestock production. He is expecting the following yields

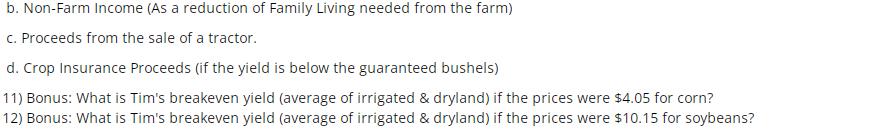

Tim farms a total of 1,903.5 acres of corn and soybeans. He does not have any livestock production. He is expecting the following yields and expenses. He wants your help in calculating his breakeven costs for both corn and soybeans. Acres Yield Irrigated Corn 698.8 230 Percent of Production Direct Costs Overhead Costs Expected Family Living Dryland Corn 182 150 Corn 86.03% $477.74 $79.31 Irrigated Soybeans Dryland Soybeans 393.5 629.2 75 55 Soybeans 79.85% $382.71 $79.31 $166,356 Required 1) What is Tim's Family Living & Taxes cost per acre? 2) What is the total cost per acre for corn? 3) What is the total cost per acre for soybeans? 4) What is Tim's total share of the expected production (bushels) for corn? 5) What is Tim's total share of the expected production (bushels) for soybeans? 6) What is Tim's share of the yield per acre for corn? 7) What is Tim's share of the yield per acre for soybeans? 8) What is Tim's cost of production per bushel for corn? 9) What is Tim's cost of production per bushel for soybeans? 10) What other information could be used in making this calculation? a. Government Farm Program Payments b. Non-Farm Income (As a reduction of Family Living needed from the farm) c. Proceeds from the sale of a tractor. d. Crop Insurance Proceeds (if the yield is below the guaranteed bushels) 11) Bonus: What is Tim's breakeven yield (average of irrigated & dryland) if the prices were $4.05 for corn? 12) Bonus: What is Tim's breakeven yield (average of irrigated & dryland) if the prices were $10.15 for soybeans?

Step by Step Solution

★★★★★

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the various values for Tims farming operation lets go step by step Family Living Taxes cost per acre Family Living Taxes cost per acre is the total expected family living and taxes divide...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started