Question

Tim Lumber buys $350,000 more inventory, pays $150,000 cash now, balance due to suppliers next month. Pays cash in Mo. 11 against Accts Payable starting

-

Tim Lumber buys $350,000 more inventory, pays $150,000 cash now, balance due to suppliers next month. Pays cash in Mo. 11 against Accts Payable starting balance owed from Mo-10 Accts Payable.

-

Tim Lumber sells $475,000 of inventory to customers for $725,000 net. $450,000 were cash sales, balance of sales on credit due from customers in 30 days in next months accounting period.

-

$140,000 cash is collected in the current Month-11 period on Accts Receivable carried over from Mo.10

-

Building monthly rent paid cash in current period is $10,000 monthly going forward

-

Wage expense = $45,000, $30,000 cash, balance paid next period. Mo-10 Wage Payable is paid cash now.

-

$50,000 is repaid on the Bank loan. Mo. loan interest expense = $1,000, paid cash in current period.

-

Tim Lumber buys extra $200,000 inventory, pays $50,000 cash, balance on Supplier credit, due in Mo. 12

-

Office supplies and utilities expense together totaled $30,000, paid cash in the current period

-

Depreciation expense is $750 per month ($72,000 div. by 8 = $9,000 annual div. by 12 = $750 mo.)

-

Amortized monthly insurance policies expense of $300 recorded in the current period

-

Another $75,000 is received in Mo.11 from accts rec. owed by customers who bought on credit in month 11.

-

Dividends = $10,000 paid cash to Owner in Mo.11 Month-11 Retained Earns = Mo. 11 N.Inc - $10,000 Div

-

Tim Lumber owes $43,950 income tax on Mo.11 pre-tax profits, pays period 12. Tim Lumber pays Mo-10 Tax payable

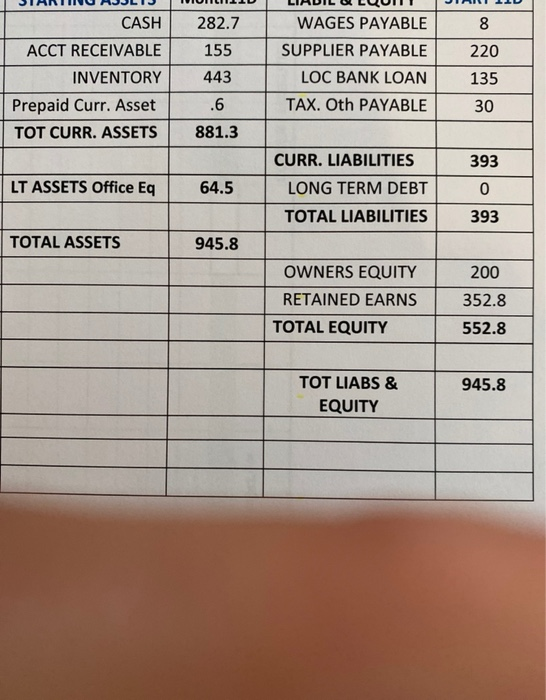

PREPARE THE 11 PERIOD INCOME STATEMENT & ENDING BALANCE SHEET

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started