Answered step by step

Verified Expert Solution

Question

1 Approved Answer

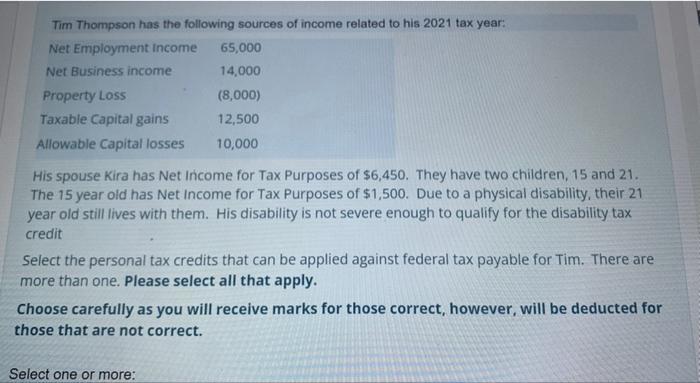

Tim Thompson has the following sources of income related to his 2021 tax year: Net Employment Income Net Business income Property Loss Taxable Capital

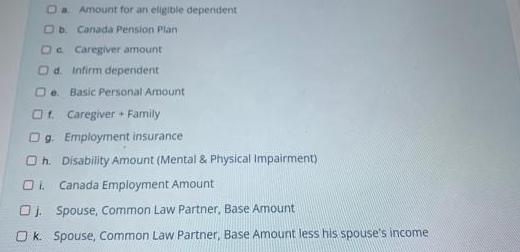

Tim Thompson has the following sources of income related to his 2021 tax year: Net Employment Income Net Business income Property Loss Taxable Capital gains Allowable Capital losses 65,000 14,000 (8,000) 12,500 10,000 His spouse Kira has Net Income for Tax Purposes of $6,450. They have two children, 15 and 21. The 15 year old has Net Income for Tax Purposes of $1,500. Due to a physical disability, their 21 year old still lives with them. His disability is not severe enough to qualify for the disability tax credit Select the personal tax credits that can be applied against federal tax payable for Tim. There are more than one. Please select all that apply. Select one or more: Choose carefully as you will receive marks for those correct, however, will be deducted for those that are not correct. Da Amount for an eligible dependent Db. Canada Pension Plan Caregiver amount Od. Infirm dependent e. Basic Personal Amount Ot. Caregiver + Family Dg. Employment insurance Oh. Disability Amount (Mental & Physical Impairment) O Canada Employment Amount Oj. Spouse, Common Law Partner, Base Amount Ok. Spouse, Common Law Partner, Base Amount less his spouse's income

Step by Step Solution

★★★★★

3.33 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

ANS WER a Amount for an eligible dependent c Care g iver amount d Inf irm ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started