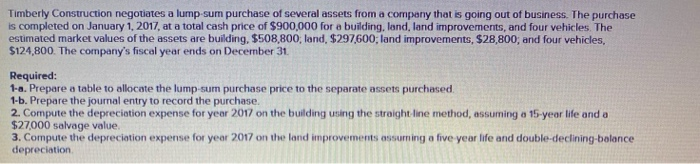

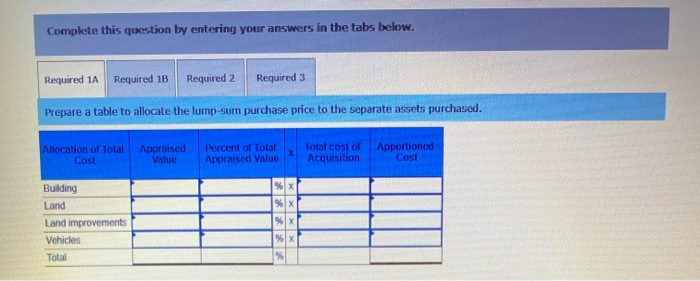

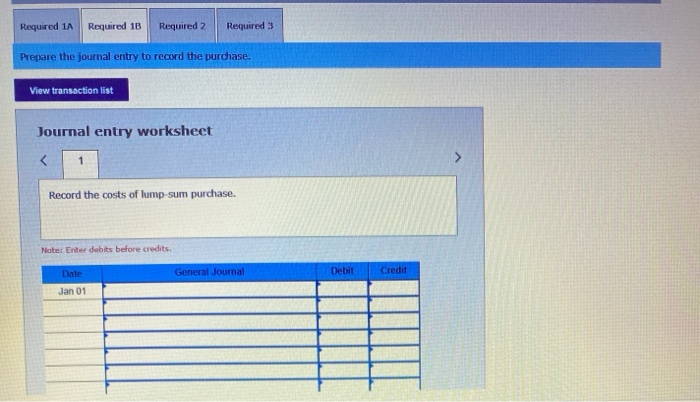

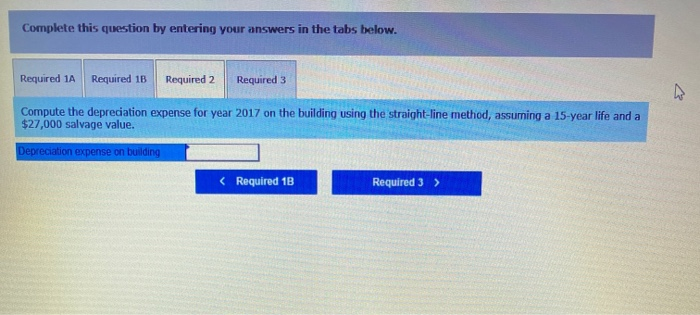

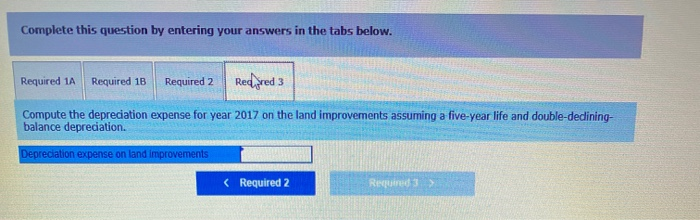

Timberly Construction negotiates a lump sum purchase of several assets from a company that is going out of business. The purchase is completed on January 1, 2017, at a total cash price of $900,000 for a building, land, land improvements, and four vehicles. The estimated market values of the assets are building, $508,800, land, $297,600, land improvements, $28,800, and four vehicles, $124,800. The company's fiscal year ends on December 31 Required: 1-a. Prepare a table to allocate the lump sum purchase price to the separate assets purchased 1-b. Prepare the journal entry to record the purchase. 2. Compute the depreciation expense for year 2017 on the building using the straight line method, assuming a 15-year life and a $27000 salvage value 3. Compute the depreciation expense for year 2017 on the land improvements assuming a five year life and double-declining balance depreciation Complete this question by entering your answers in the tabs below. Required 1A Required 1B Required 2 Required 3 Prepare a table to allocate the lump-sum purchase price to the separate assets purchased. Allocation of Total Cost Appraised Value Percent of Total Appraised Value T otal cost of Acquisition Apportioned C ost Building Land Land improvements Vehicles Total Required 1A Required 1B Required 2 Required 3 Prepare the journal entry to record the purchase. View transaction list Journal entry worksheet Record the costs of lump sum purchase. Note: Enter debits before credits Date General Journal Debit Credit Jan 01 Complete this question by entering your answers in the tabs below. Required 1A Required 1B Required 2 Required 3 Compute the depreciation expense for year 2017 on the building using the straight-line method, assuming a 15-year life and a $27,000 salvage value. Depreciation expense on building Required 1B Required 3 > Complete this question by entering your answers in the tabs below. Required 1A Required 18 Required 2 Redyred 3 Compute the depreciation expense for year 2017 on the land improvements assuming a five-year life and double-dedining- balance depreciation. Depreciation expense on land improvements (Required 2 Required 3 >