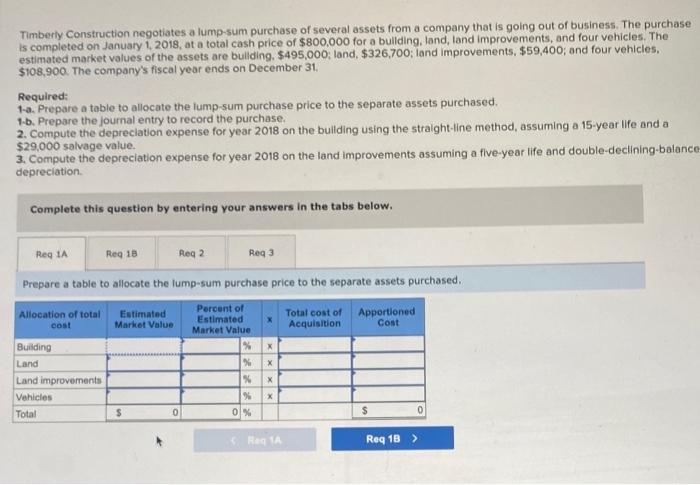

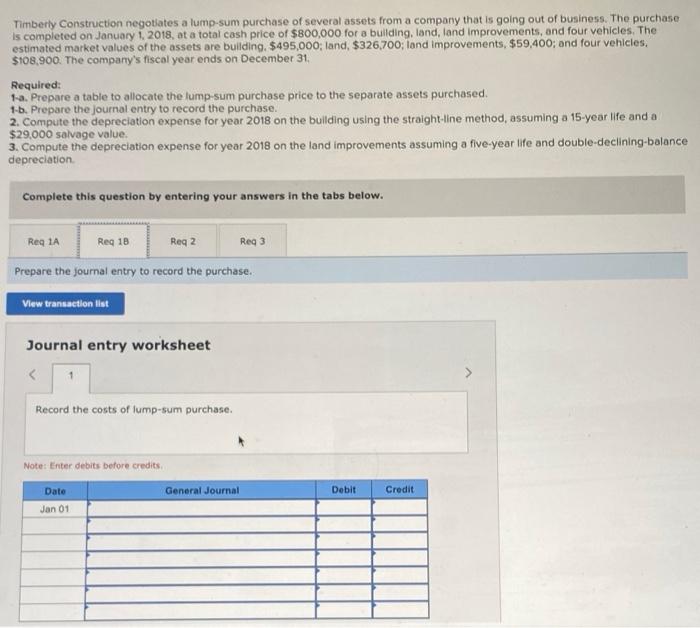

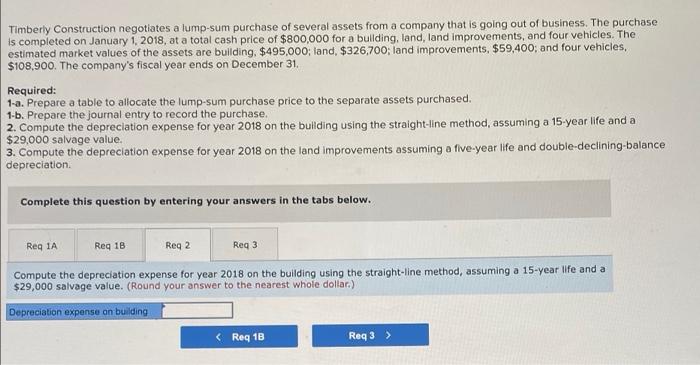

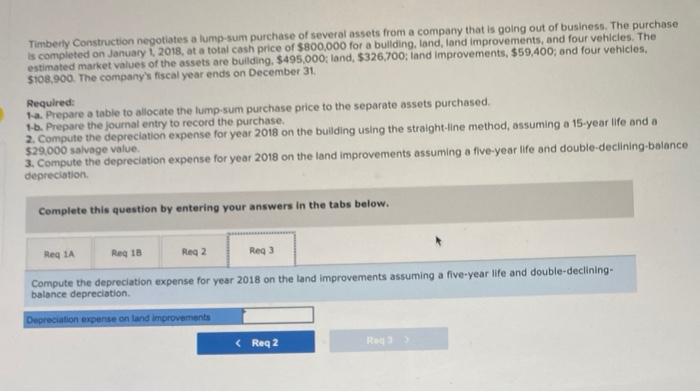

Timberly Construction negotiates a lump sum purchase of several assets from a company that is going out of business. The purchase is completed on January 1, 2018, at a total cash price of $800,000 for a building, land, land improvements, and four vehicles. The estimated market values of the assets are building, $495,000: land, $326,700; and improvements, $59,400; and four vehicles, $108,900. The company's fiscal year ends on December 31, Required: 1-a. Prepare a table to allocate the lump-sum purchase price to the separate assets purchased 1-6. Prepare the journal entry to record the purchase. 2. Compute the depreciation expense for year 2018 on the building using the straight-line method, assuming a 15-year life and a $29,000 salvage value. 3. Compute the depreciation expense for year 2018 on the land improvements assuming a five-year life and double-declining-balance- depreciation Complete this question by entering your answers in the tabs below. Reg 1A Reg 18 Reg 2 Reg 3 Prepare a table to allocate the lump-sum purchase price to the separate assets purchased Estimated Market Value Percent of Estimated Market Value Total cost of Apportioned Acquisition Cost Allocation of total cost Building Land Land improvements Vehicles Total % x $ 0 0 % $ Rag A Reg 18 > Timberly Construction negotiates a lump-sum purchase of several assets from a company that is going out of business. The purchase is completed on January 1, 2018, at a total cash price of $800,000 for a building, land, land improvements, and four vehicles. The estimated market values of the assets are building, $495,000; land, $326700; and improvements, $59,400; and four vehicles, $108,900. The company's fiscal year ends on December 31 Required: 1-a. Prepare a table to allocate the lump-sum purchase price to the separate assets purchased. 1-b. Prepare the journal entry to record the purchase. 2. Compute the depreciation expense for year 2018 on the building using the straight-line method, assuming a 15-year life and a $29,000 salvage value. 3. Compute the depreciation expense for year 2018 on the land improvements assuming a five-year life and double-declining balance depreciation Complete this question by entering your answers in the tabs below. Reg 1A Reg 18 Reg 2 Reg 3 Prepare the journal entry to record the purchase. View transaction list Journal entry worksheet Record the costs of lump-sum purchase. Note: Enter debits before credits Date General Journal Debit Credit Jan 01 Timberly Construction negotiates a lump sum purchase of several assets from a company that is going out of business. The purchase is completed on January 1, 2018, at a total cash price of $800,000 for a building, land, land improvements, and four vehicles. The estimated market values of the assets are building, $495,000; land, $326,700; land improvements, $59,400; and four vehicles, $108,900. The company's fiscal year ends on December 31 Required: 1-a. Prepare a table to allocate the lump-sum purchase price to the separate assets purchased. 1-b. Prepare the journal entry to record the purchase. 2. Compute the depreciation expense for year 2018 on the building using the straight-line method, assuming a 15-year life and a $29,000 salvage value. 3. Compute the depreciation expense for year 2018 on the land improvements assuming a five-year life and double-declining balance depreciation Complete this question by entering your answers in the tabs below. Reg 1A Reg 1B Reg 2 Reg 3 Compute the depreciation expense for year 2018 on the building using the straight-line method, assuming a 15-year life and a $29,000 salvage value. (Round your answer to the nearest whole dollar.) Depreciation expense on building Timberly Construction negotiates a lump sum purchase of several assets from a company that is going out of business. The purchase is completed on January 1, 2018 at a total cash price of $800,000 for a building, land, land improvements, and four vehicles. The estimated market values of the assets are building, $495,000;land, $326,700; and improvements, $59,400; and four vehicles, 5108.900. The company's fiscal year ends on December 31 Required: 1a. Prepare a table to allocate the lump-sum purchase price to the separate assets purchased. 1-b. Prepare the journal entry to record the purchase. 2. Compute the depreciation expense for year 2018 on the building using the straight-line method, assuming a 15-year life and a $29,000 salvage value 3. Compute the depreciation expense for year 2018 on the land improvements assuming a five-year life and double-declining balance depreciation Complete this question by entering your answers in the tabs below. Reg 1B Reg 2 Reg 3 Regia Compute the depreciation expense for year 2018 on the land improvements assuming a five-year life and double-declining- balance depreciation Depreciation expense on land improvements