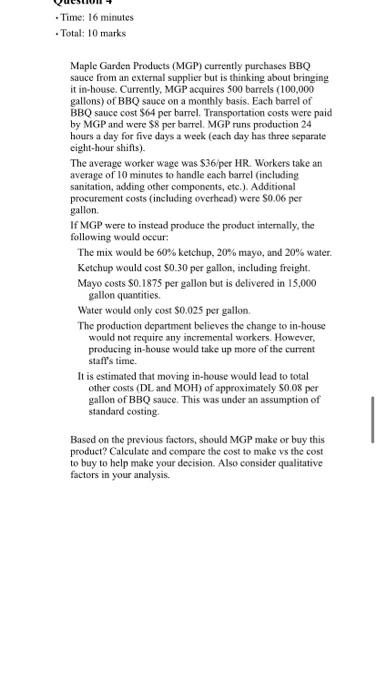

Time: 16 minutes Total: 10 marks Maple Garden Products (MGP) currently purchases BBQ sauce from an external supplier but is thinking about bringing it in-house. Currently, MGP acquires 500 barrels (100,000 gallons) of BBQ sauce on a monthly basis. Each barrel of BBQ sauce cost $64 per barrel. Transportation costs were paid by MGP and were 58 per barrel. MGP runs production 24 hours a day for five days a week (each day has three separate cight-hour shifts). The average worker wage was $36/per HR. Workers take an average of 10 minutes to handle each barrel (including sanitation, adding other components, etc.). Additional procurement costs (including overhead) were $0.06 per gallon. If MGP were to instead produce the product internally, the following would occur The mix would be 60% ketchup, 20% mayo, and 20% water Ketchup would cost $0.30 per gallon, including freight. Mayo costs $0.1875 per gallon but is delivered in 15,000 gallon quantities Water would only cost $0.025 per gallon. The production department believes the change to in-house would not require any incremental workers. However, producing in-house would take up more of the current staff's time. It is estimated that moving in-house would lead to total other costs (DL and MOH) of approximately 50.08 per gallon of BBQ sauce. This was under an assumption of standard costing. Based on the previous factors, should MGP make or buy this product? Calculate and compare the cost to make vs the cost to buy to help make your decision. Also consider qualitative factors in your analysis. Time: 16 minutes Total: 10 marks Maple Garden Products (MGP) currently purchases BBQ sauce from an external supplier but is thinking about bringing it in-house. Currently, MGP acquires 500 barrels (100,000 gallons) of BBQ sauce on a monthly basis. Each barrel of BBQ sauce cost $64 per barrel. Transportation costs were paid by MGP and were 58 per barrel. MGP runs production 24 hours a day for five days a week (each day has three separate cight-hour shifts). The average worker wage was $36/per HR. Workers take an average of 10 minutes to handle each barrel (including sanitation, adding other components, etc.). Additional procurement costs (including overhead) were $0.06 per gallon. If MGP were to instead produce the product internally, the following would occur The mix would be 60% ketchup, 20% mayo, and 20% water Ketchup would cost $0.30 per gallon, including freight. Mayo costs $0.1875 per gallon but is delivered in 15,000 gallon quantities Water would only cost $0.025 per gallon. The production department believes the change to in-house would not require any incremental workers. However, producing in-house would take up more of the current staff's time. It is estimated that moving in-house would lead to total other costs (DL and MOH) of approximately 50.08 per gallon of BBQ sauce. This was under an assumption of standard costing. Based on the previous factors, should MGP make or buy this product? Calculate and compare the cost to make vs the cost to buy to help make your decision. Also consider qualitative factors in your analysis