Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Time: 60 Minutes Full Marks 10 (Answer all the Questions) Q. 1. Ms. X, a lawyer, accepts a legal engagement in March, performs the work

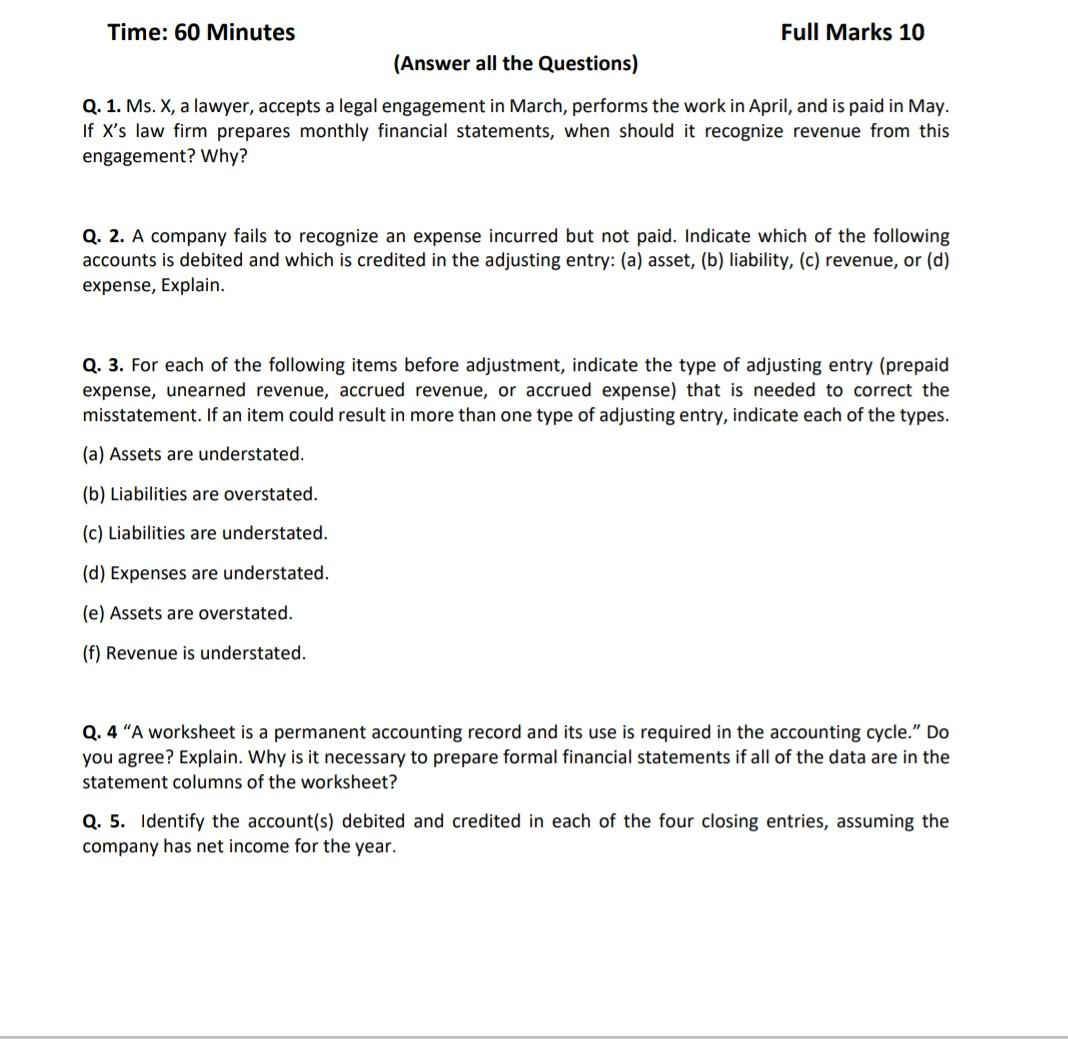

Time: 60 Minutes Full Marks 10 (Answer all the Questions) Q. 1. Ms. X, a lawyer, accepts a legal engagement in March, performs the work in April, and is paid in May. If X's law firm prepares monthly financial statements, when should it recognize revenue from this engagement? Why? Q. 2. A company fails to recognize an expense incurred but not paid. Indicate which of the following accounts is debited and which is credited in the adjusting entry: (a) asset, (b) liability, (c) revenue, or (d) expense, Explain. Q. 3. For each of the following items before adjustment, indicate the type of adjusting entry (prepaid expense, unearned revenue, accrued revenue, or accrued expense) that is needed to correct the misstatement. If an item could result in more than one type of adjusting entry, indicate each of the types. (a) Assets are understated. (b) Liabilities are overstated. (c) Liabilities are understated. (d) Expenses are understated. (e) Assets are overstated. (f) Revenue is understated. Q. 4 "A worksheet is a permanent accounting record and its use is required in the accounting cycle." Do you agree? Explain. Why is it necessary to prepare formal financial statements if all of the data are in the statement columns of the worksheet? Q. 5. Identify the account(s) debited and credited in each of the four closing entries, assuming the company has net income for the year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started