Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Time left 0 : 5 7 : 0 9 Abigail Chase had the following other income or deduction items in 2 0 2 3 .

Time left ::

Abigail Chase had the following other income or deduction items in Determine the impact that each item has on the calculation of her net income for tax purpose on her personal income tax return by dragging and dropping the amount of the income inclusion or the allowable deduction to the field to the right of that item. The choices may be used more than once.

Abigail's spouse passed away in an employment accident. Abigail received a death benefit of $

The YMCA Childcare was paid $ to take care of her yearold daughter. Abigail's earned $ of employment income in no pension adjustment Her daughter is eligible for the disability tax credit.

Abigail's former spouse paid her $$ in child support and $ in spousal support for The same amounts were paid in

Abigail contributed $ to her own RRSP on March She did not have any unused RRSP room from see other items for information needed to determine earned income

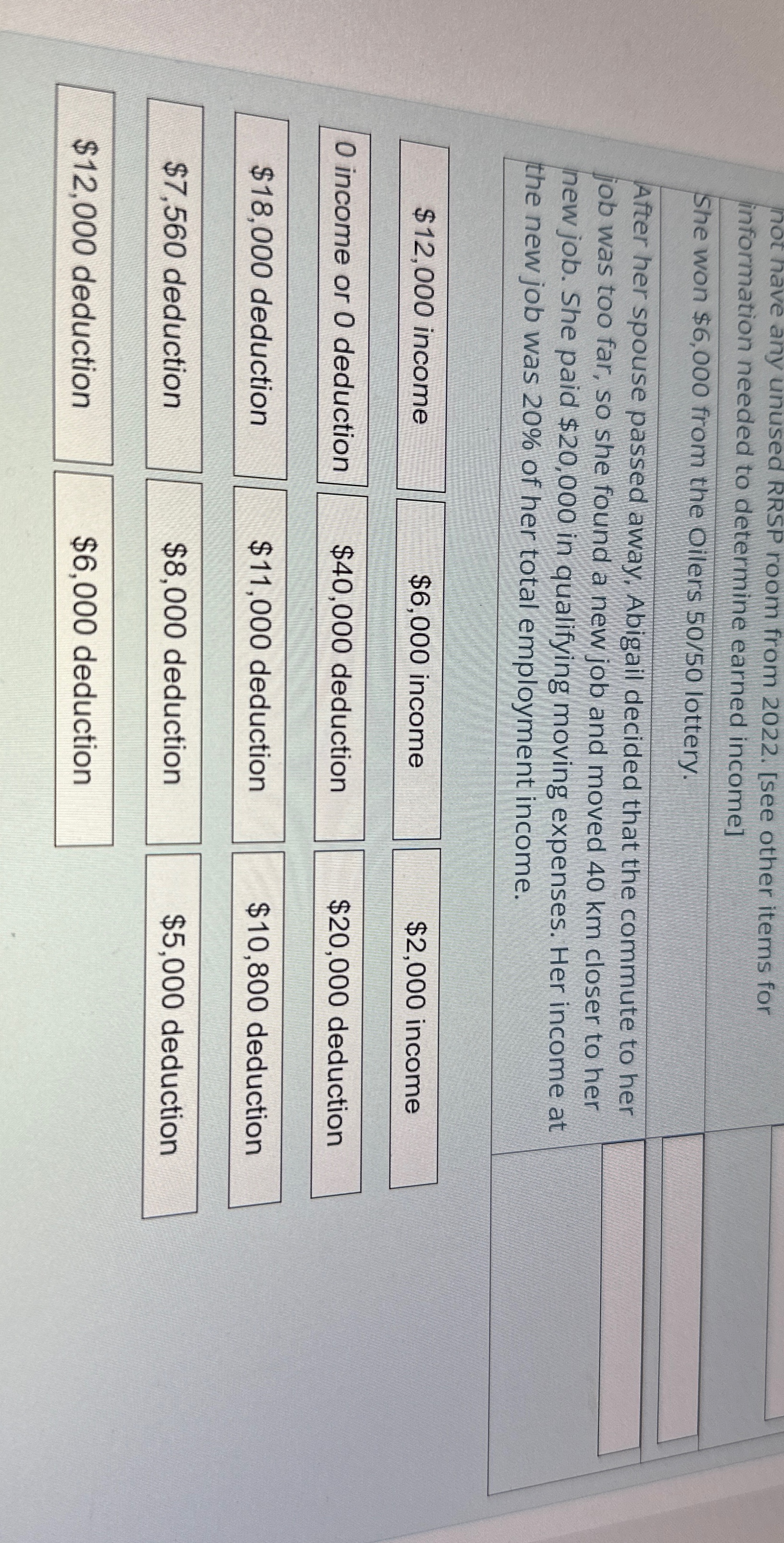

She won $ from the Oilers lottery.

Inot have any unused RRSP room from see other items for information needed to determine earned income

She won $ from the Oilers lottery.

After her spouse passed away, Abigail decided that the commute to her job was too far, so she found a new job and moved closer to her new job. She paid $ in qualifying moving expenses. Her income at the new job was of her total employment income.

$ income $ income $ income

income or deduction $ deduction $ deduction

$ deduction

$ deduction

$ deduction

$ deduction

$ deduction

$ deduction

$ deduction

$ deduction

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started