Answered step by step

Verified Expert Solution

Question

1 Approved Answer

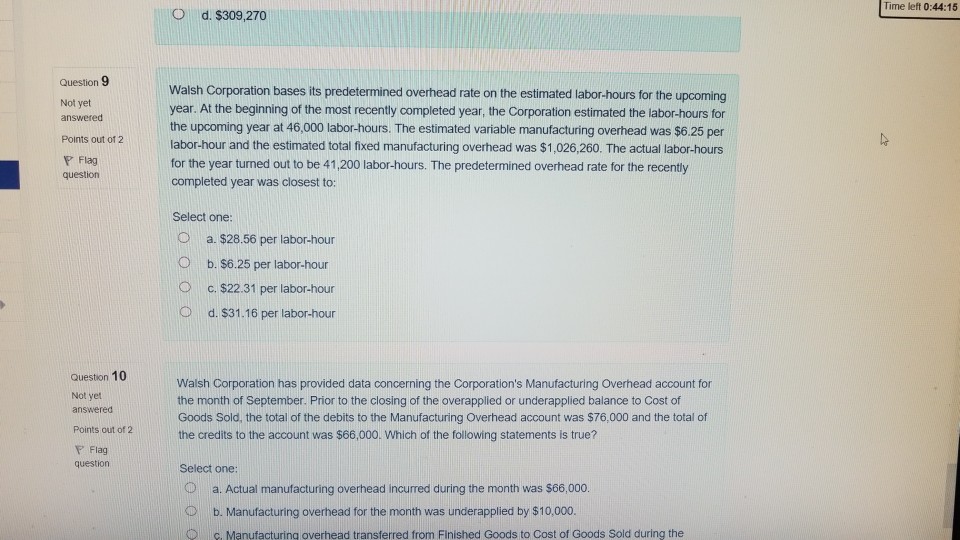

Time left 0:44:15 O d. $309,270 Question 9 Walsh Corporation bases its predetermined overhead rate on the estimated labor-hours for the upcoming year. At the

Time left 0:44:15 O d. $309,270 Question 9 Walsh Corporation bases its predetermined overhead rate on the estimated labor-hours for the upcoming year. At the beginning of the most recently completed year, the Corporation estimated the labor-hours for the upcoming year at 46,000 labor-hours. The estimated variable manufacturing overhead was $6.25 per labor-hour and the estimated total fixed manufacturing overhead was $1,026,260. The actual labor-hours for the year turned out to be 41,200 labor-hours. The predetermined overhead rate for the recently completed year was closest to Not yet answered Flag question Select one: Oa. $28.56 per labor-hour O b. $6.25 per labor-hour Oc. $22.31 per labor-hour O d. $31.16 per labor-hour Question 10 Walsh Corporation has provided data concerning the Corporation's Manufacturing Overhead account for the month of September. Prior to the closing of the overapplied or underapplied balance to Cost of Goods Sold, the total of the debits to the Manufacturing Overhead account was $76,000 and the total of the credits to the account was $66,000. Which of the following statements is true? Points out of2 F Flag question Select one: O a. Actual manufacturing overhead incurred during the month was $66,000 O b. Manufacturing overhead for the month was underapplied by $10,000 Oc. Manufacturing overhead transferred from Finished Goods to Cost of Goods Sold during the

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started