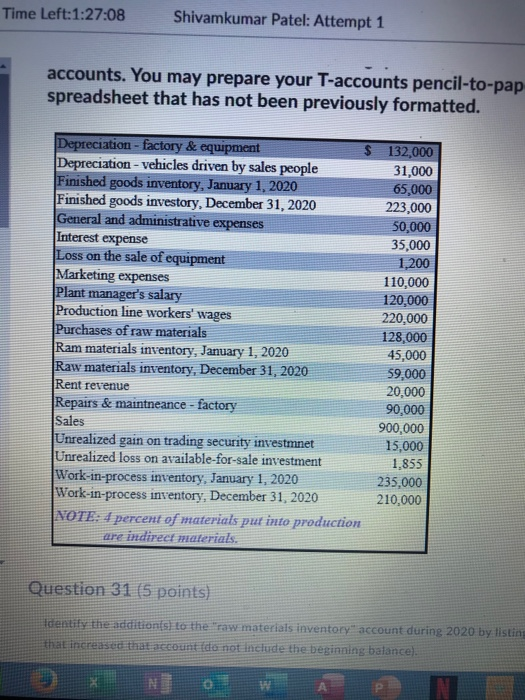

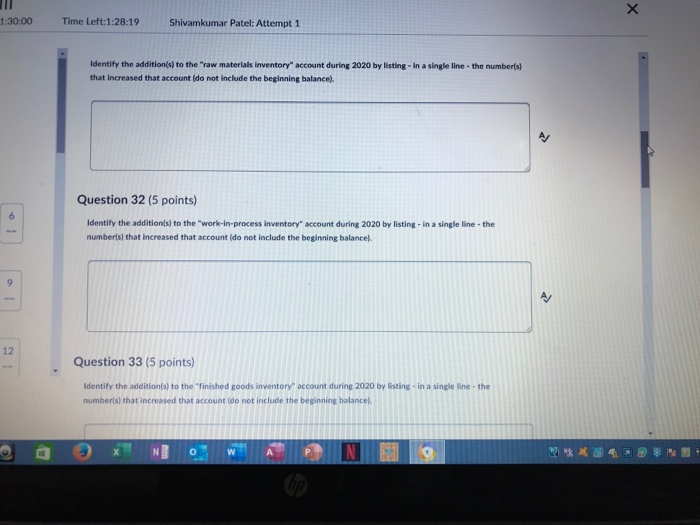

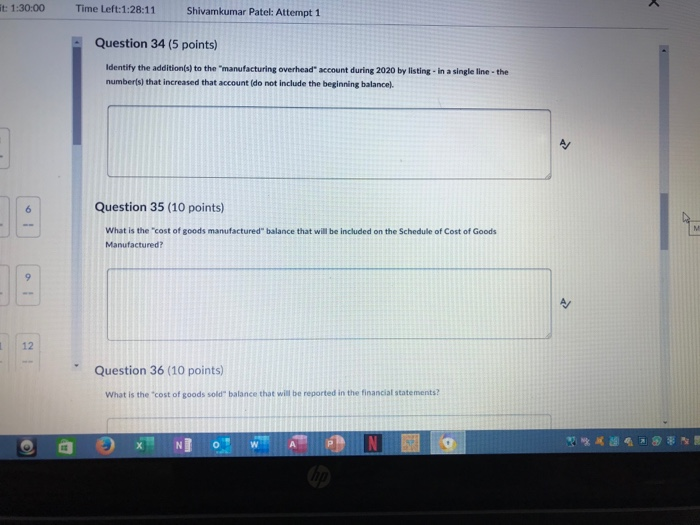

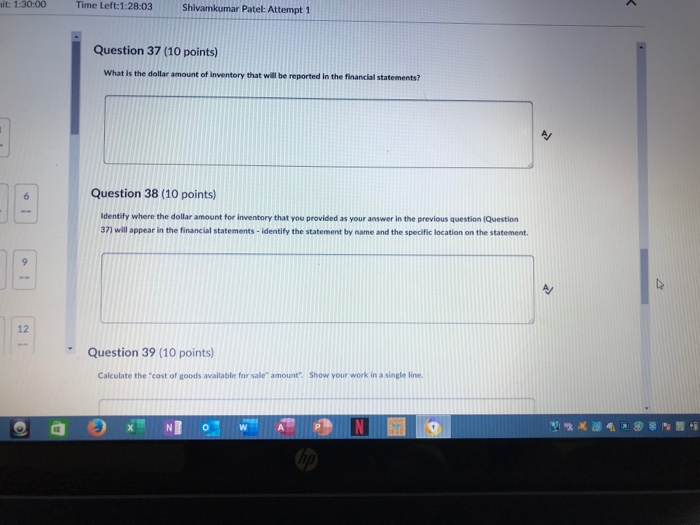

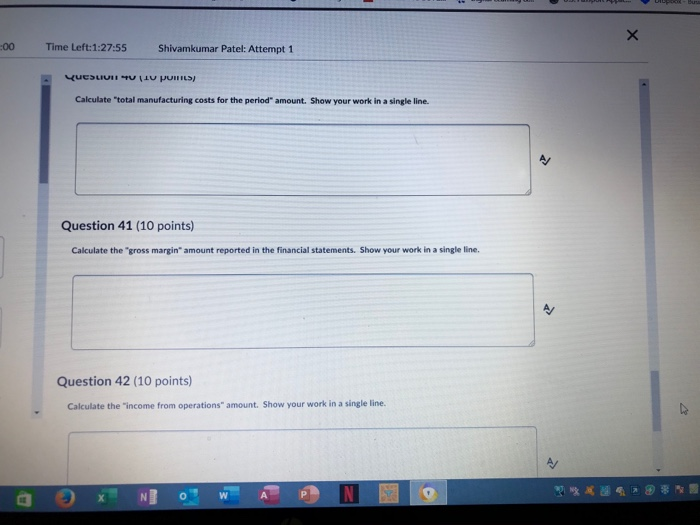

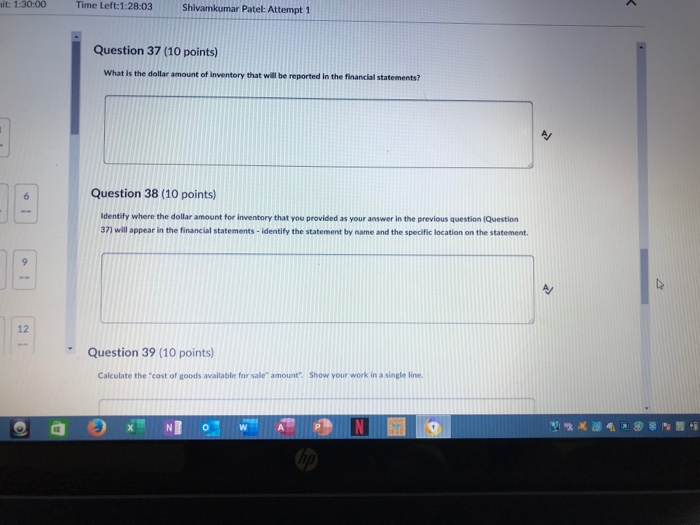

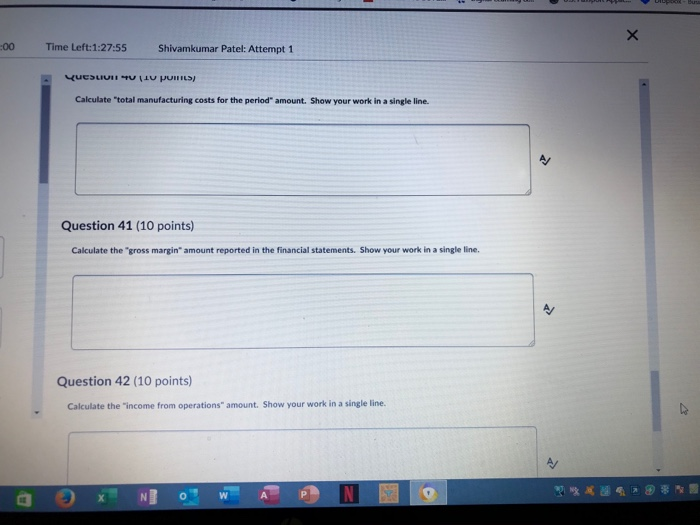

Time Left:1:27:08 Shivamkumar Patel: Attempt 1 accounts. You may prepare your T-accounts pencil-to-pap, spreadsheet that has not been previously formatted. Depreciation - factory & equipment $ Depreciation - vehicles driven by sales people Finished goods inventory, January 1, 2020 Finished goods investory, December 31, 2020 General and administrative expenses Interest expense Loss on the sale of equipment Marketing expenses Plant manager's salary Production line workers' wages Purchases of raw materials Ram materials inventory, January 1, 2020 Raw materials inventory, December 31, 2020 Rent revenue Repairs & maintneance - factory Sales Unrealized gain on trading security investmnet Unrealized loss on available-for-sale investment Work-in-process inventory, January 1, 2020 Work-in-process inventory, December 31, 2020 NOTE: 4 percent of materials put into production are indirect materials. 132,000 31,000 65,000 223,000 50,000 35,000 1,200 110,000 120,000 220,000 128,000 45,000 59,000 20,000 90,000 900,000 15,000 1.855 235,000 210,000 Question 31 (5 points) Identify the addition to the raw materials inventory account during 2020 by listin that increased that account do not lnclude the beginning balance). 11:30:00 Time Left:1:28:19 Shivamkumar Patel: Attempt 1 Identify the addition(s) to the raw materials inventory account during 2020 by listing in a single line - the numberto that increased that account do not include the beginning balance). Question 32 (5 points) Identify the addition(s) to the "work-in-process inventory account during 2020 by listing in a single line the number(s) that increased that account (do not include the beginning balance). Question 33 (5 points) Identify the addition to the finished goods inventory account during 2020 by listing in a single number(s) that increased that account (do not include the beginning balance) @ Now A N it: 1:30:00 Time Left:1:28:11 Shivamkumar Patel: Attempt 1 Question 34 (5 points) Identify the addition(s) to the manufacturing overhead account during 2020 by listing in a single line the number(s) that increased that account (do not include the beginning balance). Question 35 (10 points) What is the cost of goods manufactured balance that will be included on the Schedule of Cost of Goods Manufactured? Question 36 (10 points) What is the cost of goods sold balance that will be reported in the financial statements? a XINI WAN MO : 1:30:00 Time Left:1:28:03 Shivakumar Patel: Attempt 1 Question 37 (10 points) What is the dollar amount of inventory that will be reported in the financial statements! Question 38 (10 points) Identify where the dollar amount for inventory that you provided as your answer in the previous question Question 37) will appear in the financial statements - identify the statement by name and the specific location on the statement Question 39 (10 points) Calculate the cost of goods available for sale amount". Show your work in a single line O wa NHO 600 Time Left:1:27:55 Shivamkumar Patel: Attempt 1 QUESLIETU pollic) Calculate total manufacturing costs for the period amount. Show your work in a single line. Question 41 (10 points) Calculate the "gross margin" amount reported in the financial statements. Show your work in a single line Question 42 (10 points) Calculate the income from operations amount. Show your work in a single line. SENS La 9x N 0' WANSO