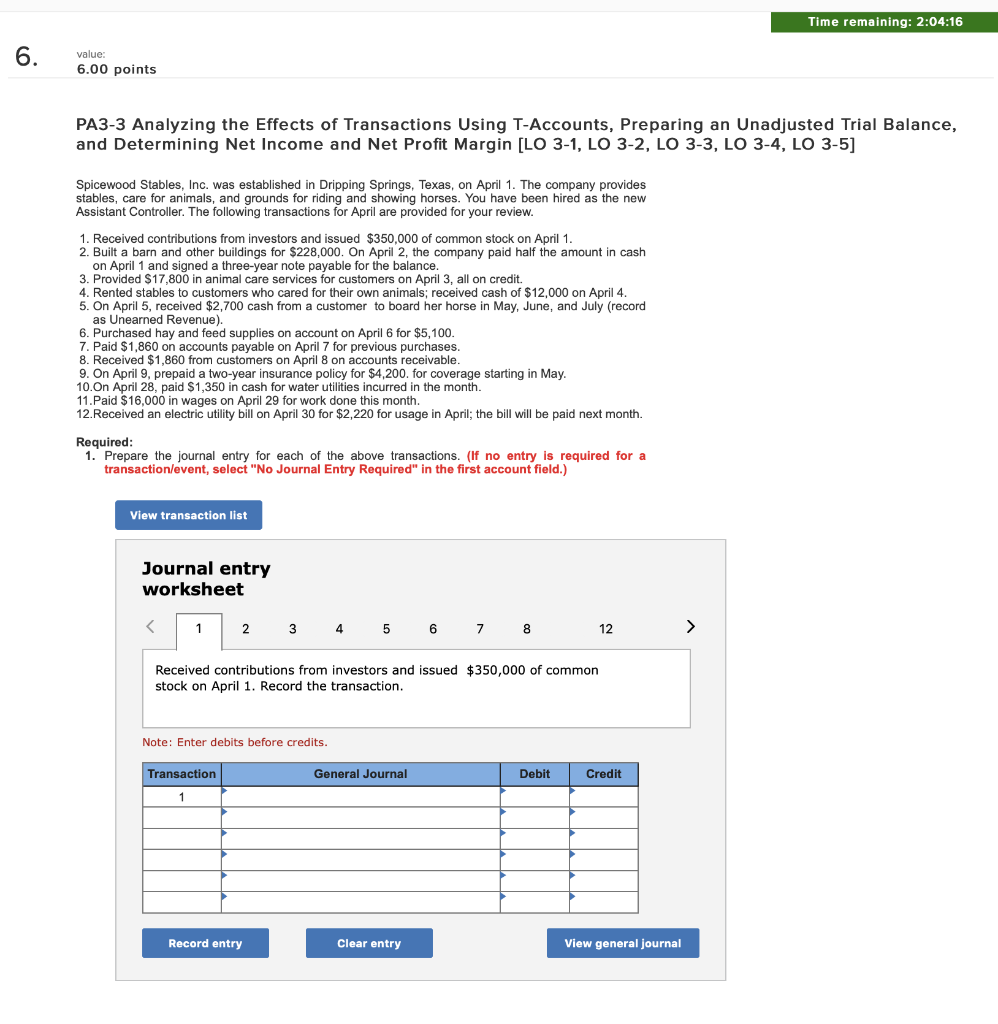

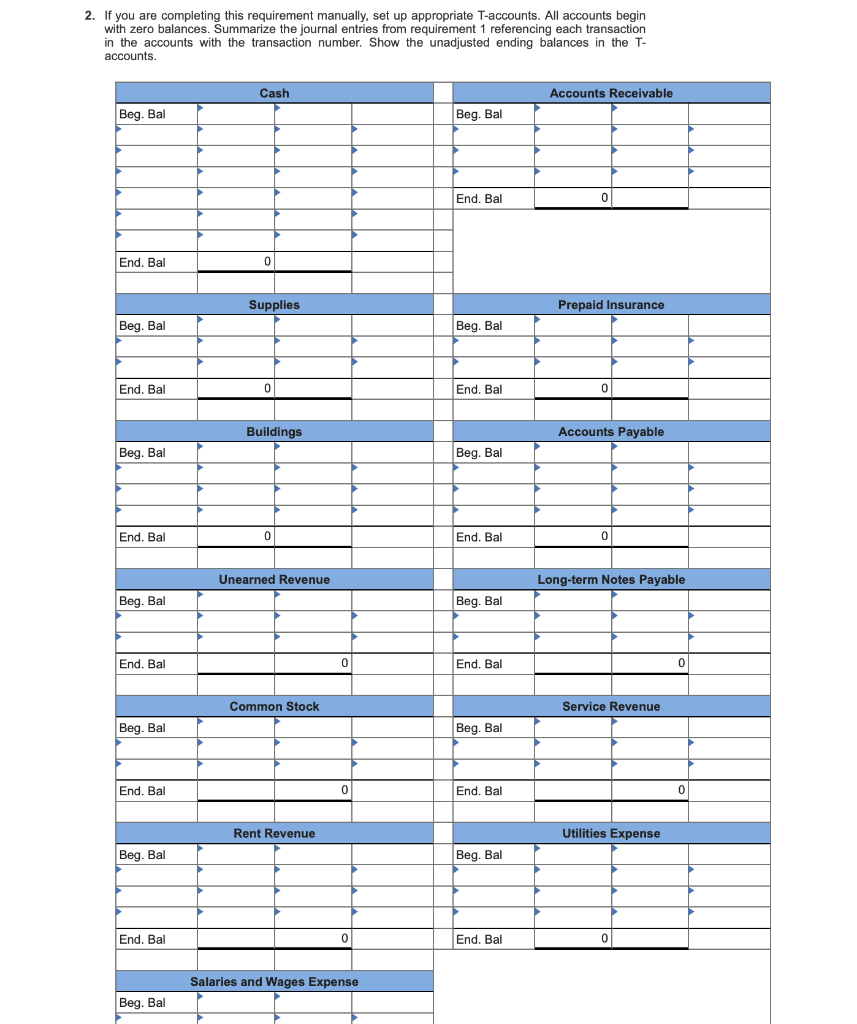

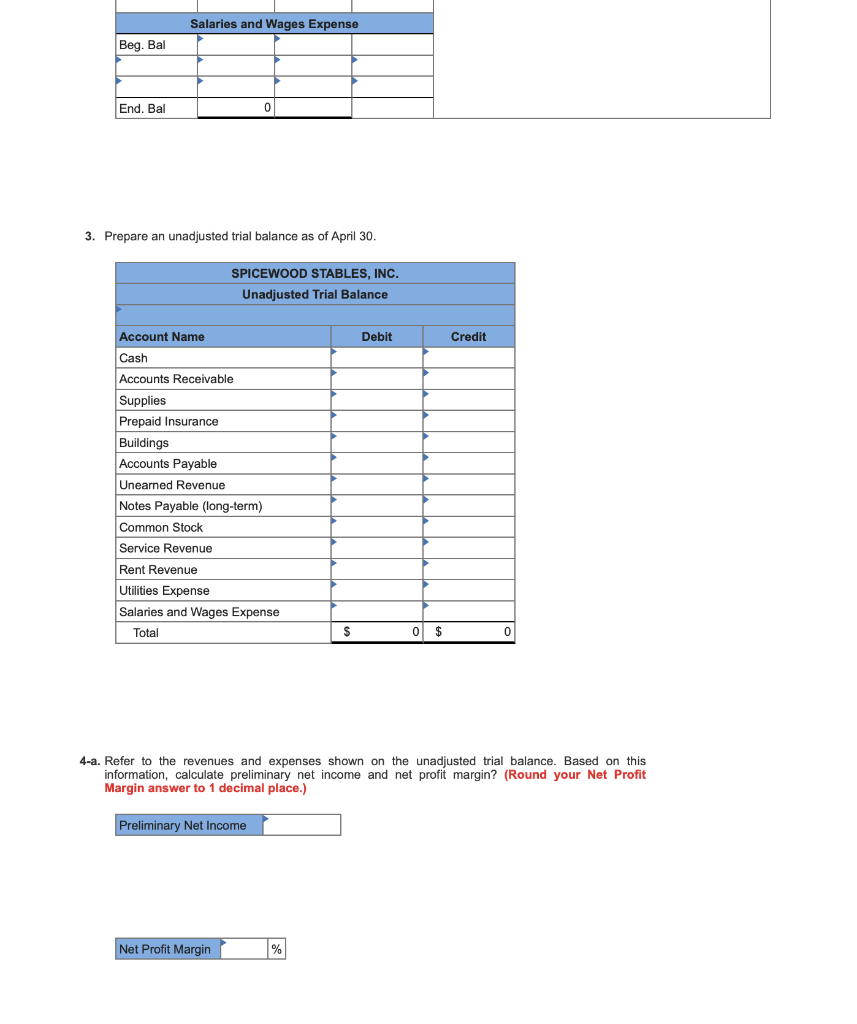

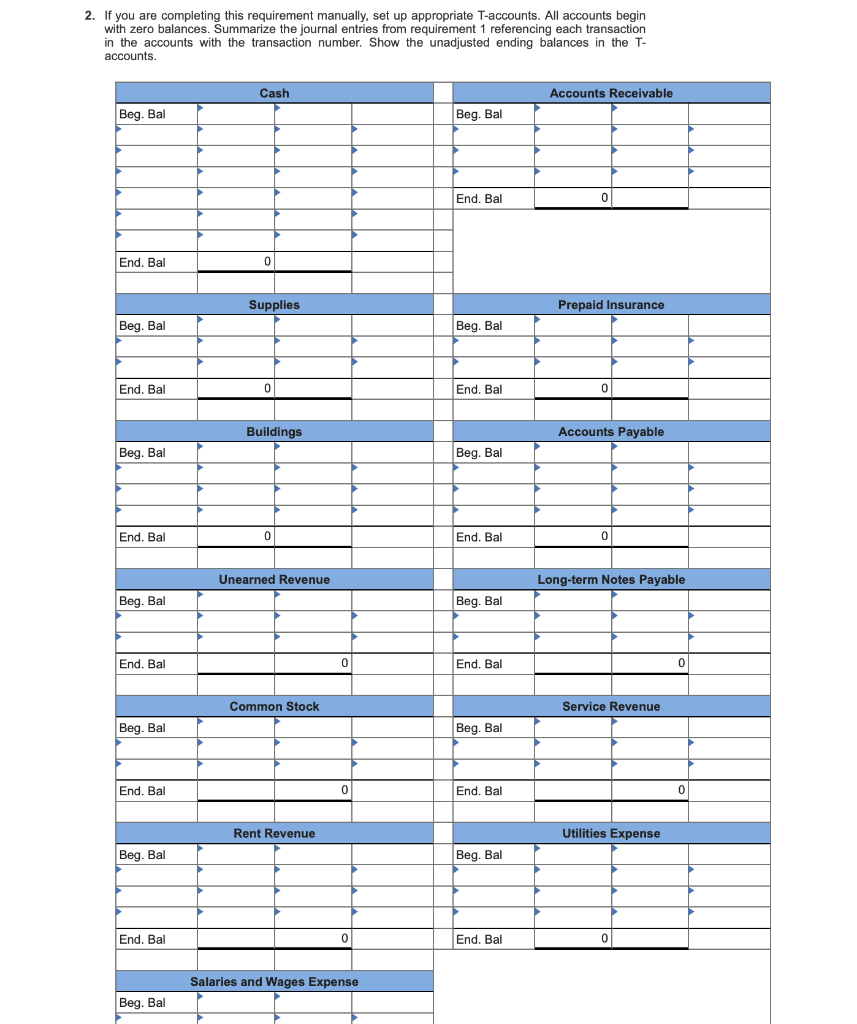

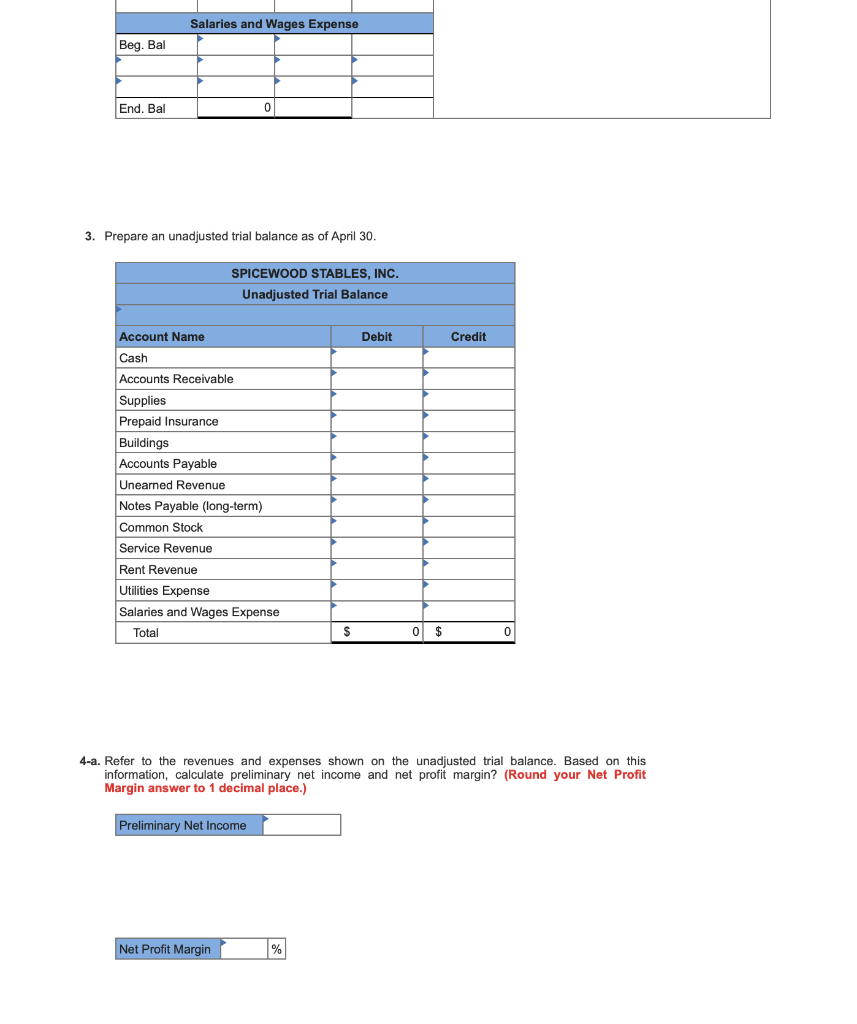

Time remaining: 2:04:16 6. value: 6.00 points PA3-3 Analyzing the Effects of Transactions Using T-Accounts, Preparing an Unadjusted Trial Balance, and Determining Net Income and Net Profit Margin [LO 3-1, LO 3-2, LO 3-3, LO 3-4, LO 3-5] Spicewood Stables, Inc. was established in Dripping Springs, Texas, on April 1. The company provides stables, care for animals, and grounds for riding and showing horses. You have been hired as the new Assistant Controller. The following transactions for April are provided for your review. 1. Received contributions from investors and issued $350,000 of common stock on April 1. 2. Built a barn and other buildings for $228,000. On April 2, the company paid half the amount in cash on April 1 and signed a three-year note payable for the balance. 3. Provided $17,800 in animal care services for customers on April 3, all on credit. 4. Rented stables to customers who cared for their own animals, received cash of $12,000 on April 4. 5. On April 5, received $2,700 cash from a customer to board her horse in May, June, and July (record as Unearned Revenue). 6. Purchased hay and feed supplies on account on April 6 for $5,100. 7. Paid $1,860 on accounts payable on April 7 for previous purchases 8. Received $1,860 from customers on April 8 on accounts receivable. 9. On April 9, prepaid a two-year insurance policy for $4,200. for coverage starting in May. 10.On April 28, paid $1,350 in cash for water utilities incurred in the month. 11.Paid $16,000 in wages on April 29 for work done this month. 12.Received an electric utility bill on April 30 for $2,220 for usage in April; the bill will be paid next month. Required: 1. Prepare the journal entry for each of the above transactions. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 2 3 4 5 6 7 8 Received contributions from investors and issued $350,000 of common stock on April 1. Record the transaction. Note: Enter debits before credits. Transaction General Journal Debit Credit Record entry Clear entry View general journal 2. If you are completing this requirement manually, set up appropriate T-accounts. All accounts begin with zero balances. Summarize the journal entries from requirement 1 referencing each transaction in the accounts with the transaction number. Show the unadjusted ending balances in the T- accounts. Cash Accounts Receivable Beg. Bal Beg. Bal End. Bal End. Bal Supplies Prepaid Insurance Beg. Bal Beg. Bal End. Bal End. Bal Buildings Accounts Payable Beg. Bal Beg. Bal End. Bal End. Bal Unearned Revenue Long-term Notes Payable Beg. Bal Beg. Bal End. Ba End. Bal Common Stock Service Revenue Beg. Bal Beg. Bal End. Bal End. Bal Rent Revenue Utilities Expense Beg. Bal Beg. Bal End. Bal 0 End. Bal 0 Salaries and Wages Expense Beg. Bal Salaries and Wages Expense Beg. Bal End. Bal 0 3. Prepare an unadjusted trial balance as of April 30. SPICEWOOD STABLES, INC. Unadjusted Trial Balance Debit Credit Account Name Cash Accounts Receivable Supplies Prepaid Insurance Buildings Accounts Payable Unearned Revenue Notes Payable (long-term) Common Stock Service Revenue Rent Revenue Utilities Expense Salaries and Wages Expense Total 0 $ 0 4-a. Refer to the revenues and expenses shown on the unadjusted trial balance. Based on this information, calculate preliminary net income and net profit margin? (Round your Net Profit Margin answer to 1 decimal place.) Preliminary Net Income Net Profit Margin %