Answered step by step

Verified Expert Solution

Question

1 Approved Answer

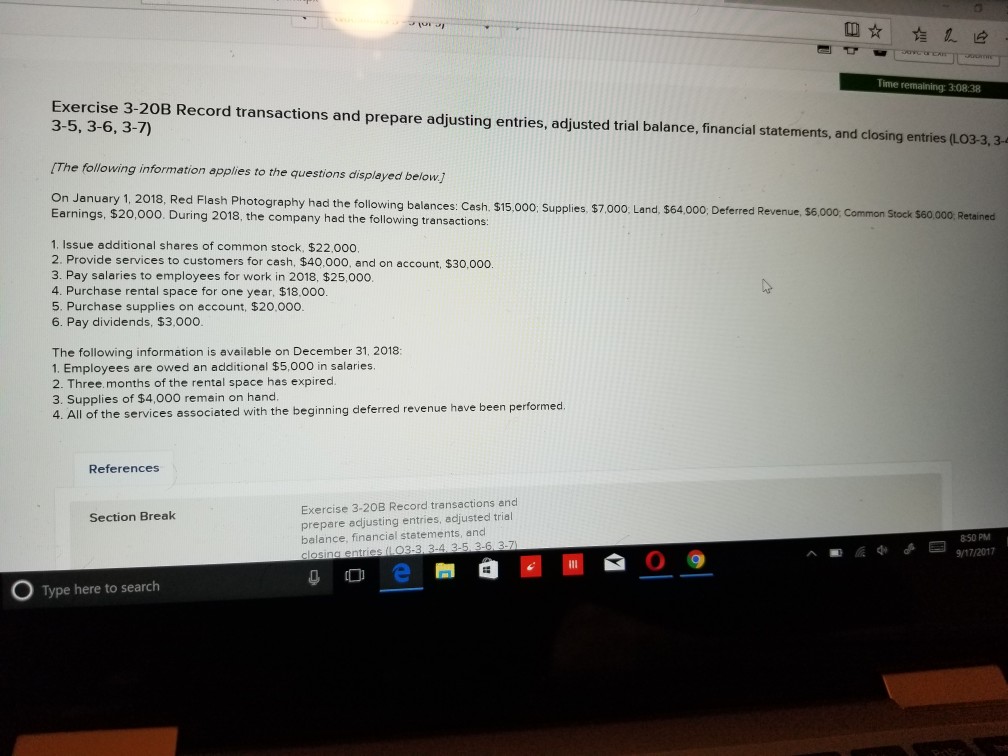

Time remaining: 3:08:38 Exercise 3-20B Record transactions and prepare adjusting entries, adjusted trial balance, financial statements, and closing entries (LO3-3, 3-4 3-5, 3-6, 3-7) [The

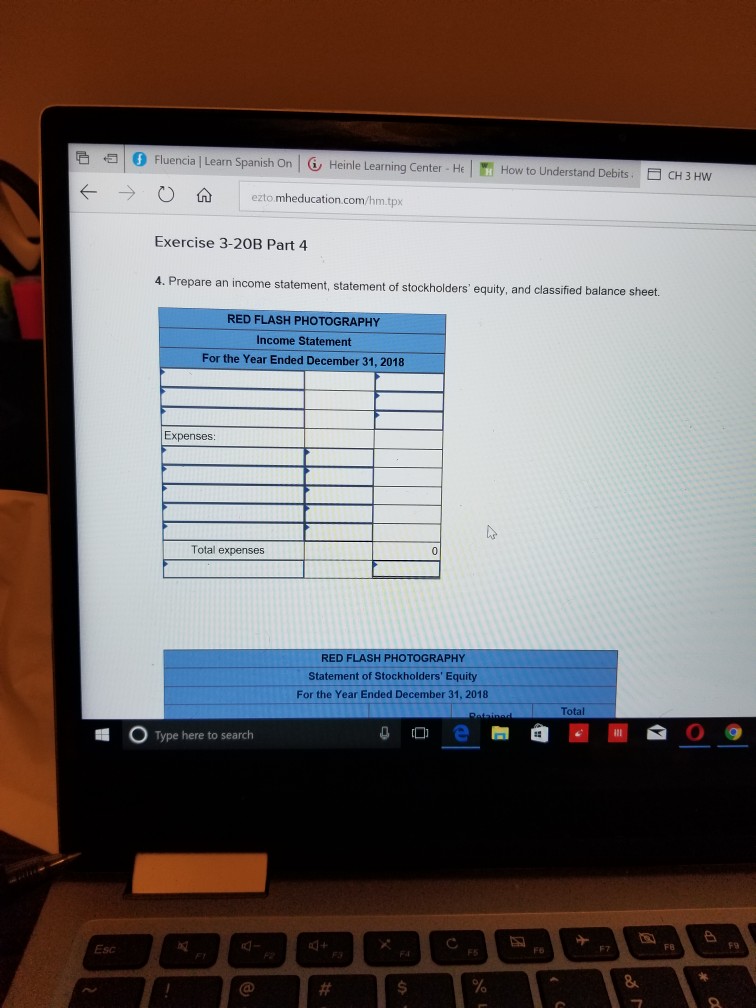

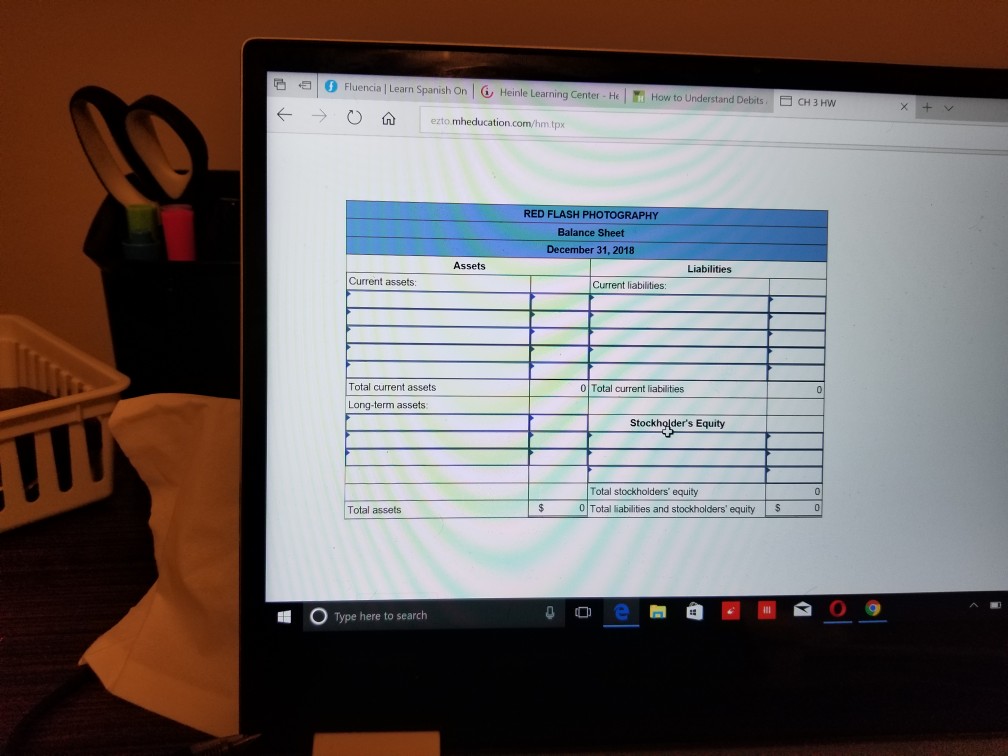

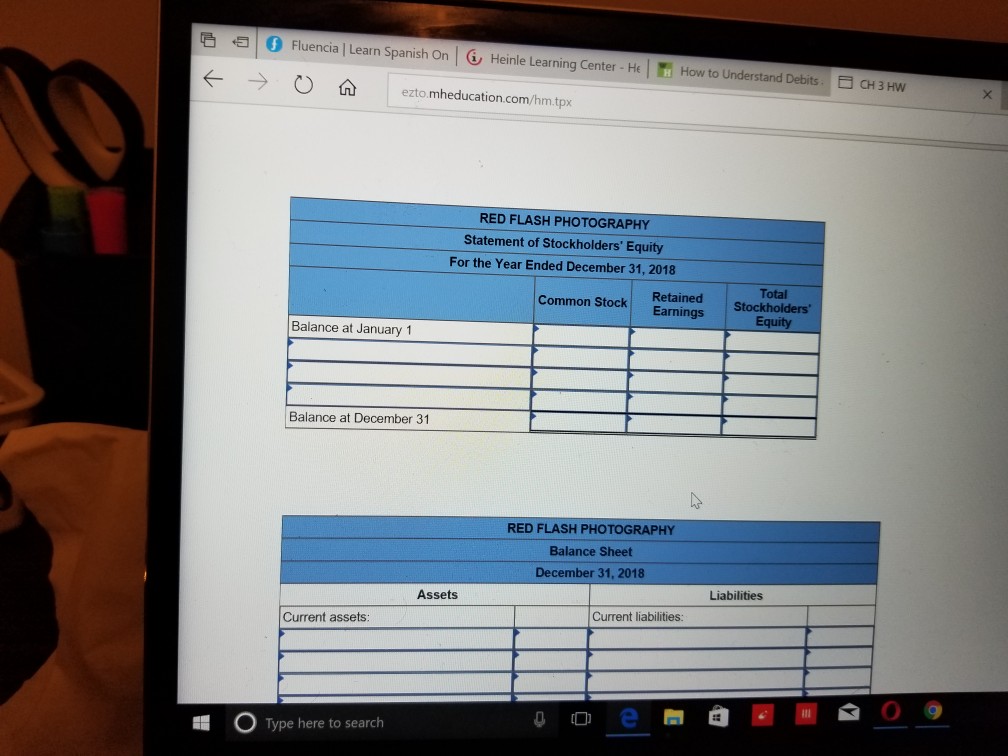

Time remaining: 3:08:38 Exercise 3-20B Record transactions and prepare adjusting entries, adjusted trial balance, financial statements, and closing entries (LO3-3, 3-4 3-5, 3-6, 3-7) [The following information applies to the questions displayed below] On January 1, 2018, Red Flash Photography had the following balances: c Earnings, $20,000. During 2018, the company had the following transactions ash. $15,000, Supplies, $7.000, Land, $64000, Deferred Revenue, $6,000, Common Stock $60 1. Issue additional shares of common stock, $22.000. 2. Provide services to customers for cash, $40,000, and on account, $30.000. 3. Pay salaries to employees for work in 2018, $25,000 4. Purchase rental space for one year, $18,000 5. Purchase supplies on account, $20,000 6. Pay dividends, $3,000. The following information is available on December 31, 2018: 1. Employees are owed an additional $5,000 in salaries. 2. Three.months of the rental space has expired. 3. Supplies of $4,000 remein on hand 4. All of the services associated with the beginning deferred revenue have been performed References Exercise 3-20B Record transactions and prepare acjusting entries, adjusted trial balance, financial statements, and Section Break 850 PM 9/17/2017 Type here to search

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started