Answered step by step

Verified Expert Solution

Question

1 Approved Answer

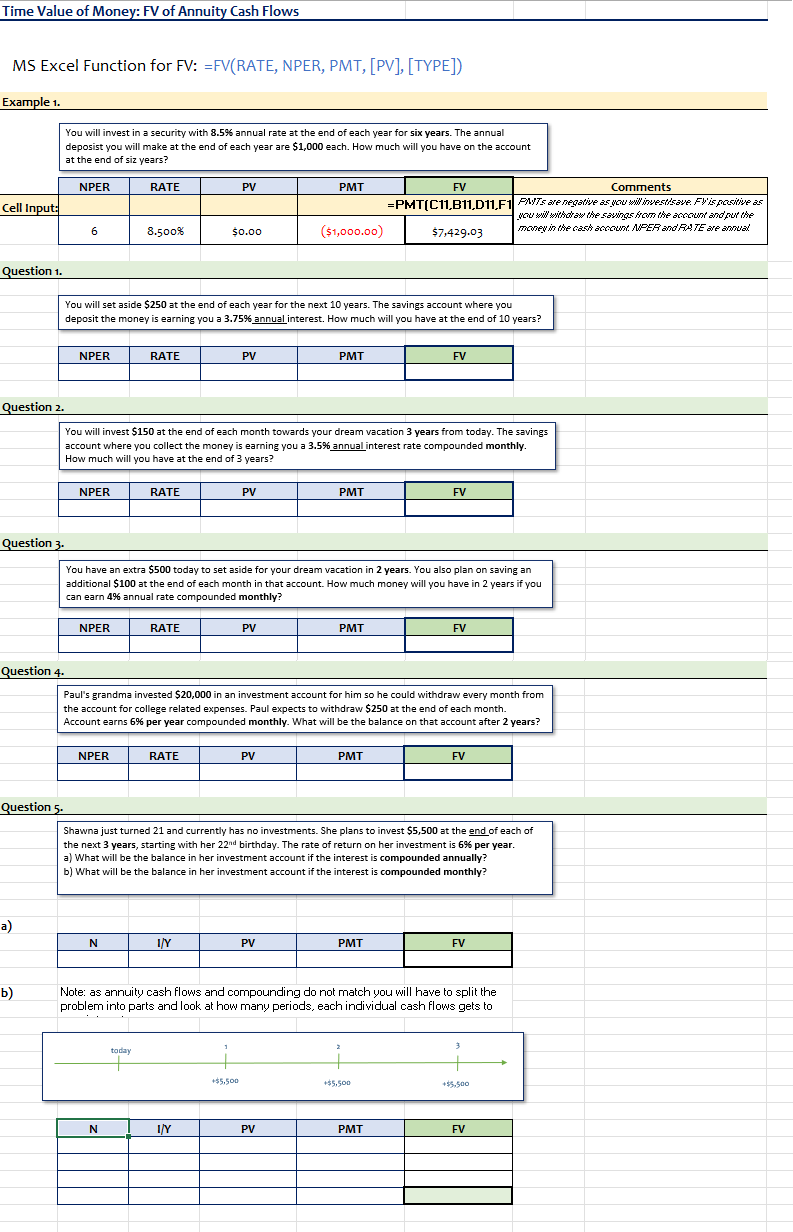

Time Value of Money: FV of Annuity Cash Flows MS Excel Function for FV: =FV(RATE, NPER, PMT, [PV], [TYPE]) Example 1. You will invest in

Time Value of Money: FV of Annuity Cash Flows MS Excel Function for FV: =FV(RATE, NPER, PMT, [PV], [TYPE]) Example 1. You will invest in a security with 8.5% annual rate at the end of each year for six years. The annual deposist you will make at the end of each year are \$1,000 each. How much will you have on the account at the end of siz years? Question 1. You will set aside $250 at the end of each year for the next 10 years. The savings account where you \begin{tabular}{|l|l|l|l|l|} \hline NPER & RATE & PV & PMT & FV \\ \hline & & & & \\ \hline \end{tabular} Question 2. You will invest $150 at the end of each month towards your dream vacation 3 years from today. The savings account where you collect the money is earning you a 3.5% annual interest rate compounded monthly. How much will you have at the end of 3 years? \begin{tabular}{|l|l|l|l|l|} \hline NPER & RATE & PV & PMT & FV \\ \hline & & & & \\ \hline \end{tabular} Question 3. You have an extra $500 today to set aside for your dream vacation in 2 years. You also plan on saving an additional $100 at the end of each month in that account. How much money will you have in 2 years if you can earn 4% annual rate compounded monthly? \begin{tabular}{|l|l|l|l|l|} \hline NPER & RATE & PV & PMT & FV \\ \hline & & & & \\ \hline \end{tabular} Question 4. Paul's grandma invested $20,000 in an investment account for him so he could withdraw every month from the account for college related expenses. Paul expects to withdraw $250 at the end of each month. Account earns 6% per year compounded monthly. What will be the balance on that account after 2 years? \begin{tabular}{|l|l|l|l|l|} \hline NPER & RATE & PV & PMT & FV \\ \hline & & & & \\ \hline \end{tabular} Question 5. Shawna just turned 21 and currently has no investments. She plans to invest $5,500 at the end of each of the next 3 years, starting with her 22nd birthday. The rate of return on her investment is 6% per year. a) What will be the balance in her investment account if the interest is compounded annually? b) What will be the balance in her investment account if the interest is compounded monthly? a) \begin{tabular}{|c|c|c|c|c|} \hline N & I/Y & PV & PMT & FV \\ \hline & & & & \\ \hline \end{tabular} b) Note: as annuity cash flows and compounding do not match you will have to split the problem into parts and look at how many periods, each individual cash flows gets to

Time Value of Money: FV of Annuity Cash Flows MS Excel Function for FV: =FV(RATE, NPER, PMT, [PV], [TYPE]) Example 1. You will invest in a security with 8.5% annual rate at the end of each year for six years. The annual deposist you will make at the end of each year are \$1,000 each. How much will you have on the account at the end of siz years? Question 1. You will set aside $250 at the end of each year for the next 10 years. The savings account where you \begin{tabular}{|l|l|l|l|l|} \hline NPER & RATE & PV & PMT & FV \\ \hline & & & & \\ \hline \end{tabular} Question 2. You will invest $150 at the end of each month towards your dream vacation 3 years from today. The savings account where you collect the money is earning you a 3.5% annual interest rate compounded monthly. How much will you have at the end of 3 years? \begin{tabular}{|l|l|l|l|l|} \hline NPER & RATE & PV & PMT & FV \\ \hline & & & & \\ \hline \end{tabular} Question 3. You have an extra $500 today to set aside for your dream vacation in 2 years. You also plan on saving an additional $100 at the end of each month in that account. How much money will you have in 2 years if you can earn 4% annual rate compounded monthly? \begin{tabular}{|l|l|l|l|l|} \hline NPER & RATE & PV & PMT & FV \\ \hline & & & & \\ \hline \end{tabular} Question 4. Paul's grandma invested $20,000 in an investment account for him so he could withdraw every month from the account for college related expenses. Paul expects to withdraw $250 at the end of each month. Account earns 6% per year compounded monthly. What will be the balance on that account after 2 years? \begin{tabular}{|l|l|l|l|l|} \hline NPER & RATE & PV & PMT & FV \\ \hline & & & & \\ \hline \end{tabular} Question 5. Shawna just turned 21 and currently has no investments. She plans to invest $5,500 at the end of each of the next 3 years, starting with her 22nd birthday. The rate of return on her investment is 6% per year. a) What will be the balance in her investment account if the interest is compounded annually? b) What will be the balance in her investment account if the interest is compounded monthly? a) \begin{tabular}{|c|c|c|c|c|} \hline N & I/Y & PV & PMT & FV \\ \hline & & & & \\ \hline \end{tabular} b) Note: as annuity cash flows and compounding do not match you will have to split the problem into parts and look at how many periods, each individual cash flows gets to Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started