Answered step by step

Verified Expert Solution

Question

1 Approved Answer

timed task, please answer for an upvote :)) The following data are taken from the records of Ms. Princess Ty, not VAT-registered, who owns various

timed task, please answer for an upvote :))

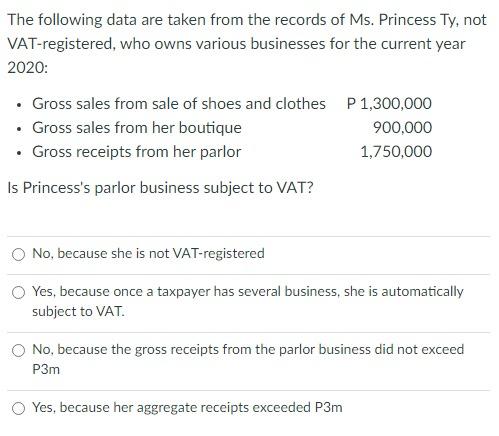

The following data are taken from the records of Ms. Princess Ty, not VAT-registered, who owns various businesses for the current year 2020: Gross sales from sale of shoes and clothes P1,300,000 Gross sales from her boutique 900,000 Gross receipts from her parlor 1,750,000 Is Princess's parlor business subject to VAT? . No, because she is not VAT-registered Yes, because once a taxpayer has several business, she is automatically subject to VAT. No, because the gross receipts from the parlor business did not exceed P3m Yes, because her aggregate receipts exceeded P3mStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started