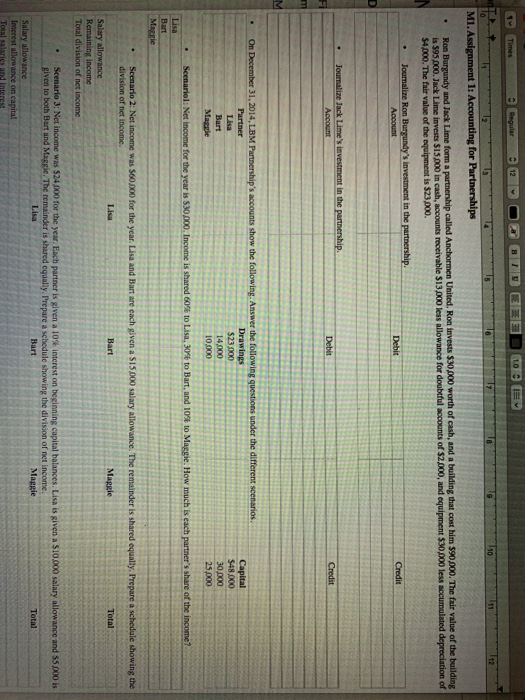

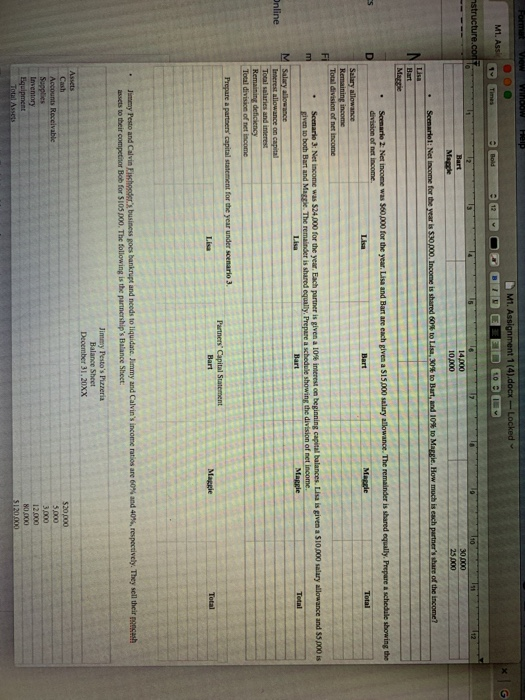

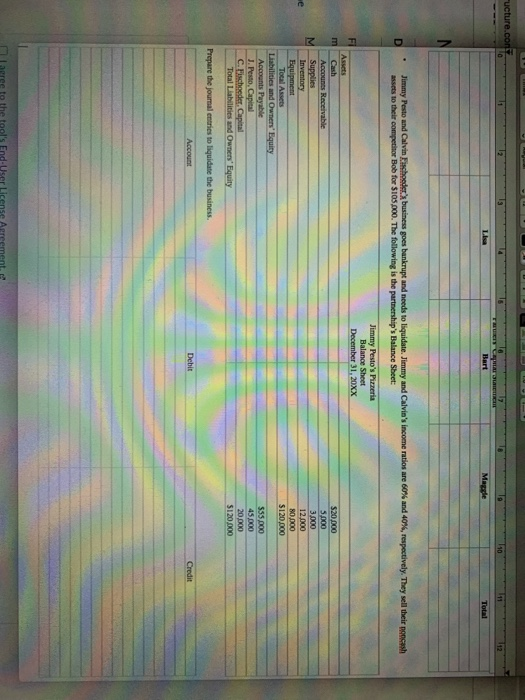

Times 10 12 Regular 17 110 in 112 10 M1. Assignment 1: Accounting for Partnerships Ron Burgundy and Jack Lime forma partnership called Anchormen United. Ron invests $30,000 worth of cash, and a building that cost him $90,000. The fair value of the building is 595 000. Jack Lime invests $15.000 in cash, accounts receivable $13,000 less allowance for doubtful accounts of $2,000, and equipment $30,000 less accumulated depreciation of $4.000. The fair value of the equipment is $23,000. Journalize Ron Burgundy's investment in the partnership Account Debit Credit D Journalize Jack Lime's investment in the partnership Account Debit Credit FI m M On December 31, 2014, LBM Partnership's accounts show the following. Answer the following questions under the different scenarios Partner Drawings Lisa $23.000 Bart 14.000 Maggie 10.000 Capital $48.000 30,000 25.000 Scenariol: Net income for the year is $30,000. Income is shared 60% to Lisa, 30% to Bart, and 10% to Maggie. How much is each partner's share of the income? Lisa Maggie . Scenario 2: Net income was $60,000 for the year. Lisa and Bart are cach given a $15.000 salary allowance. The remainder is shared equally, I'repare a schedule showing the division of net income Bart Maggie Total Salary allowance Remaining income Total division of net income Scenario 3: Net income was $24,000 for the year. Each partner is given a 10% interest on beginning capital balances. Lisa is given a $10.000 salary allowance and S5.000 is given to both Bart and Maggie. The remainder is shared equally. Prepare a schedule showing the division of net income Lisa Bart Maggie Total Salary allowance Interest allowance on capital Total salaries and interes Forme Window Help M1. Assignment 1(4).docx - Locked LO M1. Ass Times Bold structure.com 151 Rart Maple 14.000 10.000 30.000 25.000 Scenario: Net income for the year is $30,000. Income is shared 60% to Lisa to Bart, and 10 to Maggie, How much is each partner's share of the income? Marge Scenario 2: Net income was $60,000 for the year. Lisa and Bart are each given a $15.000 salary allowance. The remainder is shared equally. Prepare a schedule showing the division of net income Lisa Bart Mapgle Total Salary allowance Remaining income Total division of net income m Online Scenario 3: Net income was $24.000 for the year. Each partner is given a 10% interest on beginning capital balances. Lisa is given a $10,000 salary allowance and pois given to both Bart and Maggle. The remainder is shared equally. Prepare a schedule showing the division of net income Lisa Bart Maggie Total M Salary allowance Interest allowance on capital Tocal salaries and interest Remaining deficiency Total division of net income Prepare a partners' capital statement for the year under scenario 3. Partners' Capital Statement Bart Lisa Maggie Total Jimmy Pesto and Calvin Kitched business goes bankrupt and needs to liquidate Jimmy and Calvin's income ratios are 60% and 40%, respectively. They sell their mesh assets to their competitor Bob for 5105DOO. The following is the partnership's Balance Sheet: Jimmy Pesto's Pizzeria Balance Sheet December 31, 20XX Assets Cash Accounts Receivable Supplies Inventory Equipment Total Assets $20.000 5.000 3.000 12.000 80.000 $120.000 ructure.com 10 150 111 112 17 Bart Maggle Total N D Jimmy Pesto and Calvin Fischoeder's business goes bankrupt and needs to liquidate. Jimmy and Calvin's income ratios are 60% and 40%, respectively. They sell their noncash assets to their competitor Bob for $105,000. The following is the partnership's Balance Sheet: Jimmy Pesto's Pizzeria Balance Sheet December 31, 20XX FI m M Assets Cash Accounts Receivable Supplies Inventory Equipment Total Assets Liabilities and Owners' Equity Accounts Payable J. Pesto, Capital C. Fischeeder, Capital Total Liabilities and Owners' Equity $20.000 5.000 3.000 12.000 80.DOO $120.000 de 555.000 45.000 20.000 $120.000 Prepare the journal entries to liquidate the business. Account Debit Credit to the tool's End-User