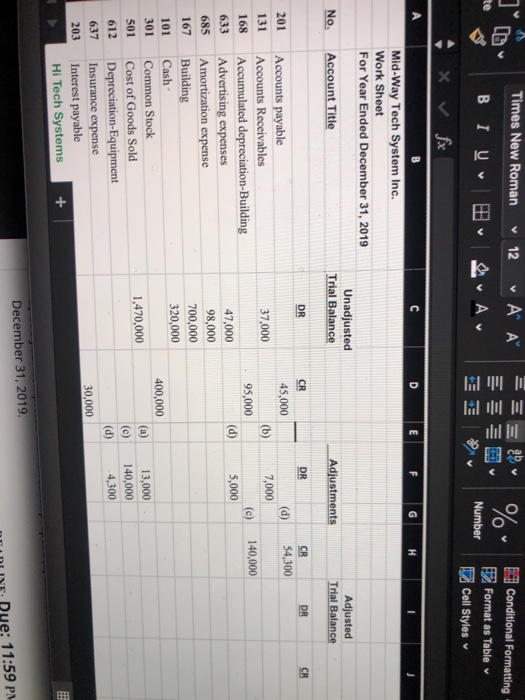

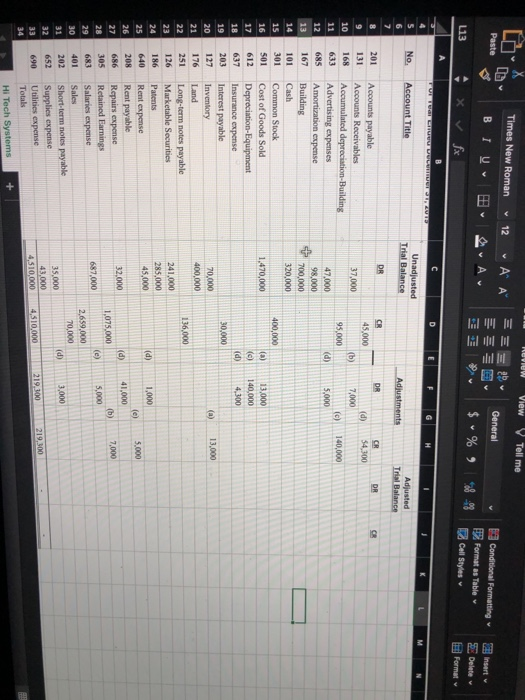

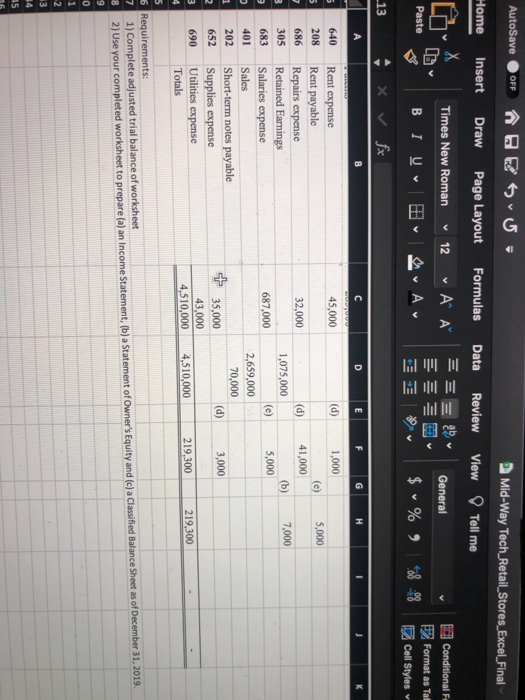

Times New Roman 12 A a. Av % te BI Conditional Formatting Format as Table Cell Styles Number C D E F G B Mid-Way Tech System Inc. Work Sheet For Year Ended December 31, 2019 Unadjusted Trial Balance Adjusted Trial Balance No. Account Title Adjustments DR DR DR CR CR 45,000 CR 54,300 201 (d) 131 37,000 7,000 (b) (c) 95,000 140,000 168 (d) 5,000 633 685 167 Accounts payable Accounts Receivables Accumulated depreciation-Building Advertising expenses Amortization expense Building Cash Common Stock Cost of Goods Sold Depreciation Equipment Insurance expense Interest payable Hi Tech Systems 47,000 98,000 700,000 320,000 101 301 400,000 1,470,000 501 612 (c) (d) 13,000 140,000 4,300 637 203 30,000 December 31, 2019. Due: 11:59 PM View Tell me Times New Roman 12 Paste General BIV Insert HII LI A $ % ) Conditional Formatting Format as Table Call Styles Delete L13 EN Format U TU LICU DOCUMENTS D E H K M No. Account Title 5 6 7 Unadjusted Trial Balance Adjustments Adjusted Trial Balance DR DR 8 CR 45,000 CR 54,300 DR 9 (d) 37,000 (b) 7,000 10 95.000 (c) 140,000 11 12 201 131 168 633 685 167 101 (d) 5.000 47.000 98,000 700,000 320,000 301 400,000 13 14 15 16 17 18 501 612 1.470,000 (a) (c 13,000 140,000 4,300 (d) 637 203 30,000 19 20 21 (a) 13,000 Accounts payable Accounts Receivables Accumulated depreciation-Building Advertising expenses Amortization expense Building Cash Common Stock Cost of Goods Sold Depreciation-Equipment Insurance expense Interest payable Inventory Land Long-term notes payable Marketable Securities Patents Rent expense Rent payable Repairs expense Retained Famings Salaries expense Sales Short-term notes payable Supplies expense Utilities expense 70,000 400,000 136,000 127 176 251 126 186 640 208 686 305 22 23 24 25 26 27 28 241.000 285,000 45,000 (d) 1,000 (e) 5.000 32,000 (d) 41.000 1,075,000 (b) 7,000 5,000 (e) 687.000 29 30 2,659,000 70,000 31 401 202 652 (d) 3,000 35,000 43.000 4.510,000 32 33 34 4,510,000 219.100 219 300 Totals Hi Tech Systems + AutoSave DOFF HESU Home Insert Draw Page Layout Mid-Way Tech_Retail_Stores_Excel_Final View Tell me Formulas Data Review Times New Roman v 12 A General CD H|||||| Conditional F. Format as Tab Cell Styles Paste BI v A $ % ) 20 _13 Xv fx B D E F G H 5 5 1 2 652 640 Rent expense 45,000 (d) 1,000 208 Rent payable (c) 5,000 686 Repairs expense 32,000 (d) 41,000 305 Retained Earnings 1,075,000 (b) 7,000 683 Salaries expense 687,000 (c) 5,000 401 Sales 2,659,000 202 Short-term notes payable 70,000 Supplies expense 35,000 (d) 3,000 690 Utilities expense 43,000 Totals 4,510,000 4,510,000 219,300 219,300 5 6 Requirements: 7 1) Complete adjusted trial balance of worksheet 8 2) Use your completed worksheet to prepare (a) an Income Statement, (b) a Statement of Owner's Equity and (c) a Classified Balance Sheet as of December 31, 2019. 9 0 1 -2 3 14 15 Times New Roman 12 A a. Av % te BI Conditional Formatting Format as Table Cell Styles Number C D E F G B Mid-Way Tech System Inc. Work Sheet For Year Ended December 31, 2019 Unadjusted Trial Balance Adjusted Trial Balance No. Account Title Adjustments DR DR DR CR CR 45,000 CR 54,300 201 (d) 131 37,000 7,000 (b) (c) 95,000 140,000 168 (d) 5,000 633 685 167 Accounts payable Accounts Receivables Accumulated depreciation-Building Advertising expenses Amortization expense Building Cash Common Stock Cost of Goods Sold Depreciation Equipment Insurance expense Interest payable Hi Tech Systems 47,000 98,000 700,000 320,000 101 301 400,000 1,470,000 501 612 (c) (d) 13,000 140,000 4,300 637 203 30,000 December 31, 2019. Due: 11:59 PM View Tell me Times New Roman 12 Paste General BIV Insert HII LI A $ % ) Conditional Formatting Format as Table Call Styles Delete L13 EN Format U TU LICU DOCUMENTS D E H K M No. Account Title 5 6 7 Unadjusted Trial Balance Adjustments Adjusted Trial Balance DR DR 8 CR 45,000 CR 54,300 DR 9 (d) 37,000 (b) 7,000 10 95.000 (c) 140,000 11 12 201 131 168 633 685 167 101 (d) 5.000 47.000 98,000 700,000 320,000 301 400,000 13 14 15 16 17 18 501 612 1.470,000 (a) (c 13,000 140,000 4,300 (d) 637 203 30,000 19 20 21 (a) 13,000 Accounts payable Accounts Receivables Accumulated depreciation-Building Advertising expenses Amortization expense Building Cash Common Stock Cost of Goods Sold Depreciation-Equipment Insurance expense Interest payable Inventory Land Long-term notes payable Marketable Securities Patents Rent expense Rent payable Repairs expense Retained Famings Salaries expense Sales Short-term notes payable Supplies expense Utilities expense 70,000 400,000 136,000 127 176 251 126 186 640 208 686 305 22 23 24 25 26 27 28 241.000 285,000 45,000 (d) 1,000 (e) 5.000 32,000 (d) 41.000 1,075,000 (b) 7,000 5,000 (e) 687.000 29 30 2,659,000 70,000 31 401 202 652 (d) 3,000 35,000 43.000 4.510,000 32 33 34 4,510,000 219.100 219 300 Totals Hi Tech Systems + AutoSave DOFF HESU Home Insert Draw Page Layout Mid-Way Tech_Retail_Stores_Excel_Final View Tell me Formulas Data Review Times New Roman v 12 A General CD H|||||| Conditional F. Format as Tab Cell Styles Paste BI v A $ % ) 20 _13 Xv fx B D E F G H 5 5 1 2 652 640 Rent expense 45,000 (d) 1,000 208 Rent payable (c) 5,000 686 Repairs expense 32,000 (d) 41,000 305 Retained Earnings 1,075,000 (b) 7,000 683 Salaries expense 687,000 (c) 5,000 401 Sales 2,659,000 202 Short-term notes payable 70,000 Supplies expense 35,000 (d) 3,000 690 Utilities expense 43,000 Totals 4,510,000 4,510,000 219,300 219,300 5 6 Requirements: 7 1) Complete adjusted trial balance of worksheet 8 2) Use your completed worksheet to prepare (a) an Income Statement, (b) a Statement of Owner's Equity and (c) a Classified Balance Sheet as of December 31, 2019. 9 0 1 -2 3 14 15