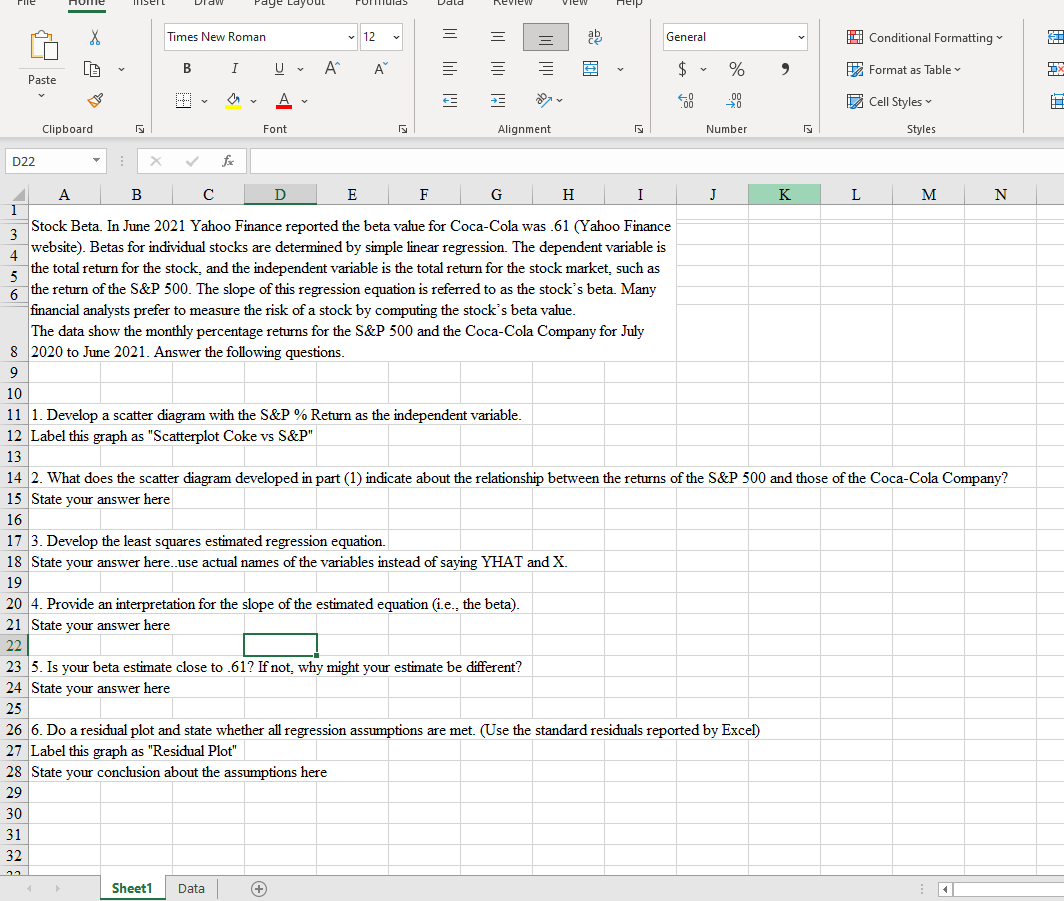

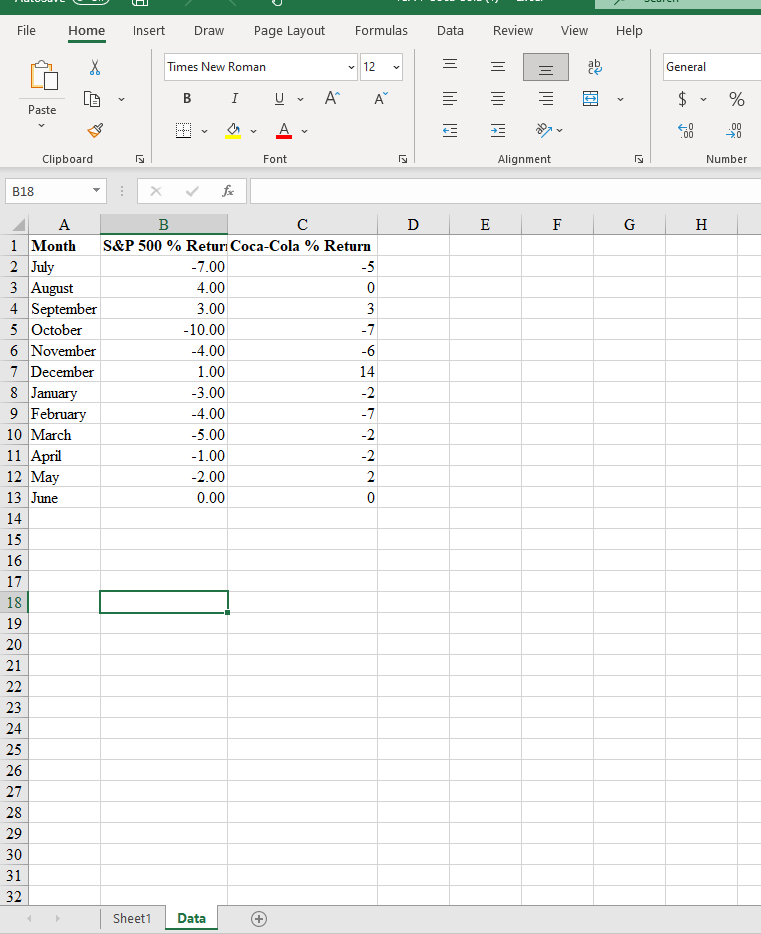

Times New Roman 12 E General Conditional Formatting LG B U v A A E Format as Table Paste = A FE i Cell Styles . Clipboard Font Alignment Number Styles D22 X V A B C D E F G H J K L M N Stock Beta. In June 2021 Yahoo Finance reported the beta value for Coca-Cola was .61 (Yahoo Finance website). Betas for individual stocks are determined by simple linear regression. The dependent variable is the total return for the stock, and the independent variable is the total return for the stock market, such as the return of the S&P 500. The slope of this regression equation is referred to as the stock's beta. Many financial analysts prefer to measure the risk of a stock by computing the stock's beta value The data show the monthly percentage returns for the S&P 500 and the Coca-Cola Company for July 8 2020 to June 2021. Answer the following questions. 10 11 1. Develop a scatter diagram with the S&P % Return as the independent variable. 12 Label this graph as "Scatterplot Coke vs S&P" 13 14 2. What does the scatter diagram developed in part (1) indicate about the relationship between the returns of the S&P 500 and those of the Coca-Cola Company? 15 State your answer here 16 17 3. Develop the least squares estimated regression equation. 18 State your answer here.. use actual names of the variables instead of saying YHAT and X. 19 20 4. Provide an interpretation for the slope of the estimated equation (i.e., the beta). 21 State your answer here 22 23 5. Is your beta estimate close to .61? If not, why might your estimate be different? 24 State your answer here 25 26 6. Do a residual plot and state whether all regression assumptions are met. (Use the standard residuals reported by Excel) 27 Label this graph as "Residual Plot" 28 State your conclusion about the assumptions here 29 30 31 32 Sheet1 Data +File Home Insert Draw Page Layout Formulas Data Review View Help Times New Roman 12 - ag General U - A* A E = = Paste A Font Alignment Number Clipboard B18 X V A B C D E F G H 1 Month S&P 500 % Retur Coca-Cola % Return 2 July 7.00 5 August 4.00 4 September 3.00 3 5 October -10.00 6 November -4.00 7 December 1.00 14 8 January -3.00 9 February -4.00 10 March -5.00 11 April -1.00 12 May -2.00 13 June 0.00 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 Sheet1 Data (+