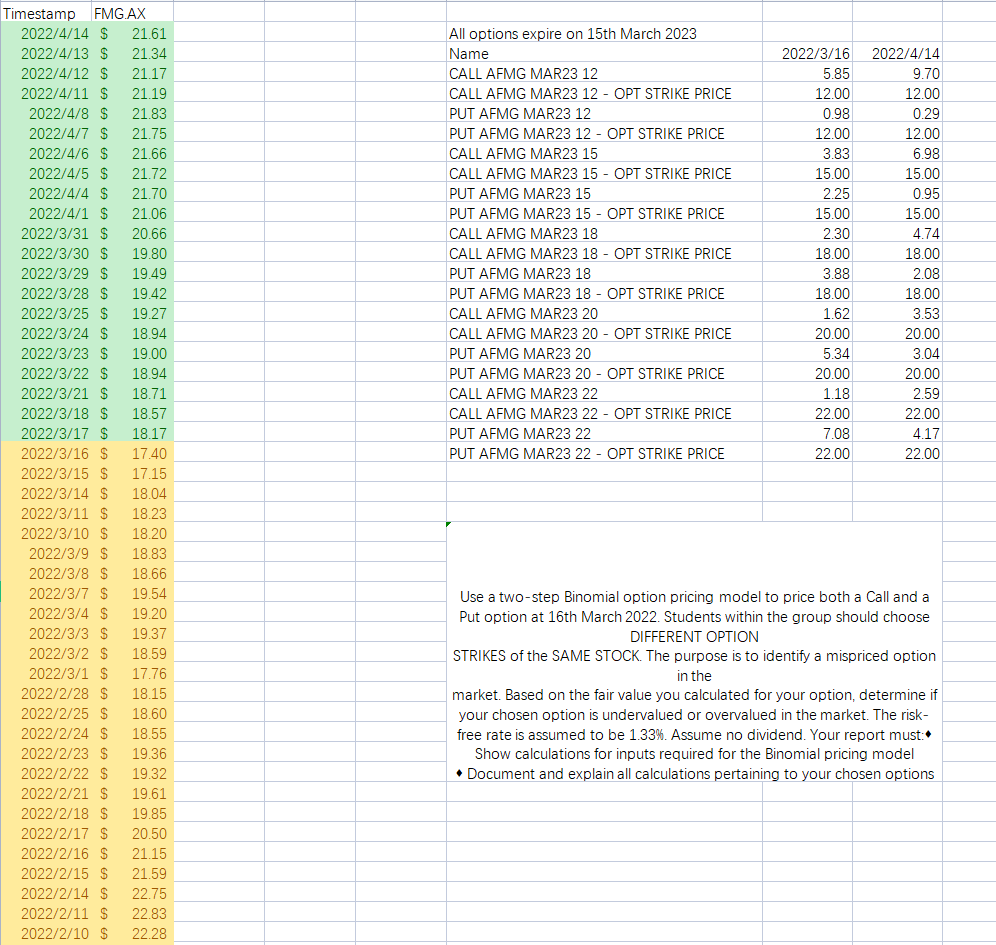

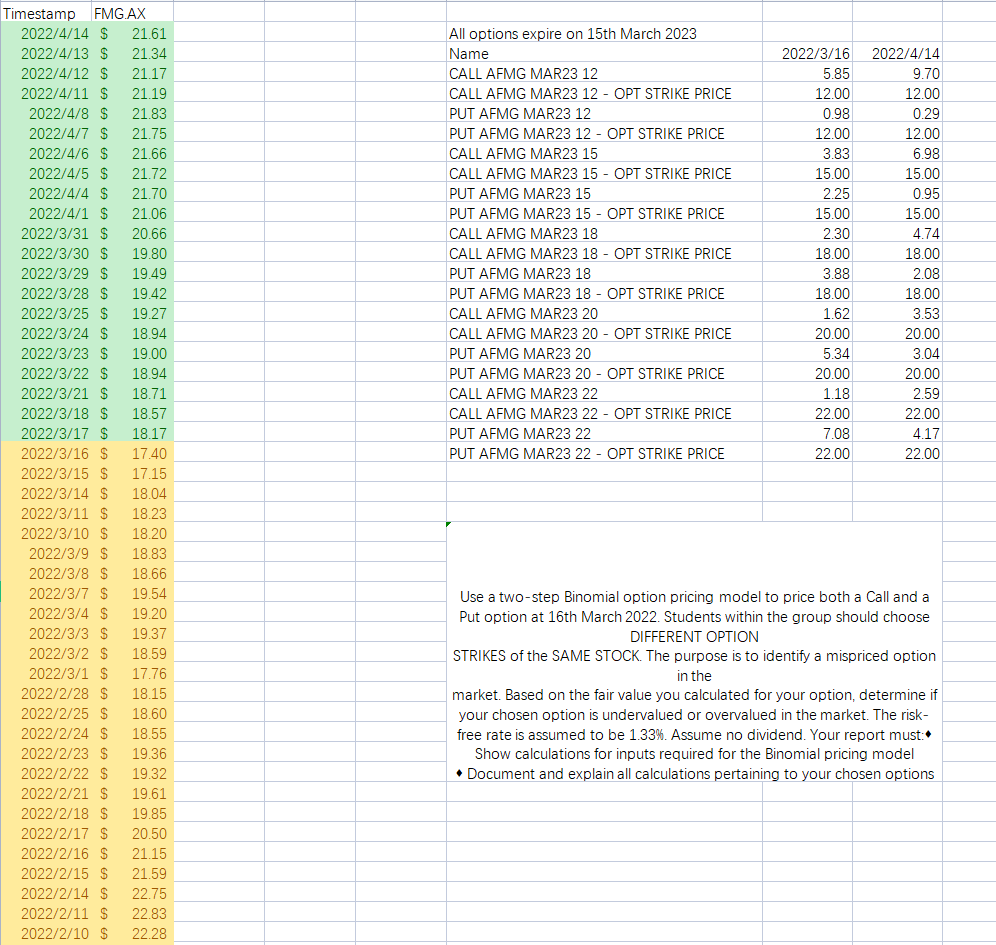

Timestamp FMG.AX 2022/4/14 $ 21.61 2022/4/13 $ 21.34 2022/4/12 $ 21.17 2022/4/11 $ 21.19 2022/4/8 $ 21.83 2022/4/7 $ 21.75 2022/4/6 $ 21.66 2022/4/5 $ 21.72 2022/4/4 $ 21.70 2022/4/1 $ 21.06 2022/3/31 $ 20.66 2022/3/30 $ 19.80 2022/3/29 $ 19.49 2022/3/28 $ 19.42 2022/3/25 $ 19.27 2022/3/24 $ 18.94 2022/3/23 $ 19.00 2022/3/22 $ 18.94 2022/3/21 $ 18.71 2022/3/18 $ 18.57 2022/3/17 $ 18.17 2022/3/16 $ 17.40 2022/3/15 $ 17.15 2022/3/14 $ 18.04 2022/3/11 $ 18.23 2022/3/10 $ 18.20 2022/3/9 $ 18.83 2022/3/8 $ 18.66 2022/3/7 $ 19.54 19.20 2022/3/4 $ 2022/3/3 $ 19.37 2022/3/2 $ 18.59 2022/3/1 $ 17.76 2022/2/28 $ 18.15 2022/2/25 $ 18.60 2022/2/24 $ 18.55 2022/2/23 $ 19.36 2022/2/22 $ 19.32 2022/2/21 $ 19.61 2022/2/18 $ 19.85 2022/2/17 $ 20.50 2022/2/16 $ 21.15 21.59 2022/2/15 $ 2022/2/14 $ 22.75 2022/2/11 $ 22.83 2022/2/10 $ 22.28 All options expire on 15th March 2023 Name 2022/3/16 2022/4/14 5.85 CALL AFMG MAR23 12 9.70 12.00 12.00 CALL AFMG MAR23 12 - OPT STRIKE PRICE PUT AFMG MAR23 12 0.98 0.29 12.00 12.00 PUT AFMG MAR23 12 - OPT STRIKE PRICE CALL AFMG MAR23 15 3.83 6.98 15.00 15.00 CALL AFMG MAR23 15- OPT STRIKE PRICE PUT AFMG MAR23 15 2.25 0.95 15.00 15.00 PUT AFMG MAR23 15- OPT STRIKE PRICE CALL AFMG MAR23 18 2.30 4.74 18.00 18.00 CALL AFMG MAR23 18 OPT STRIKE PRICE PUT AFMG MAR23 18 3.88 2.08 18.00 18.00 PUT AFMG MAR23 18 - OPT STRIKE PRICE CALL AFMG MAR23 20 1.62 3.53 20.00 20.00 5.34 3.04 CALL AFMG MAR23 20 - OPT STRIKE PRICE PUT AFMG MAR23 20 PUT AFMG MAR23 20 CALL AFMG MAR23 22 OPT STRIKE PRICE 20.00 20.00 1.18 2.59 22.00 22.00 CALL AFMG MAR23 22 - OPT STRIKE PRICE PUT AFMG MAR23 22 7.08 4.17 PUT AFMG MAR23 22 - OPT STRIKE PRICE 22.00 22.00 Use a two-step Binomial option pricing model to price both a Call and a Put option at 16th March 2022. Students within the group should choose DIFFERENT OPTION STRIKES of the SAME STOCK. The purpose is to identify a mispriced option in the market. Based on the fair value you calculated for your option, determine if your chosen option is undervalued or overvalued in the market. The risk- free rate is assumed to be 1.33%. Assume no dividend. Your report must: Show calculations for inputs required for the Binomial pricing model Document and explain all calculations pertaining to your chosen options Timestamp FMG.AX 2022/4/14 $ 21.61 2022/4/13 $ 21.34 2022/4/12 $ 21.17 2022/4/11 $ 21.19 2022/4/8 $ 21.83 2022/4/7 $ 21.75 2022/4/6 $ 21.66 2022/4/5 $ 21.72 2022/4/4 $ 21.70 2022/4/1 $ 21.06 2022/3/31 $ 20.66 2022/3/30 $ 19.80 2022/3/29 $ 19.49 2022/3/28 $ 19.42 2022/3/25 $ 19.27 2022/3/24 $ 18.94 2022/3/23 $ 19.00 2022/3/22 $ 18.94 2022/3/21 $ 18.71 2022/3/18 $ 18.57 2022/3/17 $ 18.17 2022/3/16 $ 17.40 2022/3/15 $ 17.15 2022/3/14 $ 18.04 2022/3/11 $ 18.23 2022/3/10 $ 18.20 2022/3/9 $ 18.83 2022/3/8 $ 18.66 2022/3/7 $ 19.54 19.20 2022/3/4 $ 2022/3/3 $ 19.37 2022/3/2 $ 18.59 2022/3/1 $ 17.76 2022/2/28 $ 18.15 2022/2/25 $ 18.60 2022/2/24 $ 18.55 2022/2/23 $ 19.36 2022/2/22 $ 19.32 2022/2/21 $ 19.61 2022/2/18 $ 19.85 2022/2/17 $ 20.50 2022/2/16 $ 21.15 21.59 2022/2/15 $ 2022/2/14 $ 22.75 2022/2/11 $ 22.83 2022/2/10 $ 22.28 All options expire on 15th March 2023 Name 2022/3/16 2022/4/14 5.85 CALL AFMG MAR23 12 9.70 12.00 12.00 CALL AFMG MAR23 12 - OPT STRIKE PRICE PUT AFMG MAR23 12 0.98 0.29 12.00 12.00 PUT AFMG MAR23 12 - OPT STRIKE PRICE CALL AFMG MAR23 15 3.83 6.98 15.00 15.00 CALL AFMG MAR23 15- OPT STRIKE PRICE PUT AFMG MAR23 15 2.25 0.95 15.00 15.00 PUT AFMG MAR23 15- OPT STRIKE PRICE CALL AFMG MAR23 18 2.30 4.74 18.00 18.00 CALL AFMG MAR23 18 OPT STRIKE PRICE PUT AFMG MAR23 18 3.88 2.08 18.00 18.00 PUT AFMG MAR23 18 - OPT STRIKE PRICE CALL AFMG MAR23 20 1.62 3.53 20.00 20.00 5.34 3.04 CALL AFMG MAR23 20 - OPT STRIKE PRICE PUT AFMG MAR23 20 PUT AFMG MAR23 20 CALL AFMG MAR23 22 OPT STRIKE PRICE 20.00 20.00 1.18 2.59 22.00 22.00 CALL AFMG MAR23 22 - OPT STRIKE PRICE PUT AFMG MAR23 22 7.08 4.17 PUT AFMG MAR23 22 - OPT STRIKE PRICE 22.00 22.00 Use a two-step Binomial option pricing model to price both a Call and a Put option at 16th March 2022. Students within the group should choose DIFFERENT OPTION STRIKES of the SAME STOCK. The purpose is to identify a mispriced option in the market. Based on the fair value you calculated for your option, determine if your chosen option is undervalued or overvalued in the market. The risk- free rate is assumed to be 1.33%. Assume no dividend. Your report must: Show calculations for inputs required for the Binomial pricing model Document and explain all calculations pertaining to your chosen options