Answered step by step

Verified Expert Solution

Question

1 Approved Answer

TIMO Ltd sells electronic components to various retailers. For the year 20X1 the following transactions were documented: One of their customers, MIA Ltd ordered 1,000

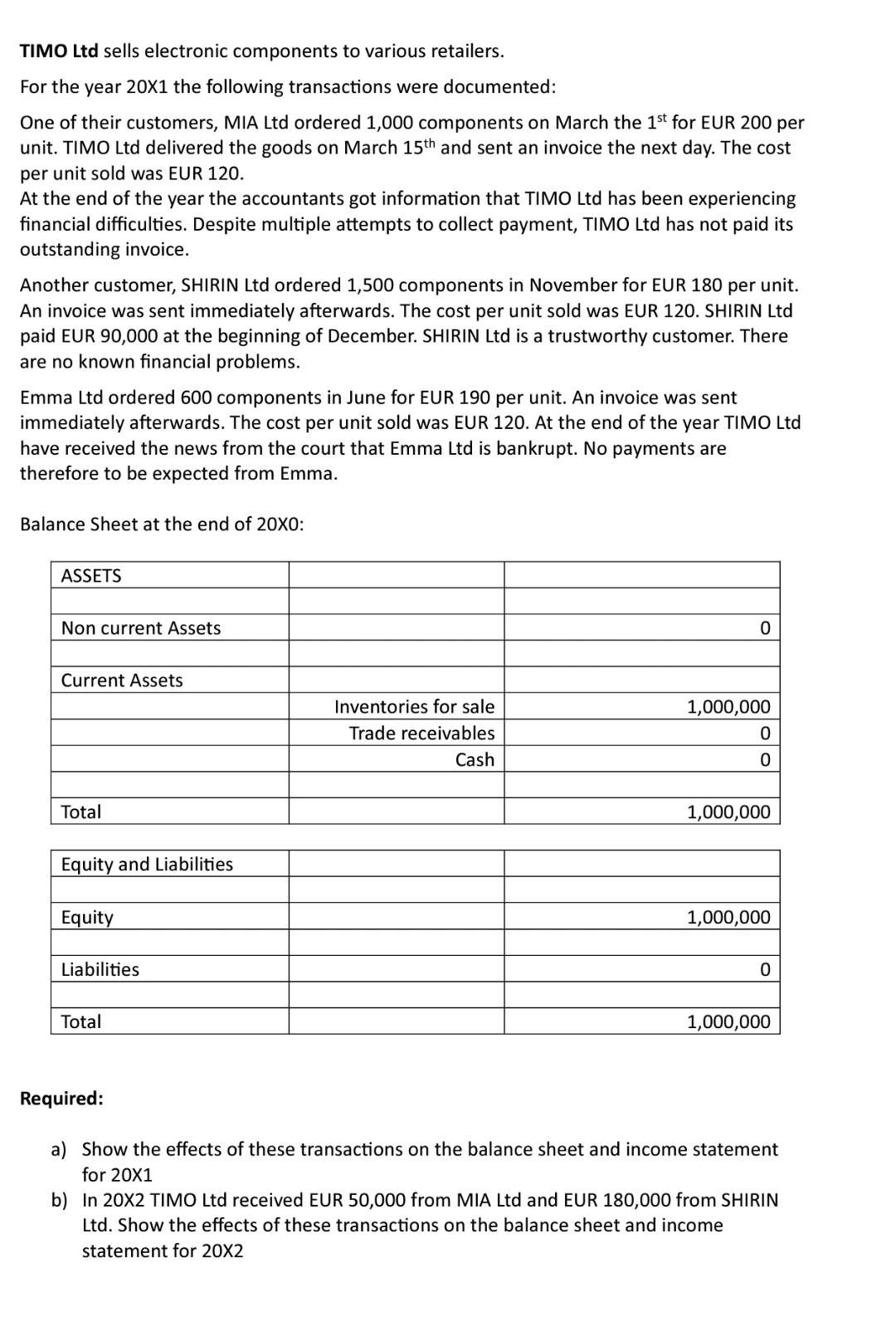

TIMO Ltd sells electronic components to various retailers. For the year 20X1 the following transactions were documented: One of their customers, MIA Ltd ordered 1,000 components on March the 1st for EUR 200 per unit. TIMO Ltd delivered the goods on March 15th and sent an invoice the next day. The cost per unit sold was EUR 120. At the end of the year the accountants got information that TIMO Ltd has been experiencing financial difficulties. Despite multiple attempts to collect payment, TIMO Ltd has not paid its outstanding invoice. Another customer, SHIRIN Ltd ordered 1,500 components in November for EUR 180 per unit. An invoice was sent immediately afterwards. The cost per unit sold was EUR 120. SHIRIN Ltd paid EUR 90,000 at the beginning of December. SHIRIN Ltd is a trustworthy customer. There are no known financial problems. Emma Ltd ordered 600 components in June for EUR 190 per unit. An invoice was sent immediately afterwards. The cost per unit sold was EUR 120. At the end of the year TIMO Ltd have received the news from the court that Emma Ltd is bankrupt. No payments are therefore to be expected from Emma. Balance Sheet at the end of 20x0: Required: a) Show the effects of these transactions on the balance sheet and income statement for 201 b) In 20X2 TIMO Ltd received EUR 50,000 from MIA Ltd and EUR 180,000 from SHIRIN Ltd. Show the effects of these transactions on the balance sheet and income statement for 202

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started