Answered step by step

Verified Expert Solution

Question

1 Approved Answer

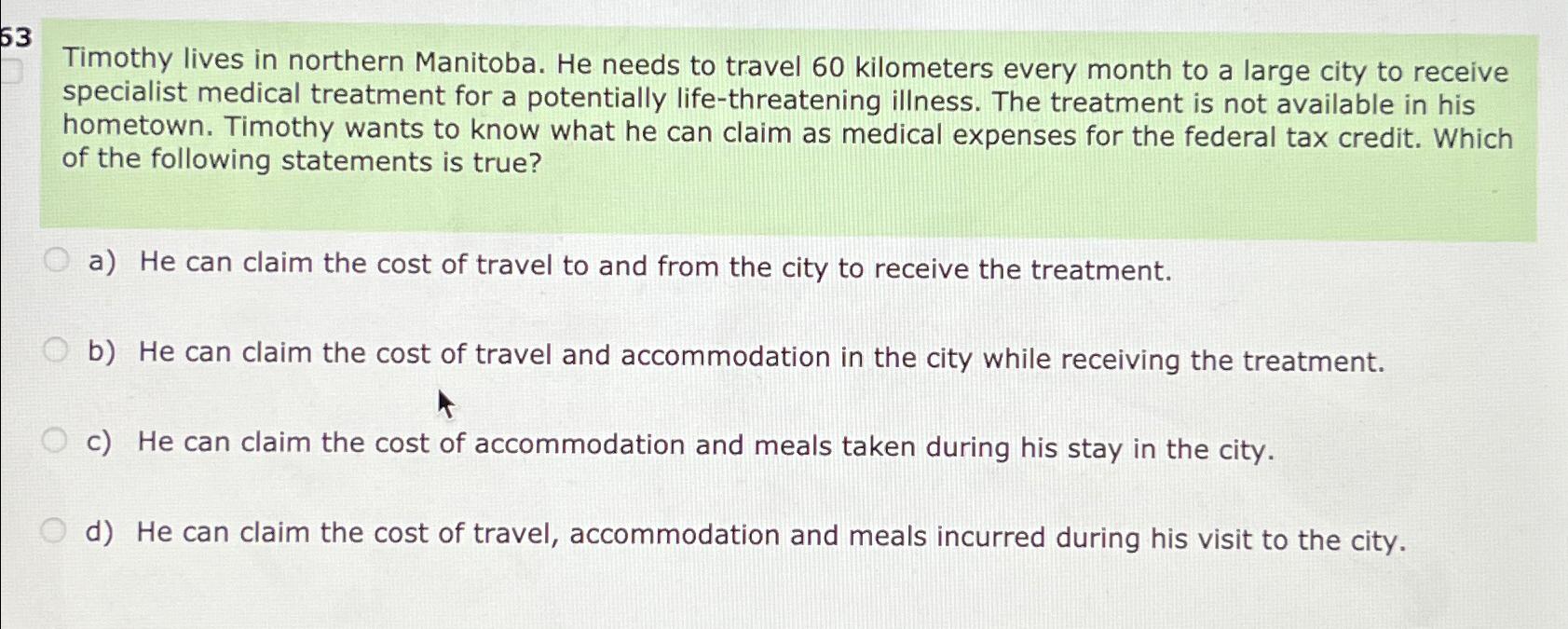

Timothy lives in northern Manitoba. He needs to travel 6 0 kilometers every month to a large city to receive specialist medical treatment for a

Timothy lives in northern Manitoba. He needs to travel kilometers every month to a large city to receive specialist medical treatment for a potentially lifethreatening illness. The treatment is not available in his hometown. Timothy wants to know what he can claim as medical expenses for the federal tax credit. Which of the following statements is true?

a He can claim the cost of travel to and from the city to receive the treatment.

b He can claim the cost of travel and accommodation in the city while receiving the treatment.

c He can claim the cost of accommodation and meals taken during his stay in the city.

d He can claim the cost of travel, accommodation and meals incurred during his visit to the city.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started