Answered step by step

Verified Expert Solution

Question

1 Approved Answer

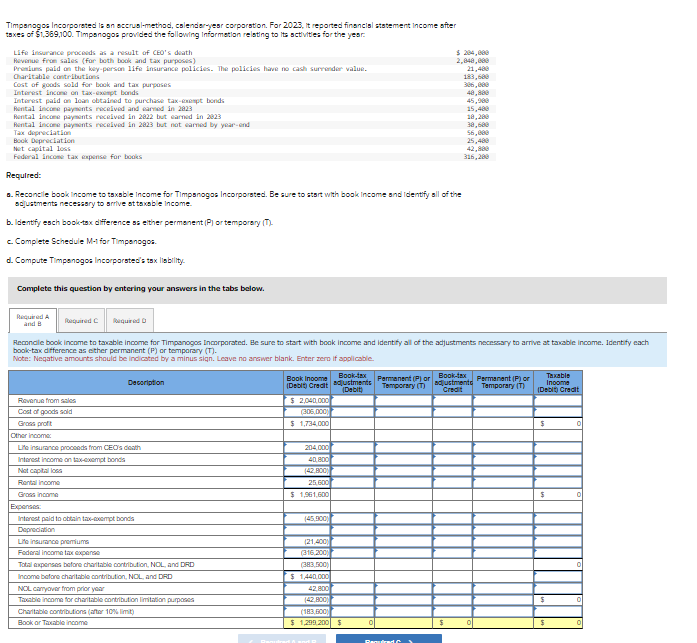

Timpsnogoa Incorporeted is an eccusi - method, csiender - yesr corporstion. For 2 0 2 3 , it reported financisl statement income after toxes of

Timpsnogoa Incorporeted is an eccusimethod, csienderyesr corporstion. For it reported financisl statement income after

toxes of $ Timponogos provided the following informetlon relating to its sctivites for the year:

Life insurance procesds as a result of CEO's doath

Rovenue from sales for both book and tax purposes

Prenlues pald on the kcyperson life Insurance policies. The policies hawe no cash surrender value.

Ouritable contriliutions

Cost of goods sold for book and tax purposes

Interest lncane on taxexompt bands

Interest paid on loan obtained to purchase taxement bonds

Acntal income payents recelved and earnod in

fontal income payments recelved in but earnod in

fiontal income payents rocelved in but not earnod by yearend

Tac doepeciation

Book. Dspreciation

Not capital loss

Fodoral incose tax empinse for books

Required:

a Reconcle book income to tsxsble income for Timpsnogos Incorporsted. Be sure to stsrt with book income snd identify sill of the

odjustmenta necesasry to srrive at toxable income.

b Identify esch booktox difference ss either permenent P ortemporery T

c Complete Schedule M for Timponogor.

d Compute Timpenogos Incorporsted's tsx lisbility

Complete this question by entering your answers in the tabs below.

Rouired

and

booktax difference as ether permanent or temparary

Note: Neqative amounts should be indicated by a minus siqn. Leave no anawer blank. Enter zero if applicable.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started