Question

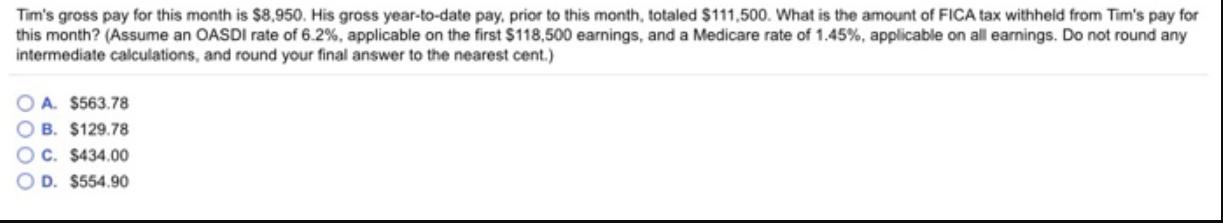

Tim's gross pay for this month is $8,950. His gross year-to-date pay, prior to this month, totaled $111,500. What is the amount of FICA

Tim's gross pay for this month is $8,950. His gross year-to-date pay, prior to this month, totaled $111,500. What is the amount of FICA tax withheld from Tim's pay for this month? (Assume an OASDI rate of 6.2%, applicable on the first $118,500 earnings, and a Medicare rate of 1.45%, applicable on all earnings. Do not round any intermediate calculations, and round your final answer to the nearest cent.) OA. $563.78 B. $129.78 C. $434.00 D. $554.90

Step by Step Solution

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the amount of FICA tax withheld from Tims pay for this month you need to consider both ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Payroll Accounting 2016

Authors: Bernard J. Bieg, Judith Toland

26th edition

978-1305665910, 1305665910, 1337072648, 978-1337072649

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App