Answered step by step

Verified Expert Solution

Question

1 Approved Answer

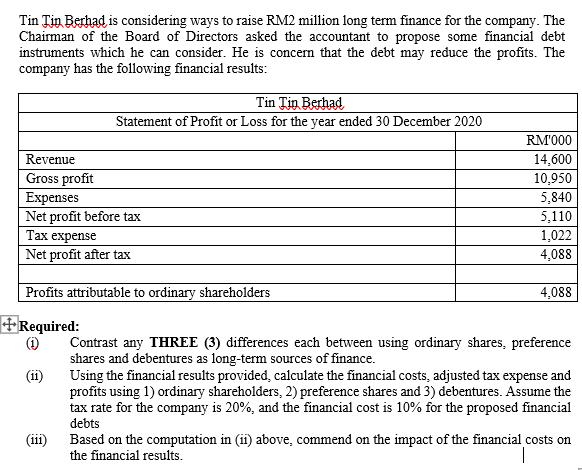

Tin Tin Berhad is considering ways to raise RM2 million long term finance for the company. The Chairman of the Board of Directors asked

Tin Tin Berhad is considering ways to raise RM2 million long term finance for the company. The Chairman of the Board of Directors asked the accountant to propose some financial debt instruments which he can consider. He is concem that the debt may reduce the profits. The company has the following financial results: Tin Tin Berhad Statement of Profit or Loss for the year ended 30 December 2020 RM'000 Revenue 14,600 Gross profit 10,950 Expenses Net profit before tax xpense Net profit after tax 5,840 5,110 1,022 4,088 Profits attributable to ordinary shareholders 4,088 +Required: (1) Contrast any THREE (3) differences each between using ordinary shares, preference shares and debentures as long-term sources of finance. Using the financial results provided, calculate the financial costs, adjusted tax expense and profits using 1) ordinary shareholders, 2) preference shares and 3) debentures. Assume the tax rate for the company is 20%, and the financial cost is 10% for the proposed financial debts (ii) (iii) Based on the computation in (ii) above, commend on the impact of the financial costs on the financial results.

Step by Step Solution

★★★★★

3.35 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started