Question

Tina H's Dog Toys, Inc. is a privately held company. You have been hired to value the company's firm value and equity using market multiple

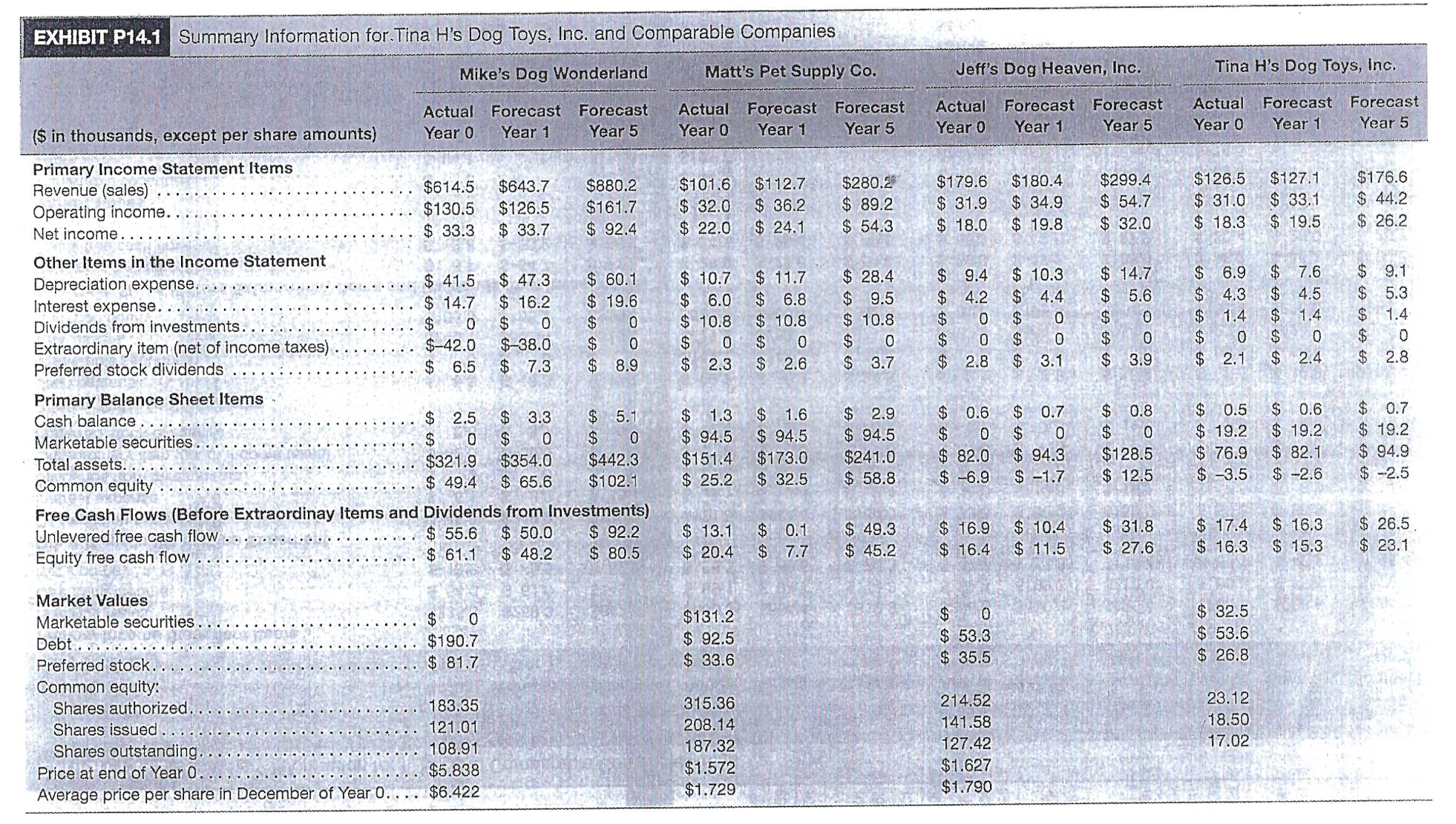

Tina H's Dog Toys, Inc. is a privately held company. You have been hired to value the company's firm value and equity using market multiple valuation methods. An analyst already identified potential comparable companies for your analysis - Mike's Dog Wonderland, Inc., Matt's Pet Supply Company, and Jeff's Dog Heaven, Inc. The analyst also prepared a summary of some accounting and market information, as well as some forecast data for your analysis as show in the exhibit you have. Some of the company's own various marketable securities that they do not need to operate their businesses. These companies record such investments at cost and show dividend income from these investments as a separate line item on the income statement. Operating income is equal to operating revenues minus all operating expenses but includes interest expense, income taxes, and any extraordinary items (which the company shows as a separate line item in the income statement net of income taxes). Net income is measured after deducting all expenses, includes other income (dividends from investments) and includes the effect of extraordinary items. All of the companies have the same income tax rate, 35%, and all income is taxed at the same rate.

1. Calculate each comparable company's earnings, EBIT, EBITDA, revenue, and P/E multiples using the adjusted financial statements.

2. Value Tina H's Dog Toys, Inc. and its equity using the market multiple valuation methods.

Note: only do calculations for Year 0 (not for all years)

EXHIBIT P14.1 Summary Information for.Tina H's Dog Toys, Inc. and Comparable Companies Mike's Dog Wonderland Matt's Pet Supply Co. Actual ($ in thousands, except per share amounts) Year 0 Forecast Year 1 Forecast Actual Year 5 Year 0 Forecast Year 1 Forecast Year 5 Actual Year 0 Forecast Year 1 Forecast Year 5 Jeff's Dog Heaven, Inc. Tina H's Dog Toys, Inc. Forecast Year 1 Forecast Year 5 Actual Year 0 Primary Income Statement Items Revenue (sales) $614.5 $643.7 $880.2 $101.6 $112.7 $280.2 $179.6 $180.4 $299.4 $126.5 $127.1 $176.6 Operating income. $130.5 $126.5 $161.7 $ 32.0 $ 36.2 $ 89.2 $ 31.9 $ 34.9 $ 54.7 $ 31.0 $ 33.1 $ 44.2 Net income. $ 33.3 $ 33.7 $ 92.4 $ 22.0 $ 24.1 $ 54.3 $ 18.0 $ 19.8 $ 32.0 $ 18.3 $ 19.5 $ 26.2 Other Items in the Income Statement Depreciation expense.... $ 41.5 $ 47.3 $ 60.1 $ 10.7 $ 11.7 $ 28.4 $ 9.4 Interest expense. $ 14.7 $ 16.2 $ 19.6 $ 6.0 $ 6.8 $ 9.5 $ 4.2 Dividends from investments. $ 0 $ 0 $ 0 $ 10.8 $ 10.8 $ 10.8 $ 0 $ Extraordinary item (net of income taxes) $-42.0 $-38.0 $ 0 $ 0 $ 0 $ 0 $ 0 $ Preferred stock dividends $ 6.5 $ 7.3 $ 8.9 $ 2.3 $ 2.6 $ 3.7 $ 2.8 69 69 69 A 69 $ 10.3 $ 14.7 $ 6.9 $ 4.4 $ 5.6 $ 4.3 0 $ 0 $ 1.4 0 $ 0 $ $ 3.1 $ 3.9 $ 2.1 OT 0 $$$$$, 654 $ 7.6 $ 9.1 4.5 1.4 $ 5.3 $ 1.4 0 $ 2.4 69 69 69 669 $ 2.8 34080 Primary Balance Sheet Items Cash balance Marketable securities. 69 69 $ 2.5 $ 3.3 $ 5.1 $ 1.3 $ 1.6 $ 2.9 $ 0 $ 0 $ 0 $ 94.5 Total assets. Common equity $321.9 $ 49.4 $354.0 $442.3 $151.4 $ 94.5 $173.0 $ 94.5 $241.0 $ 65.6 $102.1 $ 25.2 $ 32.5 $ 58.8 $$$$ 0.6 $ 0.7 $ 0.8 $ 0.5 $ 0.6 $ 0.7 0 $ 0 $ 0 $ 19.2 $ 19.2 $ 19.2 $ 82.0 $ 94.3 $128.5 $ 76.9 $ 82.1 $ 94.9 $ -6.9 $ -1.7 $ 12.5 $ -3.5 $ -2.6 $ -2.5 Free Cash Flows (Before Extraordinay Items and Dividends from Investments) Unlevered free cash flow..... $ 55.6 $ 50.0 $ 92.2 $ 13.1 $ 0.1 $ 49.3. $ 16.9 $ 10.4 $ 31.8 $ 17.4 $ 16.3 $ 26.5. Equity free cash flow $ 61.1 $ 48.2 $ 80.5 $ 20.4 $ 7.7 $45.2 $ 16.4 $ 11.5 $ 27.6 $ 16.3 $ 15.3 $ 23.1 Market Values Marketable securities $ 0 $131.2 $ 0 $ 32.5 Debt. Preferred stock.... Common equity: Shares authorized $190.7 $ 92.5 $ 53.3 $ 53.6 $ 81.7 $ 33.6 $ 35.5 $ 26.8 183.35 315.36 214.52 23.12 Shares issued 121.01 208.14 141.58 18.50 Shares outstanding. 108.91 187.32 127.42 17.02 Price at end of Year 0. $5.838 $1.572 $1.627 Average price per share in December of Year 0.... $6.422 $1.729 $1.790

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started