Question

Tina Rollt (her parents got a little carried away with names, giving her many problems when she was in school) founded her company in late

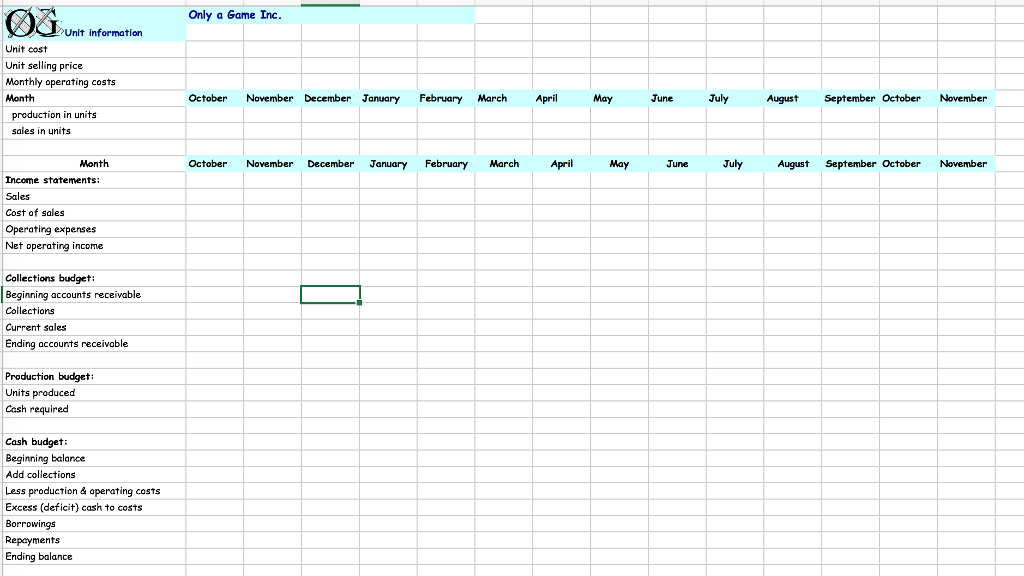

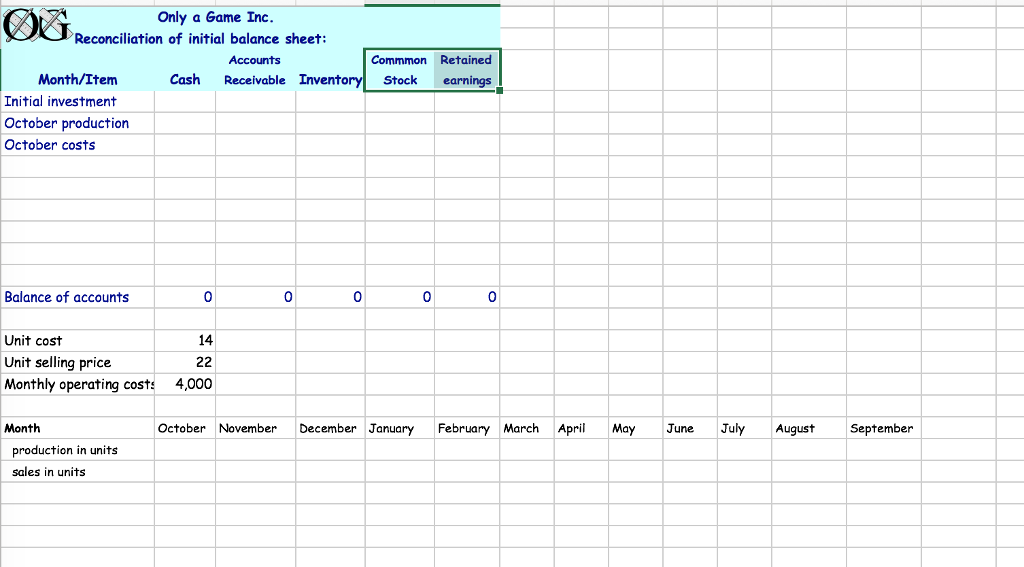

Tina Rollt (her parents got a little carried away with names, giving her many problems when she was in school) founded her company in late 2002. She had worked as a product designer for a well-known toy company, developing new toys and games in keeping with the fashions of the times. Tina thought shed like to market some of her better ideas herself, and decided to invest her savings in founding a new company. She converted her savings into common stock, and taking the simple approach, she called the company Only a Game. Their first hit toy was a puzzle called Sticky Fingers, a handheld electronic puzzle requiring both dexterity and thinking skills. Each Sticky Fingers costs the company $14 to produce. In addition to these production costs that vary in direct proportion to volume, the company also incurs $4,000 monthly costs just to be in business, irrespective of the months volume. Sticky Fingers sells to retailers for $22 each. As of December 31, 2002, Only a Game had been producing Sticky Fingers for three months, using rented facilities. The balance sheet on December 31 looked as follows: Only a Game Company Balance Sheet December 31, 2002 Assets Cash $56,500 Accounts receivable 27,500 Inventory 14,000 Total assets $98,000 Equities Common Stock $100,000 Retained earnings -2000 Total equities $98,000 Rollt was very pleased to be operating at a profit in such a short time. December sales had been 750 units, up from 500 in November, enough to report a profit for the month and to reduce the deficit accumulated in October and November. Sales were projected to be 1,000 units in January, and Rollts projections showed sales increases of 500 units per month after that. Thus, by May, monthly sales were expected to be 3,000 units. By September, that figure would be 5,000 units. Rollt was very conscious of the importance of developing good sales channel relationships in order to increase sales, so Sticky Fingers deliveries were always prompt. This required production to be scheduled 30 days in advance of predicted sales. For example, Only a Game produced 1,000 Sticky Fingers in December in anticipation of January sales, and planned to produce 1,500 in January for Februarys anticipated demand. The company billed its customers with stated terms of 30 days net, but had not spent a lot of effort in enforcing these credit terms, with the result that customers appeared to actually be taking an additional month to pay. All of the companys costs (production and operating) were paid in cash in the month they were incurred. Tinas projections were accurate. By March, sales had reached 2,000 Sticky Fingers, and 2,500 were produced in March for April sale. Total profit for the first quarter of the year 2003 (the end of March) had reached $24,000. In order to get a respite from what had been a very hectic 6 months getting her business started, Tina decided to take her family on a much-deserved vacation in early April (see above). Tina had hardly been gone for a week when her cell phone rang. It was her bookkeeper, who was in a panic. The companys bank balance was nearly at zero, so materials needed for April production could not be purchased. Unless Tina returned immediately to raise more cash, the entire operation would grind to a halt within a few days. Question: Fill in the attached excel tempalate with the above information

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started