Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Tina's medical equipment berhad paid RM1.15 common stock dividend last year. The company's policy is to allow its dividend to grow at 5.50 percent per

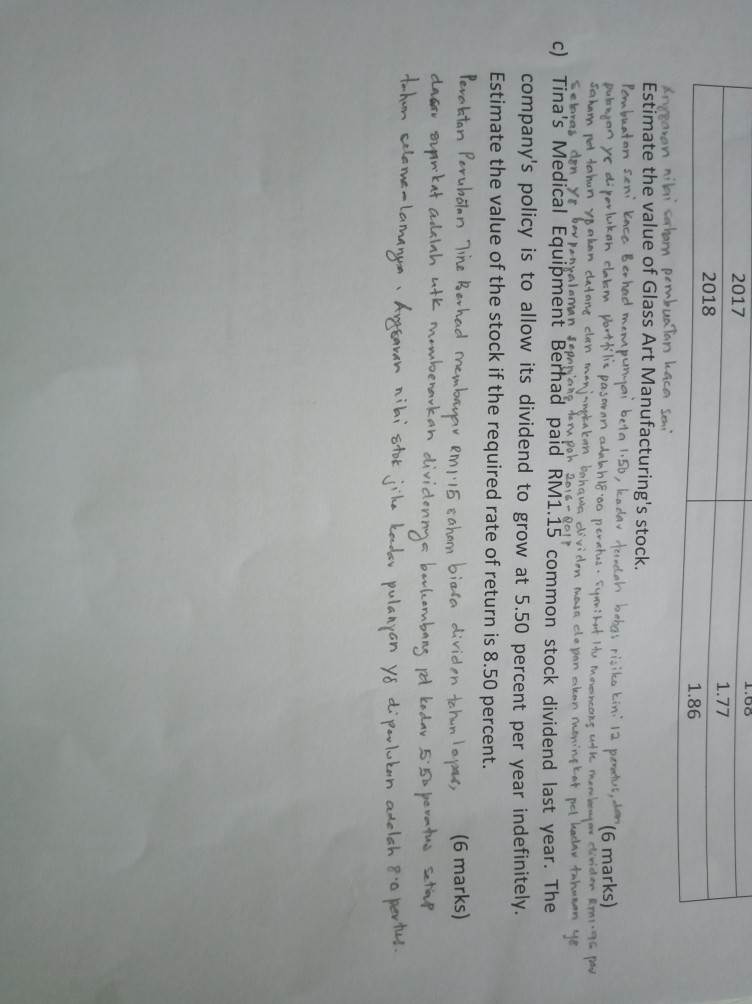

Tina's medical equipment berhad paid RM1.15 common stock dividend last year. The company's policy is to allow its dividend to grow at 5.50 percent per year indefinitely. Estimated the value of the stock if the required rate of return is 8.50 percent.

2017 2018 1.68 1.77 1.86 Anggaran niki saham pembuatan kaca seni Estimate the value of Glass Art Manufacturing's stock. Pembuatan seni kace Berhad mempunyai beta 1.50, kadar teredah bebas risiko kini 12 peratus, son 16 marks). pubajan ye diporlukan clakim portfilie pasoman adabhi8.00 peratus. Syarikat to moroneous utk membayar cividor Rm1.96 por saham pot tahun yg akan datang dan manjangkakan bahawa dividon masa depan akan meningkat pel karlar tahunan yo Selaras den yr. bernyalaman seperang tempoh 2016 - 2017 Tina's Medical Equipment Berhad paid RM1.15 common stock dividend last year. The company's policy is to allow its dividend to grow at 5.50 percent per year indefinitely. Estimate the value of the stock if the required rate of return is 8.50 percent. Perakitan Perubolan Tine Berhad membayar RM115 sahom biasa dividen tahun dasa supin kat adalah utk membenarkan dividennya berkembang pd kodav 5.50 peratus setiap tohom selama-lamanya Anggaran niki stok jika kadar pulanyan yg diperlukan adalah 8.0 port

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started