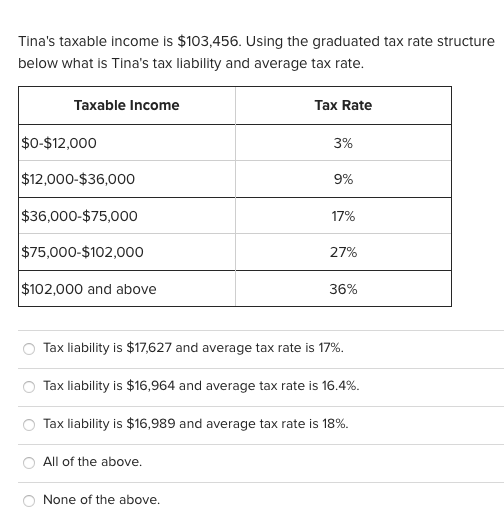

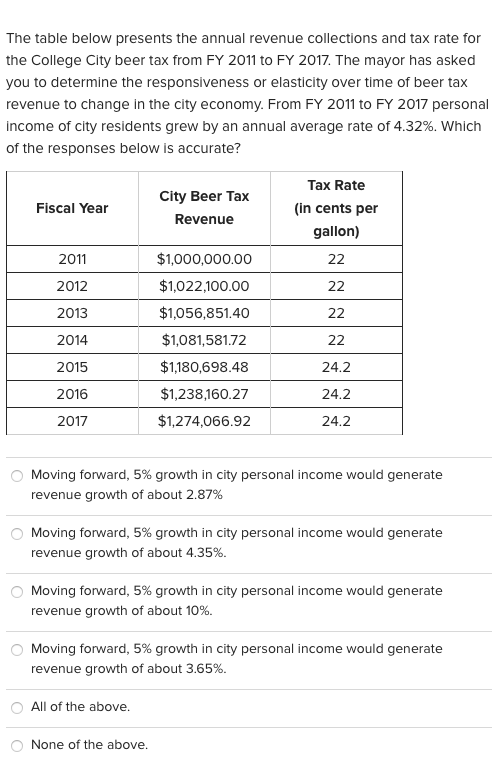

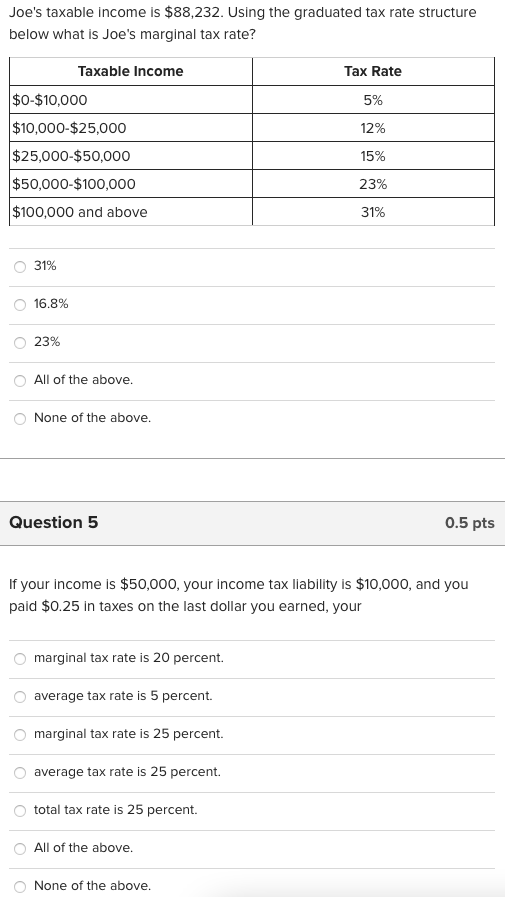

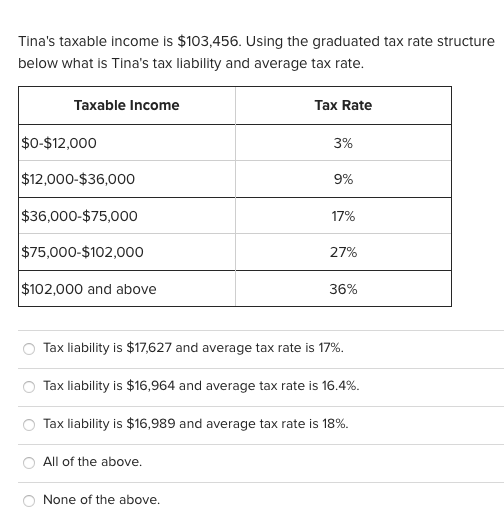

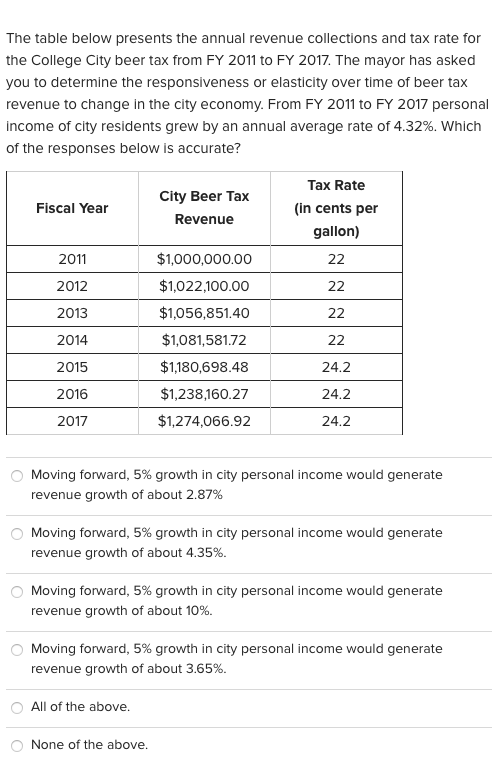

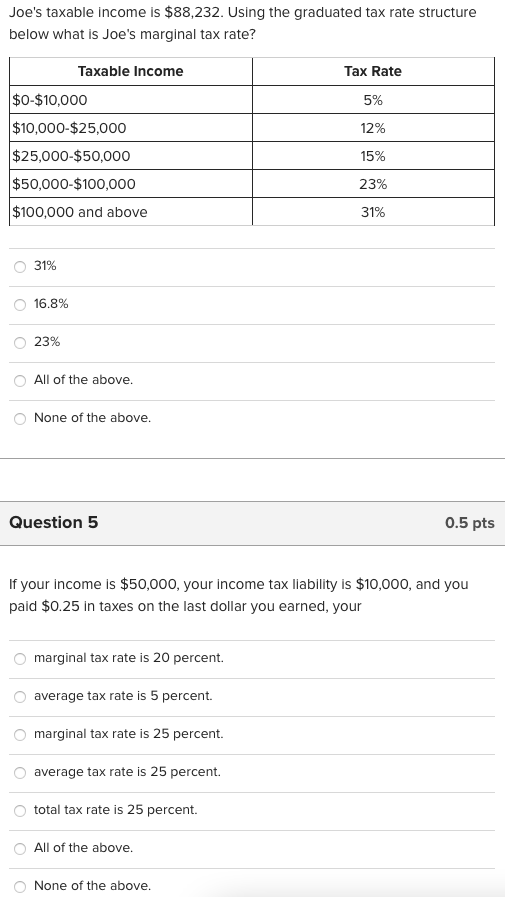

Tina's taxable income is $103,456. Using the graduated tax rate structure below what is Tina's tax liability and average tax rate. Taxable income Tax Rate $0-$12,000 3% $12,000-$36,000 9% $36,000-$75,000 17% $75,000-$102,000 27% $102,000 and above 36% Tax liability is $17,627 and average tax rate is 17%. Tax liability is $16,964 and average tax rate is 16.4%. Tax liability is $16,989 and average tax rate is 18%. All of the above. None of the above. The table below presents the annual revenue collections and tax rate for the College City beer tax from FY 2011 to FY 2017. The mayor has asked you to determine the responsiveness or elasticity over time of beer tax revenue to change in the city economy. From FY 2011 to FY 2017 personal income of city residents grew by an annual average rate of 4.32%. Which of the responses below is accurate? Fiscal Year City Beer Tax Revenue Tax Rate (in cents per gallon) 2011 22 2012 22 2013 22 $1,000,000.00 $1,022,100.00 $1,056,851.40 $1,081,581.72 $1,180,698.48 $1,238,160.27 $1,274,066.92 2014 2015 22 24.2 2016 24.2 2017 24.2 Moving forward, 5% growth in city personal income would generate revenue growth of about 2.87% Moving forward, 5% growth in city personal income would generate revenue growth of about 4.35%. Moving forward, 5% growth in city personal income would generate revenue growth of about 10%. Moving forward, 5% growth in city personal income would generate revenue growth of about 3.65%. All of the above. None of the above. Joe's taxable income is $88,232. Using the graduated tax rate structure below what is Joe's marginal tax rate? Tax Rate 5% 12% Taxable income $0-$10,000 $10,000-$25,000 $25,000-$50,000 $50,000-$100,000 $100,000 and above 15% 23% 31% 31% 16.8% 23% All of the above. None of the above. Question 5 0.5 pts If your income is $50,000, your income tax liability is $10,000, and you paid $0.25 in taxes on the last dollar you earned, your marginal tax rate is 20 percent. average tax rate is 5 percent. marginal tax rate is 25 percent. average tax rate is 25 percent. total tax rate is 25 percent. All of the above. None of the above