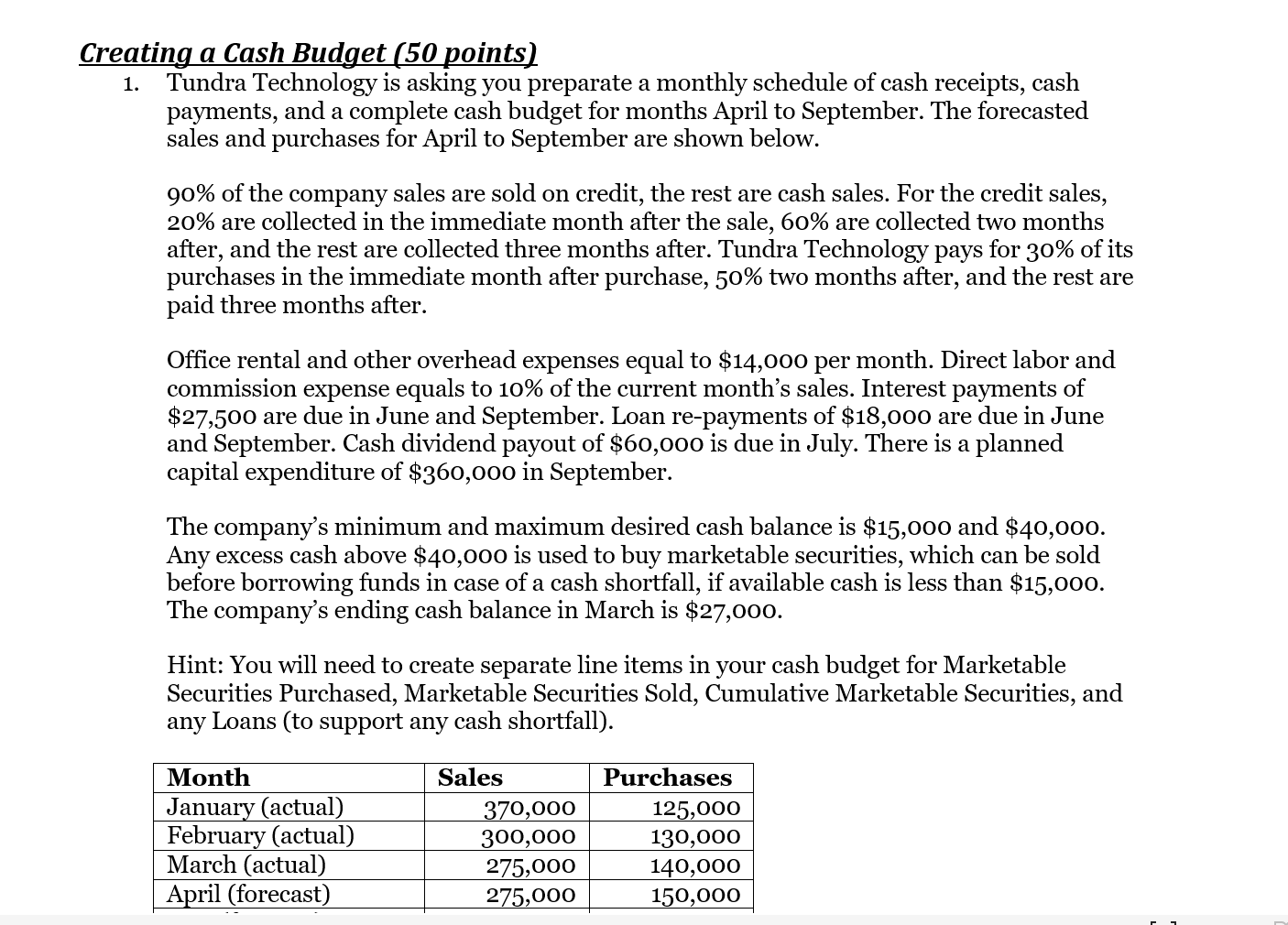

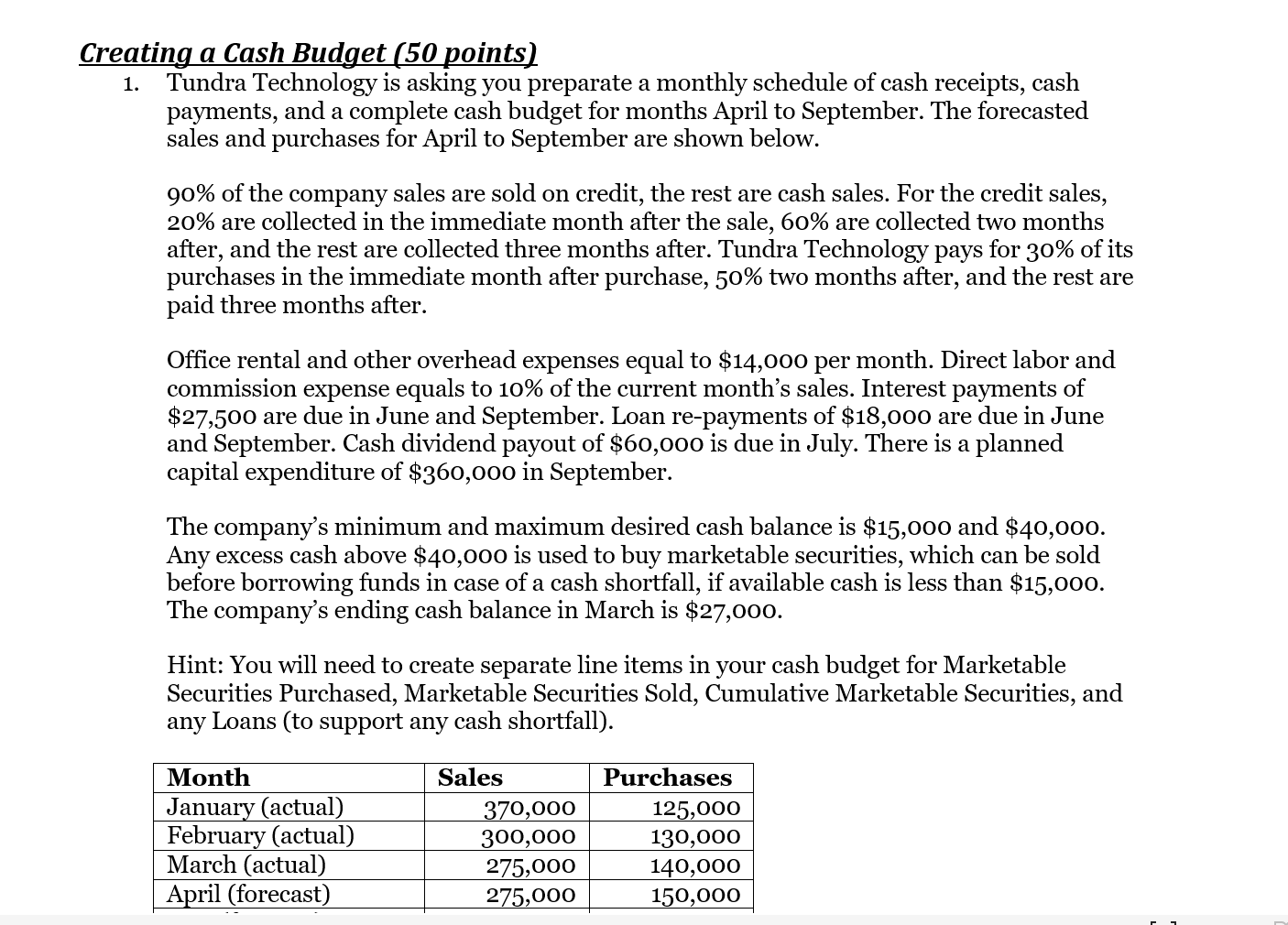

ting a Cash Budget (50 points) Tundra Technology is asking you preparate a monthly schedule of cash receipts, cash payments, and a complete cash budget for months April to September. The forecasted sales and purchases for April to September are shown below. 90% of the company sales are sold on credit, the rest are cash sales. For the credit sales, 20% are collected in the immediate month after the sale, 60% are collected two months after, and the rest are collected three months after. Tundra Technology pays for 30% of its purchases in the immediate month after purchase, 50% two months after, and the rest are paid three months after. Office rental and other overhead expenses equal to $14,000 per month. Direct labor and commission expense equals to 10% of the current month's sales. Interest payments of $27,500 are due in June and September. Loan re-payments of $18,000 are due in June and September. Cash dividend payout of $60,000 is due in July. There is a planned capital expenditure of $360,000 in September. The company's minimum and maximum desired cash balance is $15,000 and $40,000. Any excess cash above $40,000 is used to buy marketable securities, which can be sold before borrowing funds in case of a cash shortfall, if available cash is less than $15,000. The company's ending cash balance in March is $27,000. Hint: You will need to create separate line items in your cash budget for Marketable Securities Purchased, Marketable Securities Sold, Cumulative Marketable Securities, and any Loans (to support any cash shortfall). ting a Cash Budget (50 points) Tundra Technology is asking you preparate a monthly schedule of cash receipts, cash payments, and a complete cash budget for months April to September. The forecasted sales and purchases for April to September are shown below. 90% of the company sales are sold on credit, the rest are cash sales. For the credit sales, 20% are collected in the immediate month after the sale, 60% are collected two months after, and the rest are collected three months after. Tundra Technology pays for 30% of its purchases in the immediate month after purchase, 50% two months after, and the rest are paid three months after. Office rental and other overhead expenses equal to $14,000 per month. Direct labor and commission expense equals to 10% of the current month's sales. Interest payments of $27,500 are due in June and September. Loan re-payments of $18,000 are due in June and September. Cash dividend payout of $60,000 is due in July. There is a planned capital expenditure of $360,000 in September. The company's minimum and maximum desired cash balance is $15,000 and $40,000. Any excess cash above $40,000 is used to buy marketable securities, which can be sold before borrowing funds in case of a cash shortfall, if available cash is less than $15,000. The company's ending cash balance in March is $27,000. Hint: You will need to create separate line items in your cash budget for Marketable Securities Purchased, Marketable Securities Sold, Cumulative Marketable Securities, and any Loans (to support any cash shortfall)