Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Tinman Clothing Wholesalers, Inc. provided you with the following information regarding inventory as of December 31, 2022: (Click the icon to view the inventory

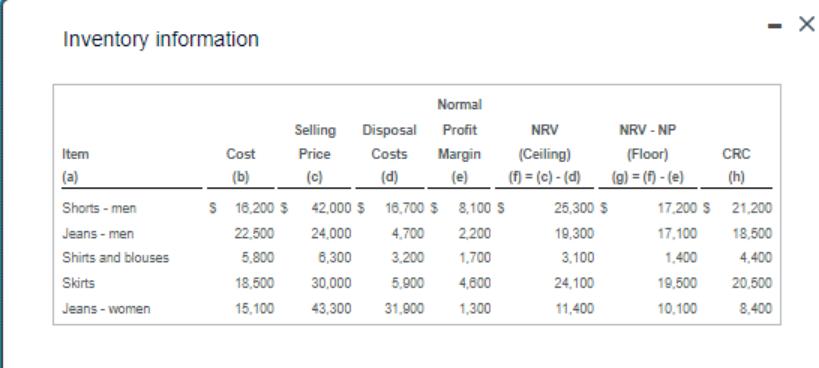

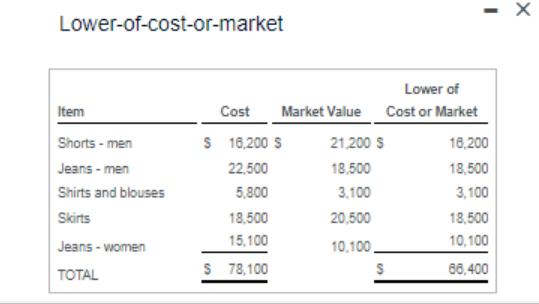

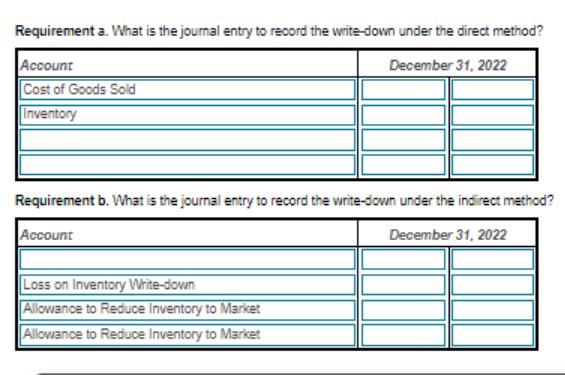

Tinman Clothing Wholesalers, Inc. provided you with the following information regarding inventory as of December 31, 2022: (Click the icon to view the inventory information.) i (Click the icon to view the abbreviation definitions.) Assume that Tinman uses the individual item approach for computing the necessary lower-of-cost-or-market rule adjustment and that Tinman had a beginning allowance balance of zero. (Click the icon to view the lower-of-cost-or-market information.) Read the requirements. Inventory information Item Shorts - men Jeans - men Shirts and blouses Skirts Jeans - women Cost (b) $ 16,200 $ 22.500 5,800 18,500 15,100 Normal Profit Costs Margin (d) (e) Selling Disposal Price (c) 42,000 $ 16,700 $ 24,000 4.700 6,300 3.200 30,000 5,900 43,300 31,900 8,100 S 2,200 1,700 4,600 1,300 NRV (Ceiling) (f) = (c)-(d) 25,300 $ 19,300 3,100 24,100 11,400 NRV - NP (Floor) (g) = (f) -(e) CRC (h) 17,200 $ 21,200 17,100 18,500 1,400 19,500 10,100 4.400 20,500 8,400 X Lower-of-cost-or-market Item Shorts - men Jeans - men Shirts and blouses Skirts Jeans-women TOTAL Cost Market Value $ 16,200 S 22,500 5,800 18,500 15,100 $ 78,100 21,200 S 18,500 3,100 20,500 10,100, Lower of Cost or Market S - 16,200 18,500 3,100 18,500 10,100 66,400 X Requirement a. What is the journal entry to record the write-down under the direct method? Account December 31, 2022 Cost of Goods Sold Inventory Requirement b. What is the journal entry to record the write-down under the indirect method? Account December 31, 2022 Loss on Inventory Write-down Allowance to Reduce Inventory to Market Allowance to Reduce Inventory to Market

Step by Step Solution

★★★★★

3.41 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Individual Item based approach in inventory management is a techniqu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started