Answered step by step

Verified Expert Solution

Question

1 Approved Answer

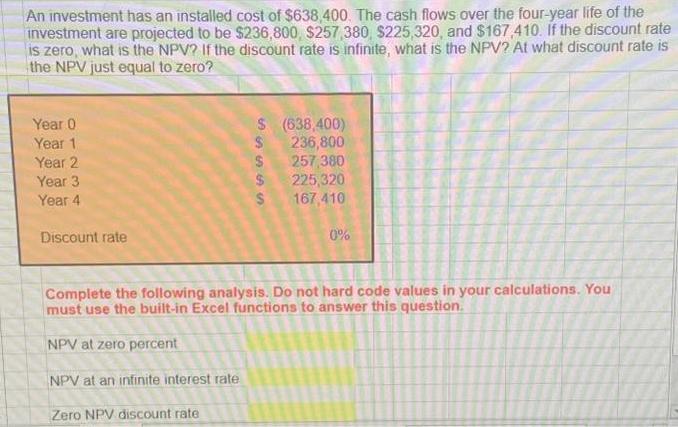

An investment has an installed cost of $638,400. The cash flows over the four-year life of the investment are projected to be $236,800, $257,380,

An investment has an installed cost of $638,400. The cash flows over the four-year life of the investment are projected to be $236,800, $257,380, $225,320, and $167,410. If the discount rate is zero, what is the NPV? If the discount rate is infinite, what is the NPV? At what discount rate is the NPV just equal to zero? Year 0 Year 1 Year 2 Year 3 Year 4 Discount rate 5555 $ (638,400) 236,800 257,380 225,320 167,410 0% Complete the following analysis. Do not hard code values in your calculations. You must use the built-in Excel functions to answer this question. NPV at zero percent NPV at an infinite interest rate Zero NPV discount rate

Step by Step Solution

★★★★★

3.36 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

NPV is given by Now the discount rate at wh...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started