Answered step by step

Verified Expert Solution

Question

1 Approved Answer

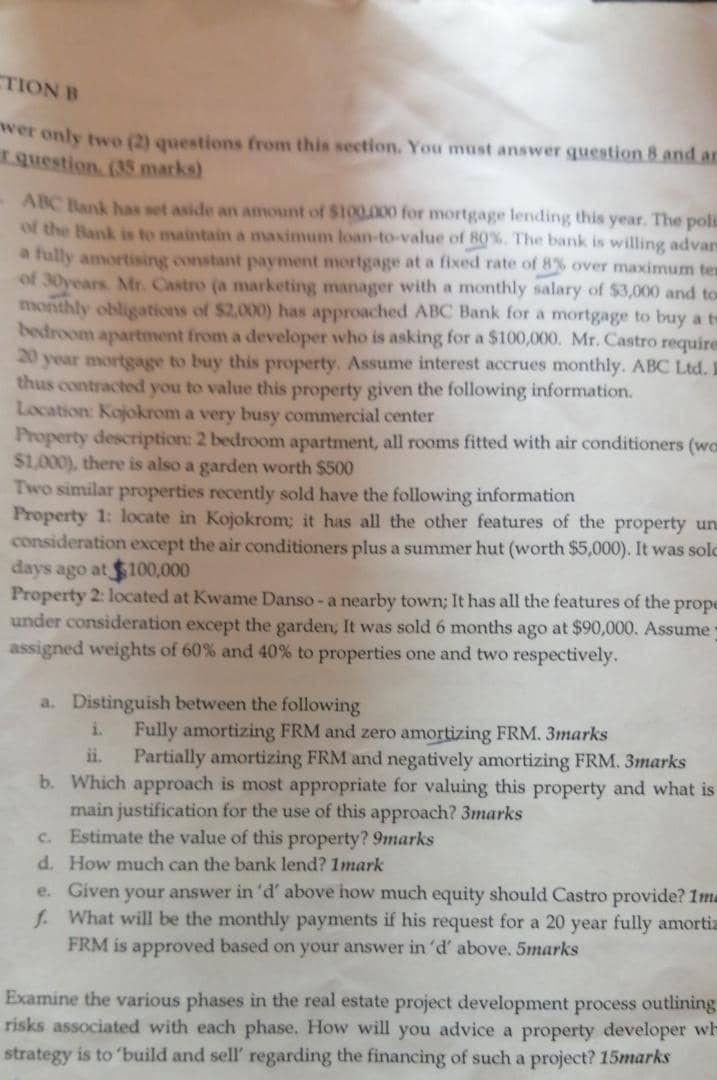

TION B wer only two (2) questions from this section. You must answer question and an question (35 marks) ABC tank has set aside an

TION B wer only two (2) questions from this section. You must answer question and an question (35 marks) ABC tank has set aside an amount of $100.000 for mortgage lending this year. The pole of the Bank is to maintain a maximum loan-to-value of B0%. The bank is willing advar a fully amortising constant payment mortgage at a fixed rate of 8% over maximum tem of 30years. Mr. Castro (a marketing manager with a monthly salary of $3,000 and to monthly obligations of $2,000) has approached ABC Bank for a mortgage to buy a to bedroom apartment from a developer who is asking for a $100,000. Mr. Castro require 20 year mortgage to buy this property. Assume interest accrues monthly. ABC Ltd. thus contracted you to value this property given the following information Location: Kojokrom a very busy commercial center Property description 2 bedroom apartment, all rooms fitted with air conditioners (wc S1000), there is also a garden worth $500 Two similar properties recently sold have the following information Property 1: locate in Kojokrom; it has all the other features of the property un consideration except the air conditioners plus a summer hut (worth $5,000). It was sold days ago at $100,000 Property 2. located at Kwame Danso - a nearby town; It has all the features of the prope under consideration except the garden. It was sold 6 months ago at $90,000. Assume assigned weights of 60% and 40% to properties one and two respectively, a. Distinguish between the following i Fully amortizing FRM and zero amortizing FRM. 3marks ii. Partially amortizing FRM and negatively amortizing FRM. 3marks b. Which approach is most appropriate for valuing this property and what is main justification for the use of this approach? 3marks c. Estimate the value of this property? 9marks d. How much can the bank lend? 1mark e. Given your answer in 'd' above how much equity should Castro provide? 1m f. What will be the monthly payments if his request for a 20 year fully amortia FRM is approved based on your answer in 'd' above. 5marks Examine the various phases in the real estate project development process outlining risks associated with each phase. How will you advice a property developer wl- strategy is to build and sell regarding the financing of such a project? 15marks TION B wer only two (2) questions from this section. You must answer question and an question (35 marks) ABC tank has set aside an amount of $100.000 for mortgage lending this year. The pole of the Bank is to maintain a maximum loan-to-value of B0%. The bank is willing advar a fully amortising constant payment mortgage at a fixed rate of 8% over maximum tem of 30years. Mr. Castro (a marketing manager with a monthly salary of $3,000 and to monthly obligations of $2,000) has approached ABC Bank for a mortgage to buy a to bedroom apartment from a developer who is asking for a $100,000. Mr. Castro require 20 year mortgage to buy this property. Assume interest accrues monthly. ABC Ltd. thus contracted you to value this property given the following information Location: Kojokrom a very busy commercial center Property description 2 bedroom apartment, all rooms fitted with air conditioners (wc S1000), there is also a garden worth $500 Two similar properties recently sold have the following information Property 1: locate in Kojokrom; it has all the other features of the property un consideration except the air conditioners plus a summer hut (worth $5,000). It was sold days ago at $100,000 Property 2. located at Kwame Danso - a nearby town; It has all the features of the prope under consideration except the garden. It was sold 6 months ago at $90,000. Assume assigned weights of 60% and 40% to properties one and two respectively, a. Distinguish between the following i Fully amortizing FRM and zero amortizing FRM. 3marks ii. Partially amortizing FRM and negatively amortizing FRM. 3marks b. Which approach is most appropriate for valuing this property and what is main justification for the use of this approach? 3marks c. Estimate the value of this property? 9marks d. How much can the bank lend? 1mark e. Given your answer in 'd' above how much equity should Castro provide? 1m f. What will be the monthly payments if his request for a 20 year fully amortia FRM is approved based on your answer in 'd' above. 5marks Examine the various phases in the real estate project development process outlining risks associated with each phase. How will you advice a property developer wl- strategy is to build and sell regarding the financing of such a project? 15marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started