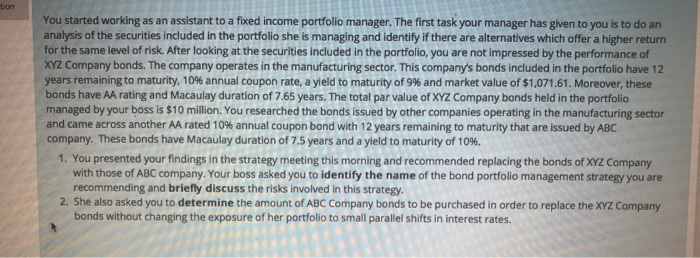

tion You started working as an assistant to a fixed income portfolio manager. The first task your manager has given to you is to do an analysis of the securities included in the portfolio she is managing and identify if there are alternatives which offer a higher return for the same level of risk. After looking at the securities included in the portfolio, you are not impressed by the performance of XYZ Company bonds. The company operates in the manufacturing sector. This company's bonds included in the portfolio have 12 years remaining to maturity, 10% annual coupon rate, a yield to maturity of 9% and market value of $1,071.61. Moreover, these bonds have AA rating and Macaulay duration of 7.65 years. The total par value of XYZ Company bonds held in the portfolio managed by your boss is $10 million. You researched the bonds issued by other companies operating in the manufacturing sector and came across another AA rated 10% annual coupon bond with 12 years remaining to maturity that are issued by ABC company. These bonds have Macaulay duration of 7.5 years and a yield to maturity of 10%. 1. You presented your findings in the strategy meeting this morning and recommended replacing the bonds of XYZ Company with those of ABC company. Your boss asked you to identify the name of the bond portfolio management strategy you are recommending and briefly discuss the risks involved in this strategy. 2. She also asked you to determine the amount of ABC Company bonds to be purchased in order to replace the XYZ Company bonds without changing the exposure of her portfolio to small parallel shifts in interest rates. tion You started working as an assistant to a fixed income portfolio manager. The first task your manager has given to you is to do an analysis of the securities included in the portfolio she is managing and identify if there are alternatives which offer a higher return for the same level of risk. After looking at the securities included in the portfolio, you are not impressed by the performance of XYZ Company bonds. The company operates in the manufacturing sector. This company's bonds included in the portfolio have 12 years remaining to maturity, 10% annual coupon rate, a yield to maturity of 9% and market value of $1,071.61. Moreover, these bonds have AA rating and Macaulay duration of 7.65 years. The total par value of XYZ Company bonds held in the portfolio managed by your boss is $10 million. You researched the bonds issued by other companies operating in the manufacturing sector and came across another AA rated 10% annual coupon bond with 12 years remaining to maturity that are issued by ABC company. These bonds have Macaulay duration of 7.5 years and a yield to maturity of 10%. 1. You presented your findings in the strategy meeting this morning and recommended replacing the bonds of XYZ Company with those of ABC company. Your boss asked you to identify the name of the bond portfolio management strategy you are recommending and briefly discuss the risks involved in this strategy. 2. She also asked you to determine the amount of ABC Company bonds to be purchased in order to replace the XYZ Company bonds without changing the exposure of her portfolio to small parallel shifts in interest rates